Third time's the charm, right?

CME hikes margins. AGAIN!

I’ve been watching something fascinating unfold in the silver market, and for once it has nothing to do with supply deficits or industrial demand or any of the usual stuff I pump out. This is about power. Plain and simple power. It’s about which banking families will survive and which ones get sacrificed.

The CME announced on Friday that silver futures margin requirements are going up again. Effective Monday, December 29th. Third hike in a month. Western silver is trading around $77, up 169% year-to-date, and the exchange that’s supposed to facilitate price discovery just keeps making it more expensive to play.

Now normally, margin hikes are used to crush the longs. That’s the playbook. That’s what happened to the Hunt Brothers in 1980. That’s what happened in 2011 when silver touched $49 and the CME raised margins five times in nine days. You jack up the cost of leverage until the speculators capitulate and the price collapses.

But here’s what’s different this time™.

The shorts are the ones who are fucked.

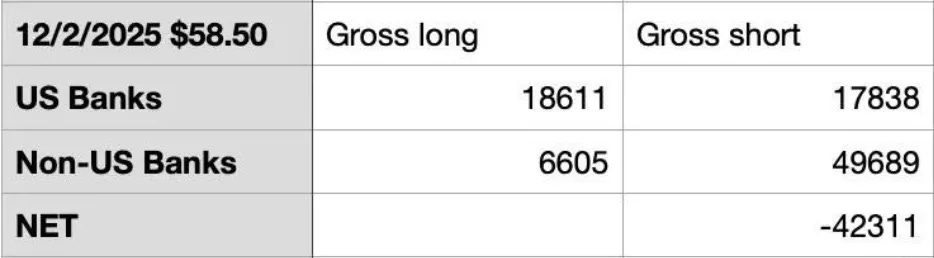

Read this: (Sprott’s Bank Participation Report from December 2nd).

US banks are now net LONG silver for the first time anyone can remember. Not short. Long. They’re sitting on 18,611 long contracts against 17,838 shorts. Net position: positive 773 contracts.

Meanwhile, Non-US banks (I am going to assume they’re European) are holding the bag. They’re net short 42,311 contracts. At current prices - call it $77 per ounce times 5,000 ounces per contract - that’s a paper loss exceeding $16 billion. And that’s before Monday’s margin hike forces them to post more collateral on those underwater positions.

Think about what a margin call means when you’re short. When you’re long and profitable, more margin is annoying but manageable. You’re sitting on gains. You can meet the call. But when you’re short and the market has moved $47 against you since January? When you’re such a bank who’ve been conditioned for decades to believe the Fed and the COMEX would always protect the dollar and suppress gold and silver?

You’re about to learn what “unlimited losses” actually means in practice.

The narrative the PTB are pushing is that this margin hike is designed to “protect market integrity” or “ensure adequate collateral coverage” or whatever corporate euphemism the CME’s risk management department cooked up. But the December 12th hike didn’t stop anything. Silver dipped for about 15 minutes, then blasted through to new highs. The market absorbed 67 million ounces of paper selling and asked for more.

Because the physical buyers don’t care about paper games anymore.

This isn’t 1980. This isn’t even 2011. The Hunt Brothers were playing with leverage on a finite balance sheet. Today’s physical demand is coming from sovereign nations, from industrial users who can’t afford supply disruptions, from central banks quietly rotating out of dollars. They’re not using leverage. They’re using cash. And when the COMEX creates a dip, they buy.

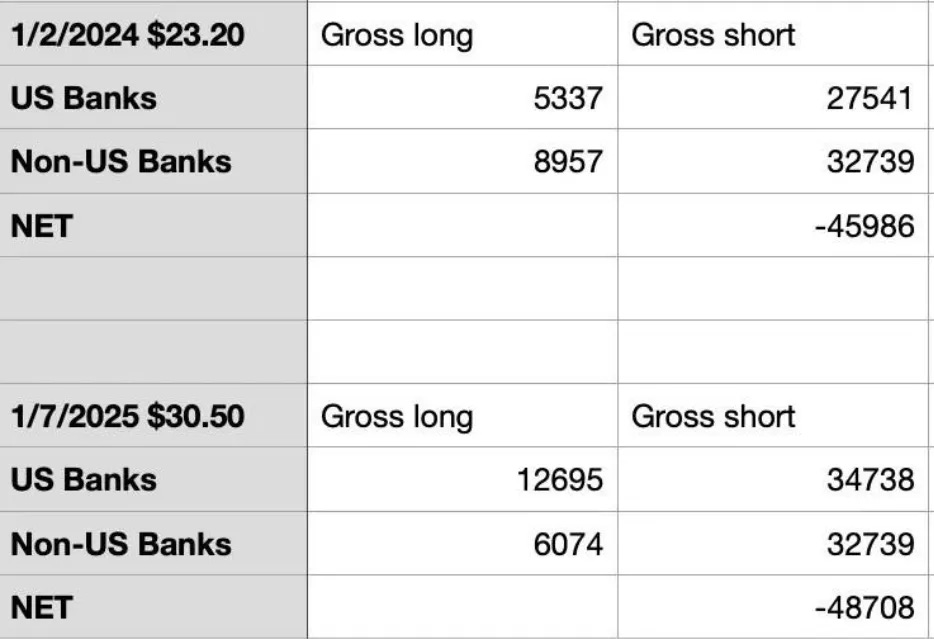

Look at the timeline. US banks started aggressively covering their shorts and flipping long over the summer. By early December, they’d completely reversed a position they’d held for literally decades. They went from being the primary suppressors of silver prices to being net long.

European banks didn’t get the memo. Or maybe they got it and couldn’t execute. Either way, they’re still massively short while their American counterparts have switched sides.

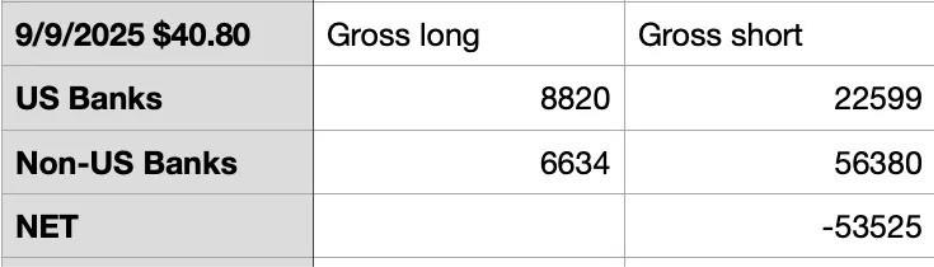

So when the CME announces another margin hike - ostensibly to “manage volatility” - who does it hurt? The European banks sitting on enormous underwater shorts. Who does it help? The US banks sitting on profitable longs and the physical buyers who’ll scoop up whatever paper gets panic-liquidated.

I’m not saying there’s coordination here. I’m just noting that when you change the rules in the middle of the game, the rule change tends to benefit whoever made the change.

The margin requirement on a standard 5,000-ounce silver contract is moving from around $20,000 to over $25,000. That’s a 25% increase in required capital. If you’re a European bank holding 49,689 short contracts, you need to find an additional $248 million in cash. Not to close your position. Not to reduce your exposure. Just to keep the trade on.

And this is happening as we roll into year-end. When balance sheets get scrutinized. When auditors ask uncomfortable questions about marked-to-market losses on your commodity derivatives book. When explaining a $16 billion hole in your precious metals trading operation becomes politically awkward.

The shorts have three options: post more capital, cover at these astronomical prices, or default.

If they post more capital, they’re throwing good money after bad. Silver has no ceiling when the physical market is this tight. Industrial buyers will pay whatever it costs. Central banks aren’t selling. The Chinese government just ordered 400 million ounces through state entities. That’s half of annual global mine production. In one order.

If they cover, they drive the price even higher through their own buying. A short squeeze feeding on itself. We saw a preview on Thu/Fri when silver jumped $6 in a matter of hours. Now imagine systematic covering of 42,311 contracts. That’s 211 million ounces. There isn’t that much registered silver available on the COMEX. You’d blow straight through $100.

If they default... well, then we find out what happens when major European financial institutions can’t meet their obligations on a commodity exchange. I suspect the answer involves bailouts and liquidity facilities and all the usual central bank magic. But it also involves reputational destruction and forced liquidations and the kind of wealth transfer that makes headlines.

Monday’s margin hike is interesting for what it reveals about who has power and who doesn’t. The CME didn’t make this decision in a vacuum. They’re seeing something in their clearing data. They’re watching which banks are posting collateral and which ones are struggling. They’re calculating counterparty risk.

And they’re protecting the clearing house.

The CME Group doesn’t care if European banks get crushed. They care about their own exposure. If a major short holder blows up and can’t cover, the clearing house is on the hook. So you raise margins. You force the weak hands to either post more cash or get out. You protect the system by sacrificing whoever can’t keep up.

I’ve watched precious metals long enough to recognize the playbook. They ran this same script with Melvin Capital and GameStop. The difference is that GameStop was a degenerate short squeeze on a dying retailer. This is a fundamental supply deficit in a strategic commodity meeting coordinated demand from the world’s largest economies.

When this unwinds, the losses won’t be confined to some European banks’ derivatives desk. Because those banks borrowed physical silver to create the paper shorts. They leased metal from central banks, from sovereign wealth funds, from pension funds looking for a return on their bullion holdings. That silver is now gone - delivered to India, melted in China, sitting in private vaults in Singapore.

It’s not coming back.

So the entities that leased their silver are going to get cash-settled. At these prices. And they’re going to realize their strategic reserve just got converted to euros at exactly the wrong moment. Right as the dollar loses its monopoly on international settlement. Right as gold and silver reassert their role as the only money that can’t be printed.

The United States banking system appears to have seen this coming. They covered their shorts. They went long. They positioned themselves on the right side of what’s about to happen. The European banks... didn’t.

Maybe that’s incompetence. Maybe it’s just bad timing. Maybe they genuinely believed the old system could be maintained indefinitely.

Or maybe, in the ruthless calculus of great power competition, someone had to hold the bag when the music stopped.

The margin call comes Monday. Silver is trading at $77. European banks are short $16 billion worth of a metal they don’t have and can’t deliver. The physical market is the tightest it’s been in decades. The Shanghai price is $7 above COMEX, signaling that China is willing to pay a premium for delivery.

And the CME just made it more expensive to stay in the trade.

When powerful families fight for survival, they don’t send polite memos. They change the rules. They force liquidations. They make sure someone else pays the price for the transition to the next monetary system.

This time, it looks like the bill is going to Europe.

Waiting for the next shoe to drop...

"'Colonel, what's the situation down there? It's getting pretty sporty down here, sir!"

Hold tight, don't panic, wait to see what the new paradigm brings...

One can only hope honesty wins, this time.

"I have not written to you because you do not know the truth, but because you know it, and that no lie is of the truth."

Informative article! I did not know of the imbalance with European silver contracts.

Interesting how JP Morgan went from a net short after so many years, to a long position. They also moved operations to Shanghai just recently, yes?

Gone are the days when Max Keizer would say, "Crash JP Morgan, buy silver". Now it's like, "Crash the Euro, buy silver!"

Thank you for this post.