Anyone knows a good plumber?

The failures started long before today

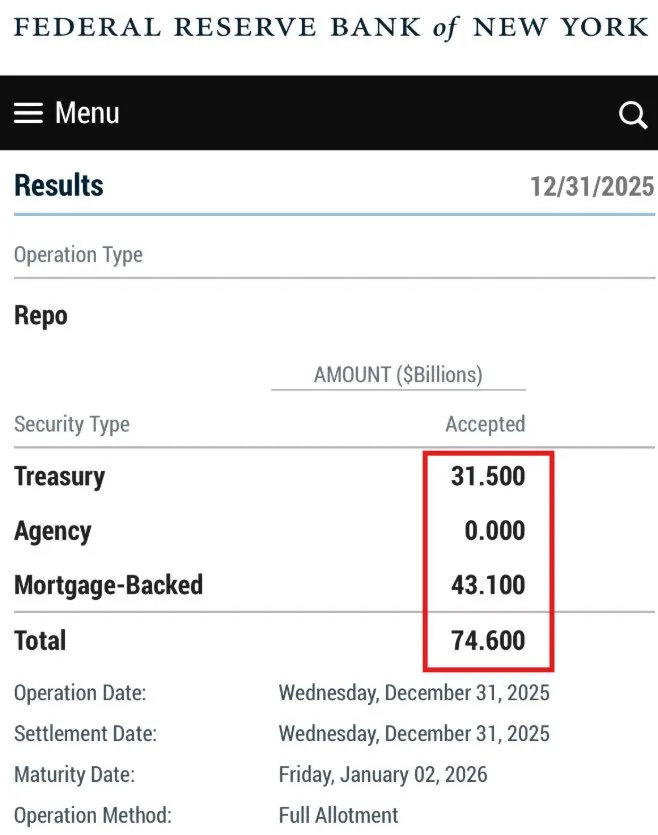

So while you were nursing your New Year’s hangover, the Federal Reserve was quietly injecting $74.6 billion into the banking system just to keep the lights on.

Happy New Year indeed.

Let me walk you through what happened on December 31, 2025, because the headline number is impressive but the details are properly terrifying. And yes, I’ve covered this repo plumbing business before, so I won’t bore you with the basics again. But what went down on the last trading day of 2025 deserves your full attention, because it’s not the size of the injection that matters most.

It’s what they brought to the pawn shop.

$74.6 billion borrowed from the Fed’s Standing Repo Facility. That’s the emergency window, by the way. The one you’re not supposed to need if everything’s working properly. The one that charges you a premium rate above what you could earn by just parking your cash at the Fed overnight. Banks paying extra to borrow money they supposedly don’t need.

But of that $74.6 billion, banks pledged $43.1 billion in mortgage-backed securities and only $31.5 billion in Treasuries.

More housing paper than government bonds.

I’ll let you pontificate on the significance of that…

Got it? Ok, 1 more minute…

Well… The safest, most liquid institutions in the financial system couldn’t come up with enough pristine Treasury collateral to get through one night. So they showed up at the Fed’s window with mortgage-backed securities, because the private repo market told them to sod off.

This is your high-quality liquid asset shortage right here. Not theoretical. Not modeled. Actually happening.

The private market rejected this collateral at reasonable rates. Full stop. So banks went to the Federal Reserve, which accepts mortgage-backed securities at the same rate as Treasuries no questions asked, and borrowed $43 billion against housing debt that the market wouldn’t touch.

If that doesn’t concern you, check your pulse.

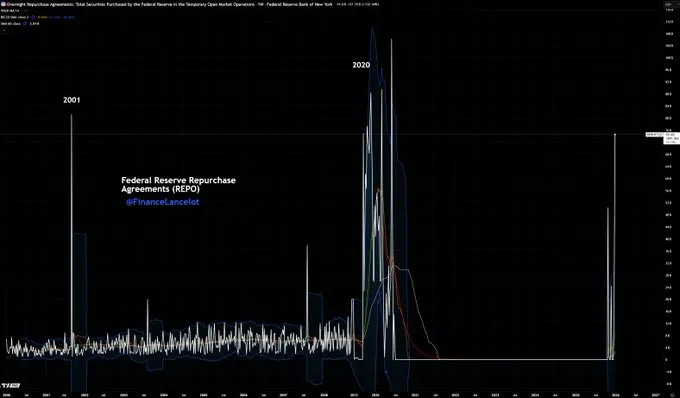

And that $74.6 billion? New record. Smashed the previous record of $50.4 billion from October 31. That one was a month-end spike, this one combined month-end, quarter-end, and year-end all at once. Both times the smooth-brained analysts insisted it was “completely normal regulatory reporting dynamics”.

Except both October and late December saw something else happen simultaneously: brutal takedowns in silver. Mid October: silver crashed from $54 to $45. Late December: vicious slam from $84 to $70.

Month-ends. Regulatory reporting dates. Times when derivatives books need to look manageable. Times when margin requirements bite hardest. Times when you need liquidity to manage positions, meet margin calls, and execute operations in leveraged markets.

The correlation is remarkable. Record repo borrowing, dodgy collateral, same exact timing as major commodity market moves. I can’t prove causation. But when you need massive overnight liquidity at the same time you’re managing large derivative positions, and the private market won’t lend against your collateral, I’m getting suspicious.

That operation requires liquidity. Lots of it. And when the private repo market is already stressed because reserves are scarce, where exactly does that cash come from?

The Fed’s emergency window.

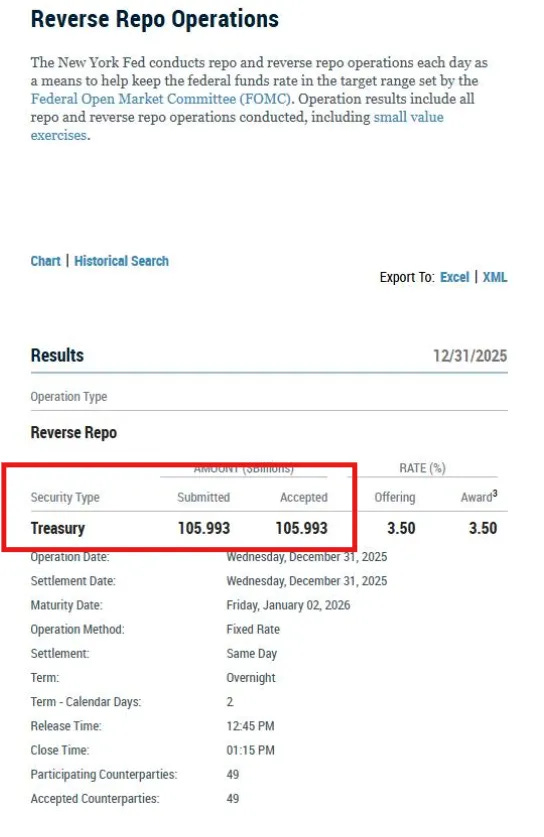

For years the Reverse Repo facility held more than $2 trillion. That was the cushion, the buffer that absorbed volatility when things got choppy. It’s now basically empty. Down to $106 billion from over $2 trillion. The entire cushion has been drained away as the Fed ran quantitative tightening for three and a half years.

Bank reserves? They’ve fallen from over $3.5 trillion to around $2.9 trillion. The Fed’s balance sheet dropped from $8.93 trillion to $6.5 trillion. Every dollar of Treasury securities that matured without replacement, every mortgage-backed security that rolled off, it all drained reserves from the system.

And now we’ve hit the floor.

On December 1, the Fed officially ended quantitative tightening. Just stopped it. Done. Finished. After insisting for months they had plenty of room to keep going, they suddenly discovered - shocking revelation - that actually they didn’t.

In December they removed aggregate limits on standing repo operations. Translation: we’re expecting you’ll need to borrow unlimited amounts and we can’t have daily caps getting in the way.

Then they announced Reserve Management Purchases starting in January 2026. Estimated $220 billion in short-term Treasury bill purchases over the next twelve months to “maintain ample reserves”. They’re very insistent this isn’t quantitative easing. It’s “technical operations”. Routine plumbing maintenance.

Bollocks.

When you’re expanding your balance sheet by $220 billion to prevent the repo market from seizing up, that’s not maintenance. That’s the monetary authorities admitting they pushed too hard and broke something.

The December 10 FOMC minutes are worth reading if you enjoy euphemistic central bank prose. My favorite bit: “reluctance by some potential participants to engage in standing repo operations” even when private market rates were trading above the facility’s rate.

Let me translate. Banks are so terrified of the stigma attached to using the Fed’s emergency window that they’ll pay higher rates in the private market rather than show up in the published data admitting they needed help.

The minutes also noted that “usage of overnight reverse repo operations remained low, while both the frequency and volume of standing repo operations increased over the intermeeting period”. In other words, the buffer is gone and the emergency facility is getting hammered with increasing frequency.

They also mentioned some “misperceptions about the intended purpose of standing repo operations” that were causing banks to avoid using it. What misperceptions might those be? Perhaps the perception that needing emergency overnight funding suggests you’re not managing your liquidity particularly well? That showing up in the Fed’s daily published data admitting you couldn’t get cash anywhere else might raise uncomfortable questions?

Just a thought.

But the smoothest phrase in the whole document: “reserve balances had declined to ample levels”. Ample. What a lovely word. Sounds reassuring, doesn’t it? Ample reserves. Plenty to go around.

Except if reserves were actually ample, you wouldn’t need emergency injections on December 31. You wouldn’t need to restart balance sheet expansion. You wouldn’t need to remove aggregate limits on emergency lending facilities.

Words mean things. Or they used to.

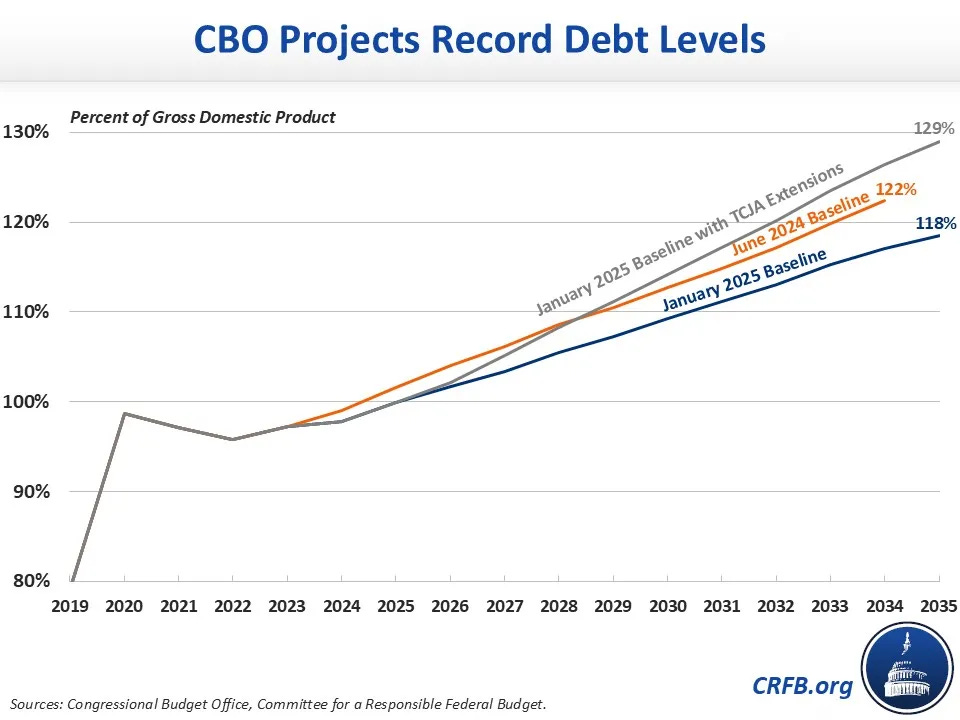

The Treasury market is another side of this problem. The U.S. government needs to issue over $2 trillion in net new debt for fiscal 2026. Every dollar the Treasury raises by selling bonds drains a dollar from the banking system when it sits in the Treasury General Account.

That account swelled to over $1 trillion during various shutdown dramas. When that cash is just sitting there, it’s not circulating in the financial system. It’s locked up at the Fed. Banks can’t use it. Markets can’t trade it. It’s effectively deleted from the available liquidity pool.

So you’ve got the Fed trying to drain reserves through quantitative tightening while the Treasury is also draining reserves by building up cash balances. Both simultaneously squeezing the same pool of liquidity.

Something had to give.

The Fed blinked first. Ended QT, announced they’ll start buying again in January, removed limits on emergency lending. All within a few weeks of each other. That’s not what I would call confidence.

Meanwhile the Treasury still needs to issue trillions in new debt. Into a market that has lost capacity to absorb shocks quietly. You can see it in auction behavior, in dealer balance sheets, in how volatile rates have become relative to actual economic data.

Primary dealers are the firms required to bid at Treasury auctions. They’re supposed to provide liquidity and ensure auctions don’t fail. But their balance sheet capacity is constrained by regulation after 2008. They can only warehouse so much inventory. When you’re hitting them with these new issuances while the Fed is simultaneously trying to shrink its holdings and the Reverse Repo facility has been drained to nothing...

Yeah. That’s how funding events start.

Not with dramatic headlines. With small failures that accumulate. A Treasury auction that goes poorly. Repo rates that spike higher than expected. Emergency facilities that see record usage. Collateral quality that degrades. Each incident gets explained away as routine or seasonal or temporary. Until the day it isn’t.

The international dimension makes this worse. Japan is a powder keg. For the first time in decades, Japanese government bonds are offering positive real yields at home. I covered this dynamic before - see link above - that when Japanese debt becomes profitable domestically, capital that’s been deployed overseas for yield starts trickling back home.

That trickle is already happening. Japanese investors holding U.S. Treasuries are starting to sell. Not in panic, not yet, but in steady repatriation as domestic yields finally become competitive. But if the yen carry trade unwinds violently - if Japan has to tighten policy to defend their currency - that trickle becomes a flood.

When that happens, Japanese selling doesn’t stay contained. U.S. Treasury yields spike. Funding costs rise everywhere. Which stresses the exact repo plumbing we’ve been discussing.

China’s got its own problems. Slow-burning debt crisis, property sector implosion, local government financing vehicles that are basically insolvent. When confidence cracks there - and it will - the feedback loop runs through currencies, through commodities, through U.S. rates. Because everything connects.

This is my nightmare scenario for 2026. Treasury auctions struggling, dealer balance sheets maxed out, international buyers pulling back, Fed trying to restart QE disguised as “technical operations”, and banks borrowing record amounts from emergency facilities using mortgage-backed securities as collateral.

The system is held together by increasingly desperate interventions. And everyone involved is pretending this is normal.

It’s not normal. It’s late-cycle desperation.

The gold and silver markets knows something is up. Gold is refusing to pull back despite every reason it should. Silver accelerating instead of consolidating. Starting to act like a monetary metal instead of a pure industrial one. That’s capital hedging against something structural. When precious metals trade like this while the Fed is supposedly in control and everything is supposedly fine, pay attention.

The market is voting with their wallets. Billions of actual dollars. Saying “we don’t believe you” to the central banks and the Treasury departments and the smooth analysts insisting there’s nothing to worry about.

Markets are currently pricing in only two rate cuts over the next two years. The Fed funds rate sits at 3.5% to 3.75%. Markets expect it around 3.0% by December 2027.

That pricing is completely divorced from fiscal reality. The U.S. government is paying over $1 trillion annually just on interest. Every 25 basis point increase in rates adds tens of billions to that burden. You think they’re going to keep rates at 3.5% when the alternative is fiscal insolvency?

Fat chance.

There’s going to be a point when the debt service costs matter more than inflation prints. When maintaining solvency requires suppressing rates regardless of what economic conditions might warrant. And I think we’re already there.

The Fed will cut rates. They’ll expand the balance sheet. They’ll inject liquidity through whatever facility they need to use. Because the alternative is watching the Treasury market seize up and the government run out of money.

Which means the next phase is inflationary, not deflationary. All that new money creation, all that suppressed rate environment, all that liquidity sloshing around... it doesn’t create deflation. It creates another wave of monetary expansion that destroys purchasing power.

This is why gold matters. Why silver matters. Why real assets matter. Not because of speculation or technical patterns or momentum trading. Because when the central banks are forced to choose between maintaining the system and maintaining the currency, they always choose the system.

Every. Single. Time. Without exception.

Large derivative positions in any market require margin. When those positions move against you, margin requirements increase. When exchanges raise margin requirements you need even more cash. When month-end and quarter-end arrive and you need your books to look acceptable for regulators, you need liquidity to manage, hedge, or window-dress those positions.

Where does that liquidity come from when reserves are scarce and the private repo market won’t lend against your collateral?

The Fed’s emergency window.

This is what makes the timing correlation so interesting. Just my observations.

When those positions blow up - and they will - it doesn’t just affect whatever market they’re in. It calls into question every other leveraged position built on the assumption that emergency funding will always be available. Every clearing house would face questions about their actual ability to manage a real crisis. The entire derivatives complex would seize up.

The banks that would get hit hardest are the same banks currently using the emergency window because they can’t get enough Treasuries. Their balance sheets are already stressed. Their liquidity is already questionable. A derivatives blowup on top of existing funding pressures would be catastrophic.

That’s why the correlation matters. Not because of any specific market, but because it reveals the mechanism. Emergency Fed liquidity is being used to manage positions that can’t survive without it. And that emergency liquidity is getting more expensive, more difficult to access, and more publicly visible with every passing month-end.

The weakest link will break first and takes everything else with it.

December 31 was a warning shot. One of the largest emergency borrowings in history, with the worst collateral mix we’ve seen this side of the GFC, executed at the exact moment when derivative positions across multiple markets needed managing and regulatory reporting required clean books.

That’s not routine. That’s desperation.

Watch the repo markets. Watch SOFR. Watch the spread between overnight funding rates and the Fed’s interest on reserves. Watch Treasury auctions. Watch dealer inventories. Watch Japan. Watch what happens at month-ends and quarter-ends when the emergency window gets hit again.

And when those signals all flash red simultaneously - which won’t be long now - don’t say you weren’t warned.

The plumbing is screaming.

Someone should probably call a plumber.

"The Treasury market is another side of this problem. The U.S. government needs to issue over $2 trillion in net new debt for fiscal 2026."

There's also $9 trillion (low interest bonds) that have to be rolled over in 2026, at current rates, which will jack up the U$T interest payments...

Same $hit, different decade: I first became aware of the RE churn & burn game back in 2003, when we compiled a *huge* down payment went out looking at RE in Queen NY ~ What we found was immigrants right off the boat (no engrish, solly) outbidding *normal* RE buyers with NINJA LIAR loans via their RE "agents"....

Once I surveiled the landscape I knew the collateralized $hy$tem was going to burst, that Ag was artificially suppressed, so we put *all* savings into physical.

The 2007-2008 cra$h should have resulted in a system wide correction, but the bank$ter$ & their puppets engineered then multi-trillion bailout$, defrauding We The Sheeple via TARP (Dumya) & TALP (Obummer)...

So, then our nest egg became our retirement savings/security.

Now, 21 years later it looks like the $y$tem is finally getting the correction required to restore *normal* economics, after 50+ years of fraudulent bank$ter disaster capitalism...

This bubble is going to now be a nuclear bomb when it *pops*, instead of the massive correction that should have happened 15+ years ago.

Elections. Have. Consequences.

Keep voting for the (D)(R) Uniparty scam, if you want to see We The Sheeple living under bridges, otherwise...

*AMERICA FIRST*

"Ample" makes it sound like the comforting, heaving breasts of a friendly barmaid, pressed against your cheek.