(Pet) rock, paper, scissors

A case study in coordinated intervention

Yesterday felt like a warning shot. Today feels like war.

Silver opened Thursday morning at $116.60, climbed to $121, then someone pulled the rug. Down to $106 before recovering to close basically flat at $115.80. The miners barely noticed. Classic end-of-month shenanigans, I figured. Some overleveraged player needed to window-dress their books. Maybe a fund had to close positions because their risk manager finally learned to read.

I was wrong.

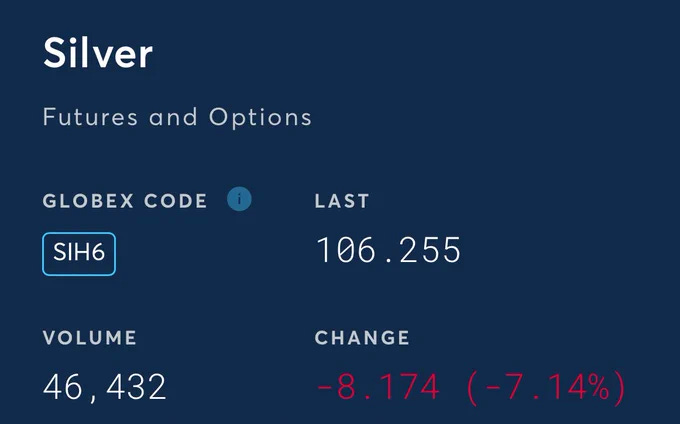

Today the real fun started. From $118 to $95. That’s not profit-taking anymore. That’s not even panic. That’s a 20% intraday collapse in what’s supposed to be money. The kind of move that makes crypto look stable. The kind of move that happens when something breaks.

So what broke?

Let’s start with what we know. China suspended trading on five commodity funds today. Silver and oil, specifically. If you want to buy physical gold in China right now, you’re waiting a month. Silver in Thailand takes two months unless you know someone who knows someone. This isn’t some normal market friction. This is “we don’t have the metal” friction.

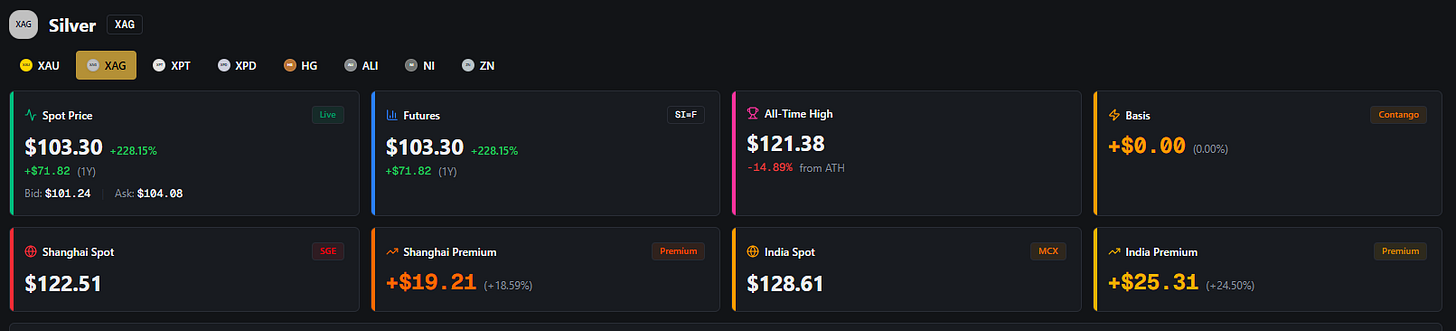

The Shanghai Gold Exchange has been trading silver at premiums over COMEX that would make VISA envious. We’re talking 10+% at the minimum (18% at the time of writing). On Thursday, Shanghai silver contracts hit $125 while New York sat at $112. That’s not arbitrage anymore, that’s increasingly the sign of two different markets. One where you actually can get the metal. And one where you get promises.

And those promises are looking awfully thin these days.

Between early and mid-January, 33.45 million ounces of silver were physically withdrawn from COMEX. That’s 26% of registered inventory. In a week. Not rolled to the next contract. Not cash-settled. Gone. Someone wanted their metal and they wanted it now.

COMEX’s response? Margin hikes. Lots of them.

The CME has raised silver margins over half a dozen times since late September. They even switched to a percentage-based system in mid-January - 9.9% for silver, compared to 5.5% for gold. When silver was at $80, that meant posting $25,000 per 5,000-ounce contract instead of $20,000. Nice and round. But when silver hit $120? That same contract needed over $30,000 in margin.

Higher prices mean higher margin requirements mean forced liquidations mean more volatility means lower prices means... well, you see where this goes.

The official story I’ve seen is stupid simple.

Kevin Warsh.

Trump’s expected nominee for Fed Chair got leaked this morning, the dollar bounced, and precious metals puked. Perfectly normal market behavior for a 17% intraday crash, right?

Sure. If you believe that, I’ve got some LBMA inventory to sell to you.

Look at the pattern. Silver is up 70% in January alone. Mining stocks are barely participating. Shanghai is diverging from the COMEX. Physical premiums are exploding across Asia. China is implementing export controls on January 1st that require exporters to prove they shipped metal annually from 2022 to 2024 and have production capacity over 80 tonnes. That’s not resource management. That’s a stranglehold.

Then the margin hikes. Multiple times. In rapid succession. The kind of intervention you see when someone’s about to default on delivery.

Yesterday’s crash happened during US trading hours. Today’s is happening in Asia. The VIX spiked 13% pre-market before settling back to 7% up. S&P and Nasdaq wobbled then recovered. Dow barely moved. So this isn’t a broad market stress. This is precious metals specific.

And then there are the whispers. Fitting the pattern perfectly. The LME encountering “temporary issues” - that wonderful euphemism exchanges use when prices are moving in directions they don’t like. HSBC also having “temporary issues”. All coincidentally happening during a 20% silver crash.

Sure. Temporary issues. “Cooling issues”… Just like the nickel market in 2022. Just like every other time an exchange cancels trades or halts markets to protect its members from their own positions.

But here’s the part that makes my spidey sense tingle: the volume.

A 20% crash should come with massive volume. Panic selling. Margin calls forcing liquidations. Dealers hedging. Algorithms piling on. You’d expect to see volume spike to multiples of the daily average.

That’s not a market. That’s a magic trick. Or more precisely, it’s spoofing. Large sell orders appearing and disappearing. Coordinated selling designed to trigger stop-losses in thin liquidity. Minimal actual metal changing hands while the price gets crushed.

For more information:

When legitimate sellers exit, volume explodes. When someone’s manipulating the price with phantom orders, volume will stay suspiciously low.

So let me throw out some theories, and you tell me which one sounds craziest.

Theory one: The pump and dump. Someone accumulated massive positions as silver climbed to $120, then coordinated the margin hikes and China fund suspensions to trigger forced selling. Classic manipulation. Buy low, sell high, crash it, buy again. Except the Shanghai premium says there’s actual physical tightness. Hard to fake that across multiple markets.

Theory two: The big player rescue. Some bank or fund is catastrophically short silver and facing delivery demands they can’t meet. The 70% January rally has them bleeding billions. They called every regulator they know - CME, Chinese authorities, maybe even the Fed’s repo window off-hours. “Help us or we blow up spectacularly”. The margin hikes and fund suspensions are the help. Force everyone else to puke so the shorts can cover at better prices. Problem: COMEX registered inventory is at multi-year lows and draining fast. Cover with what?

Theory three: The system break. The paper-to-physical ratio on silver was recently estimated at 356 to 1. That’s 356 ounces of paper promises for every ounce of real metal in the vaults. The system works as long as nobody asks for delivery all at once. But what if they are? What if someone realized COMEX doesn’t have the metal and decided to dump their paper contracts before they’re worth zero? Better to get $95 than $0.

That would explain why this isn’t happening in the same magnitude in gold. Gold’s contango has been driving arbitrage flows from London to New York. Silver’s in backwardation - spot above futures. That’s supply stress. That’s “I need metal now, not in three months”.

Theory four: Iran. There’s always Iran. Or something geopolitical. Except this feels too coordinated across too many jurisdictions. China doesn’t suspend commodity funds because of Middle East tensions.

My money - and yes, literally, I bought SLV calls yesterday and I’m buying more today, not financial advice - is on some combination of theories two and three. Someone big is in trouble. The physical squeeze is real. The margin hikes are an attempt to take pressure off before something breaks completely. The China fund suspensions are Beijing protecting its own markets from Western contagion or vice versa.

What really bothers me though?

The price action is violent. Scary. The kind of volatility that shakes out weak hands and makes retail investors swear off metals forever. The underlying fundamentals haven’t suddenly changed. Industrial demand is still climbing. Mine supply is still constrained. China still controls the refining capacity and they’re not sharing. Central banks are still accumulating.

Physical delivery in Shanghai, Japan, and UAE has been trading at massive premiums - reports of $130 per ounce when COMEX showed $72 on January 1st. That’s not a typo. That’s an 80% premium. The biggest paper-physical decoupling in precious metals history.

So either we just witnessed the most aggressive price suppression attempt since the Hunt Brothers, or we’re watching the paper market realize it sold promises it can’t keep. Maybe both.

The backtest to $100 is holding. For now. Whether that’s a floor or just a rest stop on the way to $50 depends on what actually broke. If it’s just overleveraged specs getting margin-called, we bounce hard. If it’s something structural - if COMEX or a major bank can’t deliver metal - this is just the beginning.

One thing I know for certain: when Shanghai is paying 23% premiums and your local dealer can’t get metal for two months, the paper price isn’t telling you the whole story. Someone’s lying about their inventory. Someone’s about to default. Someone’s going to get rescued.

And when the smoke clears, we’ll find out who was swimming naked when the tide went out.

Silver at $95 after hitting $121 yesterday? That’s either the buying opportunity of the year or a warning to get the hell out before the real crash begins.

I’m betting on the former. Because when paper breaks, physical is all that’s left. And from where I’m sitting, the paper’s starting to tear.

Position note: I entered SLV call positions on January 29th and will add PSLV, SILJ, SIL, GDX or GDXJ today. This reflects my personal thesis that the current weakness is forced selling rather than a fundamental change in the silver supply deficit. Do your own research and risk management. When volatility is this extreme, position sizing matters more than being right.

I'm with your "both" happening. I see no way for the manipulation to end until the silver paper market is exposed as a gambling lie. As long as calls can be bought to cover the puts they will.......... right up to that point where the percentage to buy curtails buying. When the loss becomes unmanageable.

Another great job. Thanks.

What do you know about PSLV and CEF? I'm curious. In that past, but I didn't dig into this deep I read the "SLV" didn't really have the physical "backup" - but presumably - by "charter" PSLV and CEF MUST have this - and it is supposedly audited.

But no doubt - the price swings suggest -

"Something big is up" - and at the end of the day it boils down to the simplest economic truism regarding simple supply and demand is what I think. So physical is real supply - paper - it burns.