This time is different ™

Shanghai's watching

You know what I’ve noticed? Every single time someone gets close to actually winning in the silver market, the rules change.

Not some of the time. Not most of the time.

Every.

Single.

Time.

And I’m watching it happen again right now.

The Hunt Brothers tried it in 1980. They bought one-third of the world’s silver supply, watched it run from $6 to $50, and then... COMEX invented “Silver Rule 7” on January 7, 1980. Position limits slashed from 5,000 contracts to 2,000. Margin requirements skyrocketed - from being able to buy on margin to needing nearly 100% cash.

But that wasn’t enough. On January 21, 1980 - the day silver peaked at $50 - COMEX went nuclear with “liquidation only” trading. You could sell. You could not buy. Not with margin. Not with cash. Not at all.

The market was rigged to go in only one direction. Down.

And just to make sure, Fed Chairman Paul Volcker quietly pressured banks to stop lending for precious metals speculation. No leverage for you. The Hunt brothers got margin called into oblivion, lost $1.7 billion, and needed a $1.1 billion bailout from a consortium of banks to avoid taking down the entire financial system with them.

And those COMEX board members who voted for these rule changes? Many of them were short silver. They were losing money on the rally. So they put on their “governors” hats, voted to change the rules to favor shorts over longs, and saved their own positions. The very people getting squeezed got to write the rules to stop the squeeze.

Conflict of interest? Sure. Legal? Apparently. The courts upheld it all.

Silver crashed from $50 to under $5 within two years. The little guy who bought at $45? Crushed. Twenty-year bear market.

Fast forward to 2011. Max Keiser launches his “Crash JP Morgan, Buy Silver” campaign. Physical demand surges. Silver runs from $8.50 to $49.50 in the span of months. JPMorgan, which had inherited Bear Stearns’ massive silver shorts in 2008, was getting absolutely destroyed.

What happened? COMEX raised margin requirements. Five times. In nine days. April 26 to May 9, 2011. Margins went from around $5,000 per contract to over $21,000. That’s more than quadrupling the cost to hold a position.

The rally died. Silver crashed. JPMorgan eventually settled with the DOJ for $920 million over precious metals manipulation, two of their traders went to prison, but only after years of rigging the market.

Then came 2021. WallStreetBets had just squeezed GameStop. Someone suggested silver next. The media jumped on it - “Reddit targeting silver!” The price spiked toward $30.

Except it wasn’t really WallStreetBets. The original forum explicitly said they weren’t targeting silver. But the narrative had been set. Robinhood and other brokers restricted buying. The rally fizzled.

Three attempts. Three times the little guy gets crushed. Three times the rules changed when the establishment was at risk.

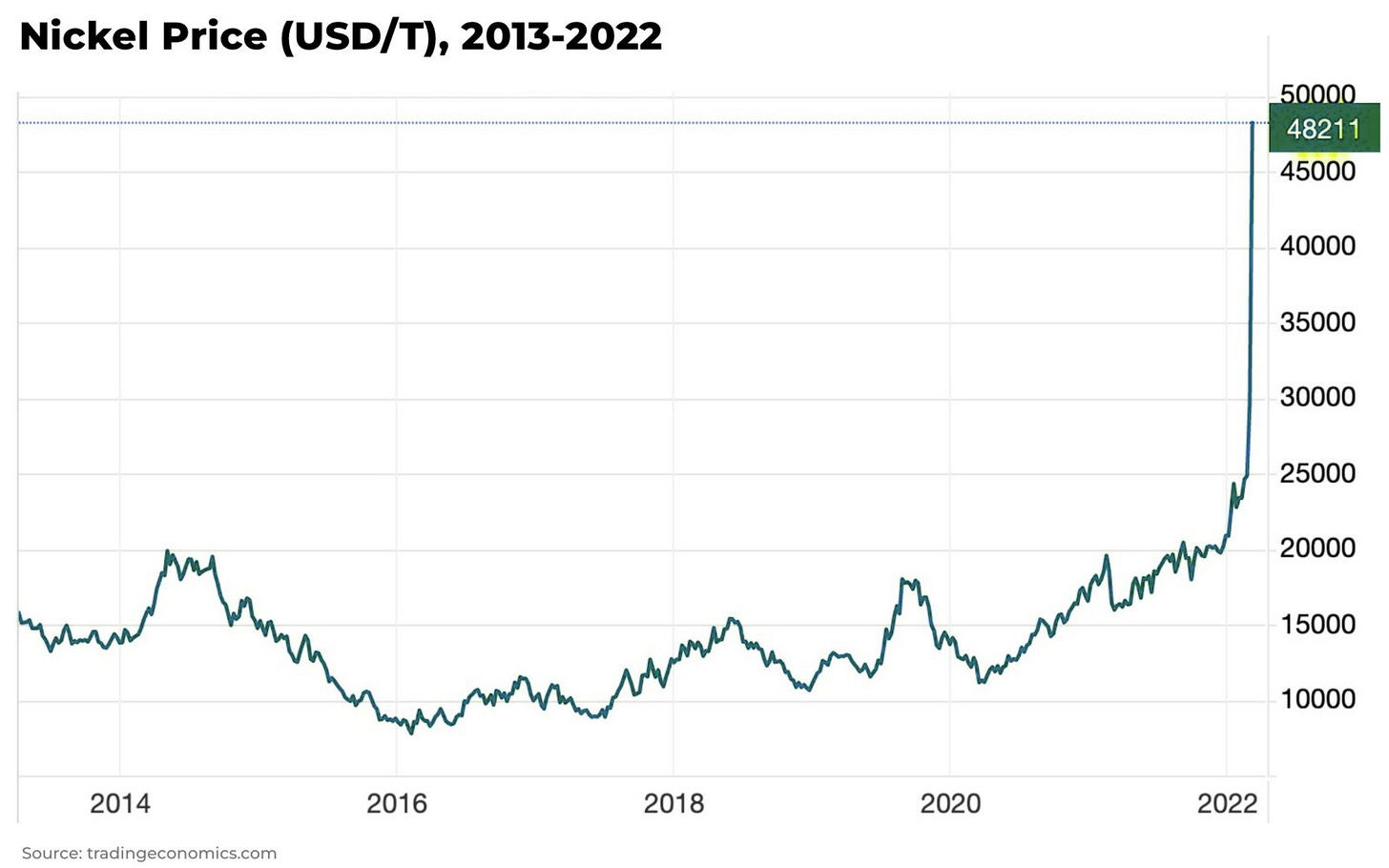

Want to know what happens when a commodity market truly breaks? Look at LME nickel in March 2022.

Chinese billionaire Xiang Guangda had a massive short position - around 450 tons. Russia invaded Ukraine. Nickel supplies got tight. The price doubled in two days, hitting $50,000 per ton. Then in about five hours, it spiked to over $100,000.

The LME didn’t just halt trading. They canceled $12 billion worth of trades. Just... deleted them. Like they never happened. People who had winning positions woke up to find their trades had been retroactively erased. The exchange was later fined £9.2 million, but those trades stayed canceled. Courts upheld it. Said the LME had “effectively no choice” given the “unprecedented, urgent and potentially catastrophic” circumstances.

The LME was never the same afterwards. Trading volumes collapsed. Trust rightfully evaporated. The exchange that had been the global center for metals trading for 145 years lost its credibility in a single morning…

That’s the precedent. When a physical squeeze becomes real, they just... change reality. Cancel trades. Suspend markets. Rewrite history.

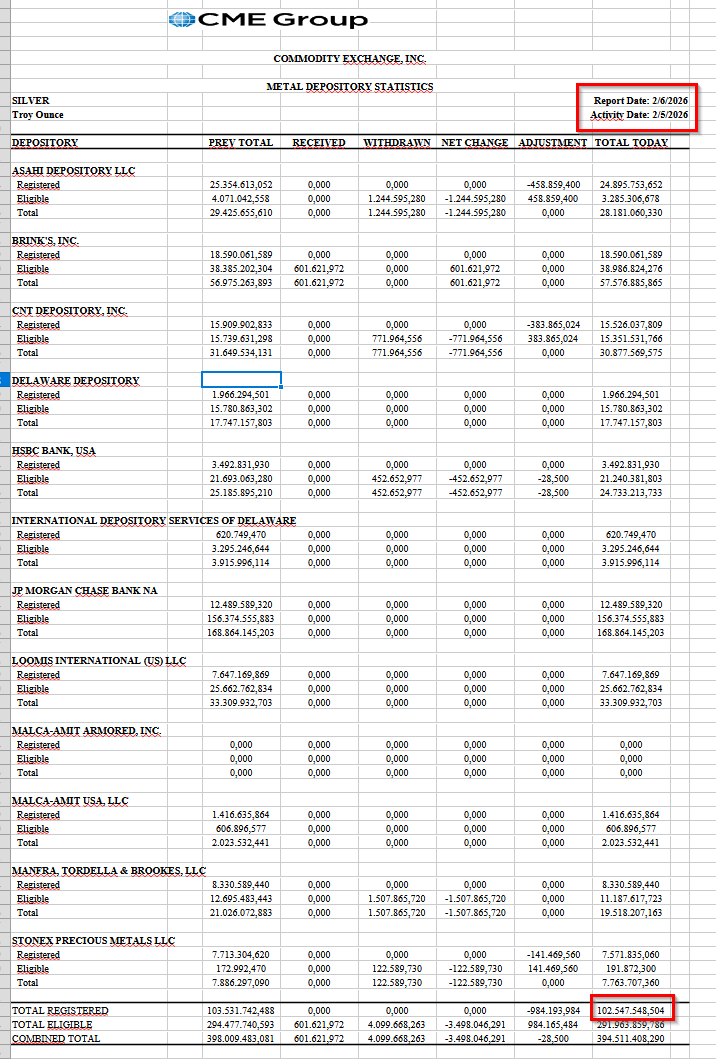

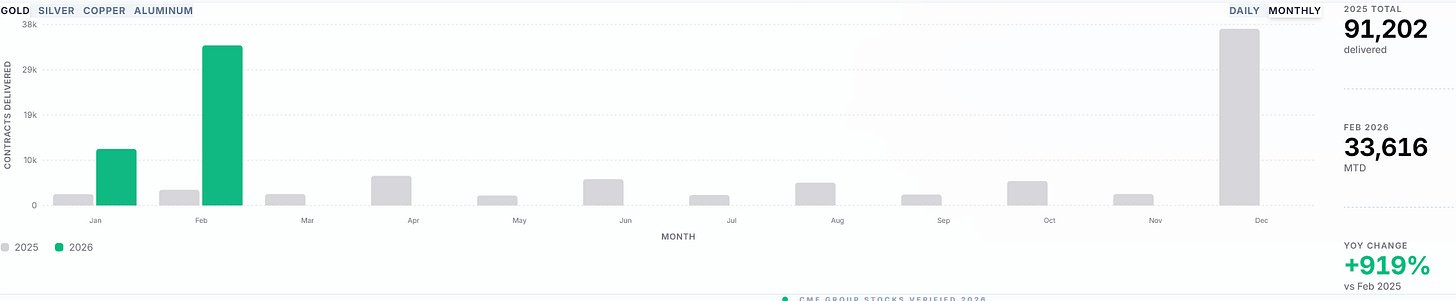

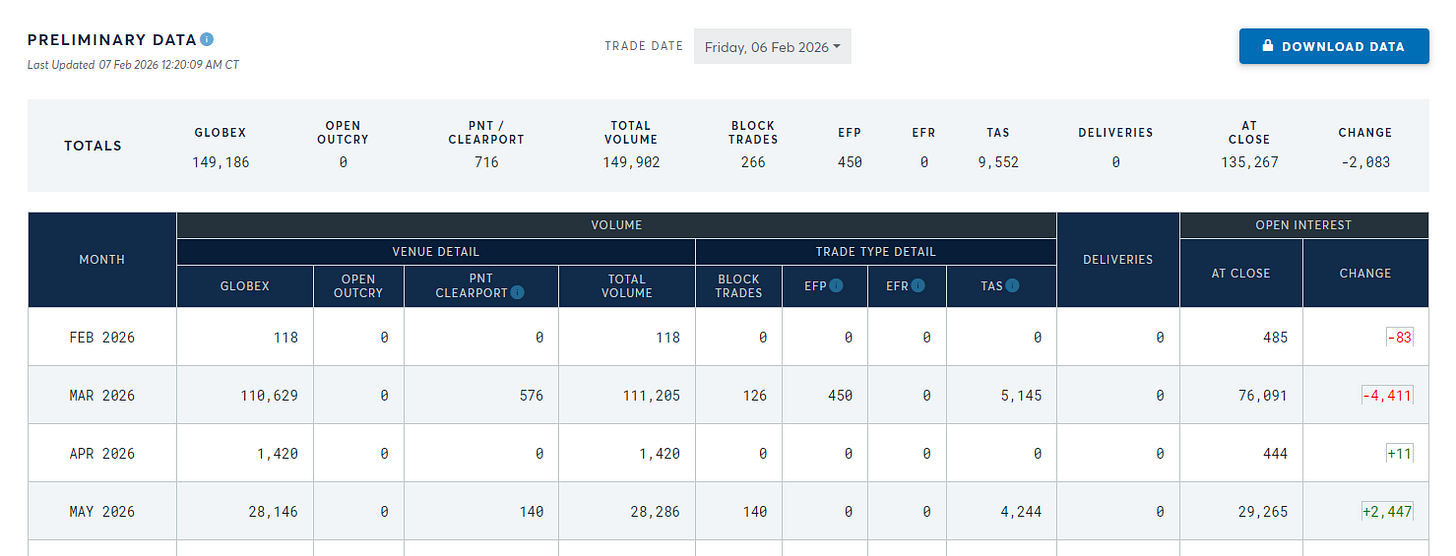

COMEX registered silver has dropped from 167.7 million ounces in October 2025 to 102.5 million ounces last report. That’s a 39% decline in four months. The drainage rate is running at around 750k ounces per day.

January 2026 saw 49.4 million ounces delivered. That’s 7.27 times January 2024 levels. In a non-primary delivery month. February is showing a 98% delivery rate - nearly every contract standing for delivery instead of rolling forward. Out of 19.11 million ounces of open interest, 18.72 million demanded delivery.

That’s not a futures market. That’s a run on the bank.

The March contract has open interest representing around 380 million ounces. COMEX has 102.5 million ounces registered, falling daily. Even if only 27% demand delivery - conservative given recent rates - they’d need 102.6 million ounces…

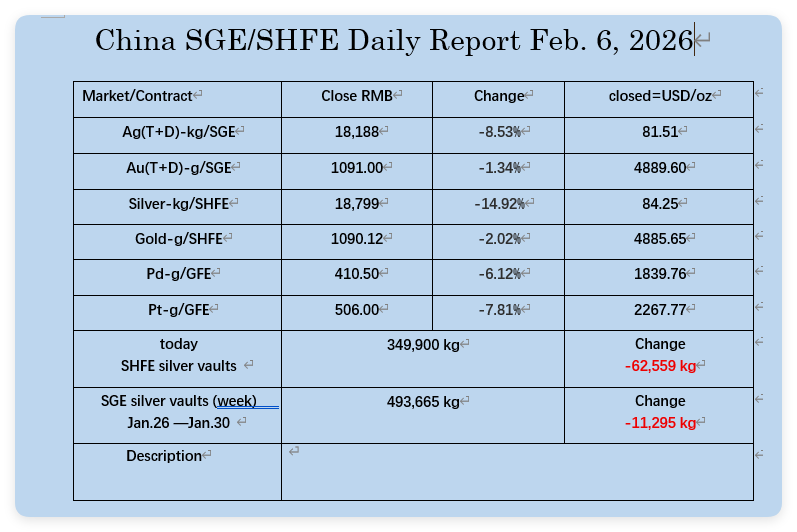

Meanwhile in Shanghai, trader Bian Ximing is short 450 tons. The entire Shanghai Futures Exchange has only 349.9 tons available. This guy is short more silver than exists on the exchange. Add to that the unbelievable drain last Friday! There’s simply no escape. Someone fails to deliver.

The paper-to-physical ratio has reached absurd levels. Some estimates put it at 250:1. For every ounce of real silver, there are 250 paper claims. I’ve seen numbers fluctuating between 400:1 to 25:1.

End of last year, I wrote that the US banks went net LONG for the first time in decades. They covered their shorts over the summer and flipped to 773 contracts net long by December. Allegedly JPMorgan, the bank that spent decades suppressing silver, is now positioned to profit from higher prices.

European banks didn’t get the memo. They’re still net short.

So when COMEX (an American institution) raises margins now, who gets hurt? Not JPMorgan (an American institution)… no no… Margin hikes squeeze European banks holding those massive underwater shorts.

So. Now we’re getting to the point I wanted to make: what happens when COMEX actually runs out?

There’s one scenario they probably should do but won’t: let the price run.

Why do you think that people are demanding delivery at 98% rates? Because they don’t trust COMEX to have metal later. Every delivery demand is a vote of no confidence.

If COMEX let silver run to $150, $200, … contracts would start rolling forward. Traders who believe COMEX delivers at $180 in June don’t ask for a panic-deliver in March. Delivery pressure will ease. Shorts will get crushed - which is what’s supposed to happen in a shortage. Markets will clear. And their credibility as a market will be restored.

But I can nearly assure you: they won’t. The shorts are European banks. But how are they entangled into the global financial system? Failure of one, would that set off a global contagion? Just look what happened to Lehman Brothers… “Contained” they said.

I wouldn’t want to be a politician in this environment. Because you’ve got the choice between two evils. Let European banks eat the losses, or permanently losing price discovery to China?

Because if they choose to intervene too obviously - liquidation-only, trade cancellations, forced cash settlement - every serious trader routes business through Shanghai. Yuan will become the pricing currency. And China controls yet another strategic market.

Remember that China just announced they want to “internationalize the RMB”. If thus the futures markets for precious metals move to Shanghai, if silver and gold gets priced in yuan? They will own everything. Manufacturing, resources, and financial infrastructure. You can’t maintain a reserve currency when you produce nothing and your adversary controls the commodities that enables said production.

That’s a geopolitical disaster that makes bank losses trivial.

Maybe they’ll let it run. Quietly bail out whoever needs it. But maintain market credibility and keep COMEX relevant.

It’s the smart play.

More likely, they’ll follow a combination of the following list:

Margins to 100%. They did it in 1980, quadrupled them in 2011. But the industry doesn’t care about margin though - they need the metal.

Position limits. “You can’t hold more than X contracts. Liquidate now”.

Trading suspension. Declare “disorderly market” and halt trading. LME suspended nickel for eight days.

Trade cancellation. The wrong people were winning.

Cash settlement. Can’t deliver metal? Here’s dollars at last Friday’s manipulated price.

Government intervention. Fed coordinated with COMEX in 1980. Volcker pressured banks. Think they won’t when dollar credibility is at stake?

Confiscation. FDR did it with gold in 1933. Silver is now a “critical mineral”. That’s the language before emergency measures.

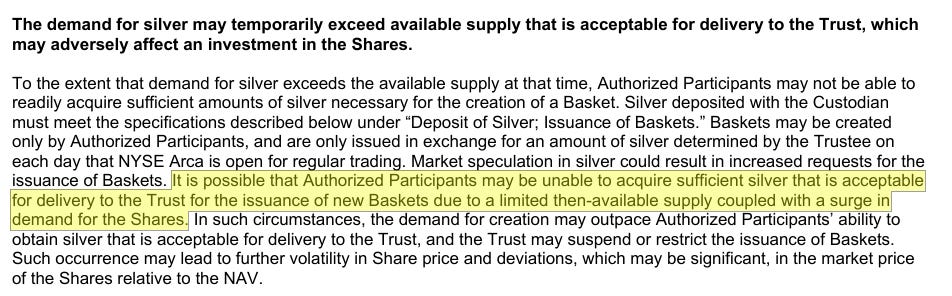

And then there’s the nuclear option. SLV

SLV can create new shares through Authorized Participants. Theoretically, each new share requires depositing physical silver. But there’s a settlement lag. And existing shares can be redeemed for physical simultaneously.

So the thought exercise goes like this: Authorized Participants flood the market with new SLV shares. Massive selling pressure. Price crashes from (completely hypothetical I assure you!) $120 to $75. They promise to deliver silver to back those shares... eventually. Meanwhile, other participants redeem existing shares for physical. More paper claims than physical silver. The vault is empty.

Then comes the announcement: “Due to unprecedented market conditions, SLV can no longer source adequate silver that meets London Good Delivery standards. Redemptions are suspended. Cash settlement only”.

Everyone gets dollars at the crashed price. ETF closes. Banks saved.

Does that benefit anyone except banks? No. Not the exchange. Not retail investors. Not America. But when did that ever matter?

And it’s all technically legal. The prospectus was amended in February 2021 to warn this could happen. “Authorized Participants may be unable to acquire sufficient silver... due to a limited then-available supply coupled with a surge in demand for the Shares”.

However, every option outlined above erodes trust. Every intervention proves the game is rigged. But if they intervene too obviously, then Shanghai wins by default.

Traders aren’t stupid. They watch this. If COMEX and LBMA become obvious jokes, if SLV turns into a cash-settlement scam, business moves to Shanghai. Not because China is more trustworthy. But because at least they actually deliver physical when demanded.

America already gave China rare earths, cobalt, lithium, solar, batteries, manufacturing, AI, … Silver and gold are about what’s left. A strategic resource that power AI, military and green energy.

Losing price discovery to Shanghai, will topple another pillar of the almighty dollar. Financial power needs something real backing it. But when China controls the commodities and the refining and the manufacturing as well as the (futures) markets that price them, what leverage does America still have?

Three genuine differences this time that might - might - break the pattern:

First, Shanghai exists as an alternative. In 1980, there was no other market. Today, if COMEX gets too obvious of a joke, traders will just leave.

Second, industrial demand is structural. You can’t margin-hike Nvidia out of needing silver for AI chips. Can’t suspend-trade solar panel production. Industrial users pay whatever it costs.

Third, above-ground stocks are nearly depleted. The Hunt Brothers had 100M oz when 12B existed globally. Now maybe 2-3B exists total. The cupboard is bare.

But I’ve learned not to underestimate the establishment’s creativity when crushing challenges to the system.

The only question is whether physical reality finally overwhelms paper fiction.

March delivery. First notice day February 27. Three weeks away.

The Hunt Brothers tried. Max Keiser tried. WallStreetBets tried.

Every time, the authorities changed the rules.

This time it’s European banks versus American banks versus China.

The Americans switched sides. They’re long now. They win if silver runs.

The Europeans are trapped. No escape.

And China? Waiting. Ready to take price discovery if the West plays too many games.

Someone’s going to get sacrificed when the music stops.

And to me it looks like Europe drew the short straw.

Addendum:

So where does that leave me?

I’m holding SILJ January ‘27 calls and SLV June/August calls. And I’m starting to think to move securities.

SLV is custodied by JPMorgan. The same JPMorgan that just flipped long silver after decades of manipulation. Same bank that can weaponize the share creation mechanism.

If COMEX suspends trading in March, my calls sit there bleeding theta while I can’t do anything about it. Although June and August gives me enough time past this March delivery crisis, but I’m still betting they don’t change the rules (too much).

SILJ has the same problem. If COMEX suspends and nobody knows the “real” price of silver, miners crash on uncertainty even as physical metal is soaring. Plus operational risk, management risk, nationalization risk in Latin America.

So - and this is NOT financial advice - what I’m thinking about instead:

Warrants on senior producers. Five-year duration, built-in leverage, can’t get theta-decayed to death during a trading suspension. Companies like Wheaton Precious Metals or Franco-Nevada sometimes have warrants outstanding. You pay pennies for years of exposure. If silver runs to $200, these go 10-20x. If they suspend COMEX for two months, you’re not watching options expire worthless. The time value doesn’t decay the same way - you have years to be right, not months.

Physical silver. 30% premiums hurt, but there is no counterparty risk. They can’t zero your account with a keystroke.

PSLV over SLV. If I’m staying in paper, at least Sprott isn’t JPMorgan. Better audit trail, actual redemption rights if I accumulate enough (or band together).

Physical gold. Boring. Won’t do 10x. But central banks are permanent buyers and they probably leave gold alone when crushing silver. It’s a 70x larger market after all, that much harder to manipulate.

March first notice day (Feb 27) will tell me a lot. If COMEX delivers smoothly, maybe I’ll keep these calls. But if they start hiking margins, changing the rules? I’m out. Because I know enough history to know how this ends when the little guy is winning.

"I’ve learned not to underestimate the establishment’s creativity when crushing challenges to the system."

Oh yes. The established players don't care whether you're trying to rob the system or reform it. Either way you will be attacked with great vigor. This applies to politics and economics equally, as they work hand in hand.

COMEX will not reform itself, nor will politicians force it to. The only hope for a functional market is Shanghai. There, at least, there's a non-zero chance that the authorities will not give banks the keys to the vault.

From a recent speech by Xi Jinping, President of China:

"[We must] adhere to the people-centered value orientation. The financial cause led by our Party is ultimately intended to benefit the people, which is very different from the nature of some countries' finance serving capital and serving a small number of rich people. In the new era, financial work should stand firm in the people's position, enhance the diversity, inclusiveness and accessibility of services, and better protect the rights and interests of financial consumers.

[We also must ensure] that the real economy remains our fundamental purpose. The real economy is the foundation of finance, finance is the bloodline of the real economy, and serving the real economy is the vocation of finance. If you are keen on self-circulation and self-expansion, [hyper-financialization, in other words] finance will become passive water, uncut wood, and sooner or later a crisis will be formed. China's finance must adhere to the service of the real economy, promote high-quality development, and must not be out of the real situation."

Generally speaking, when the highest authorities in China say, "This is the way it's going to be," they mean it. And if you'd like the evidence of that, simply look at how the government of China has gone after their billionaires, like Jack Ma (Alibaba), Jimmy Lai (China Daily) and the Evergrande crew.

In China, banks and oligarchs don't tell the government how things are going to work. It's the other way 'round.

So JPMC moving metals tading desk to Shanghai? That tells me which way the wind is blowing. When the music stops, there will be a lot of people holding paper and a few people holding cool, shiny silver.