Oops! They did it again!

The Shanghai silver massacre

They did it again. sigh…

Just days after Friday’s historic silver crash, the same playbook ran in Shanghai this morning. Except this time we got names. We got numbers. And we got an exchange that will actually do something about it.

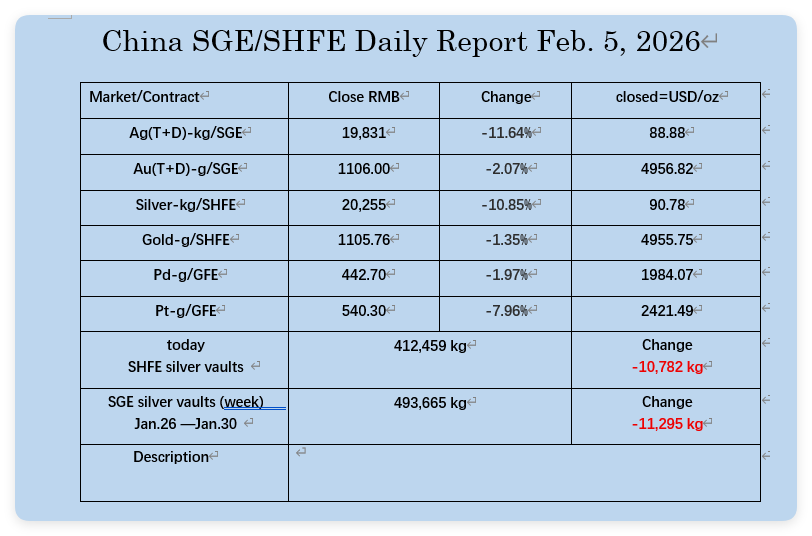

1.3 billion ounces of silver traded at the Shanghai Futures Exchange in two hours. Read that again! That is nearly double the entire world’s annual silver production. Traded in a single morning session. On one contract month alone - April 2026 - they moved 674 million ounces.

This was not some retail players. This DEFINITELY was not some organic market event. This was a coordinated assault on the silver market, and it left fingerprints everywhere.

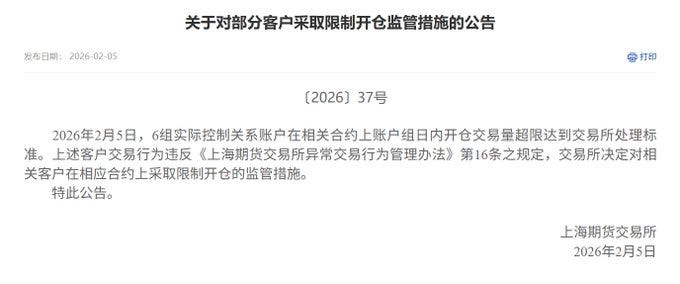

Six account groups exceeded daily trading volume limits, violating Article 16 of the exchange’s Abnormal Trading Behavior Management Measures. The exchange restricted their ability to open new positions. In plain English: they got caught manipulating the market and got their hands slapped.

But who were they?

Financial Times and Bloomberg pieced it together. Zhongcai Futures, run by billionaire commodity trader Bian Ximing, built the largest net short position on the SHFE - 450 tons, or about 30,000 contracts. According to the data, he is now up roughly 2 billion yuan. That is $288 million in profit from betting against silver since late January.

Zhongcai had gotten burned shorting silver in November. They rebuilt their bearish positions in January, right before the retail “long squeeze” hype peaked. They used Friday’s massacre as their first strike - silver dropped 26% that day. Then they finished the job overnight in Shanghai.

And they were not alone.

Multiple sources reported that JPMorgan, which conveniently opened an Asian trading desk just months ago, used the crash to close roughly $10 billion in short positions at the market bottom. Perfect timing, wouldn’t you say? Retail gets liquidated. The big boys cash out. Tale as old as markets.

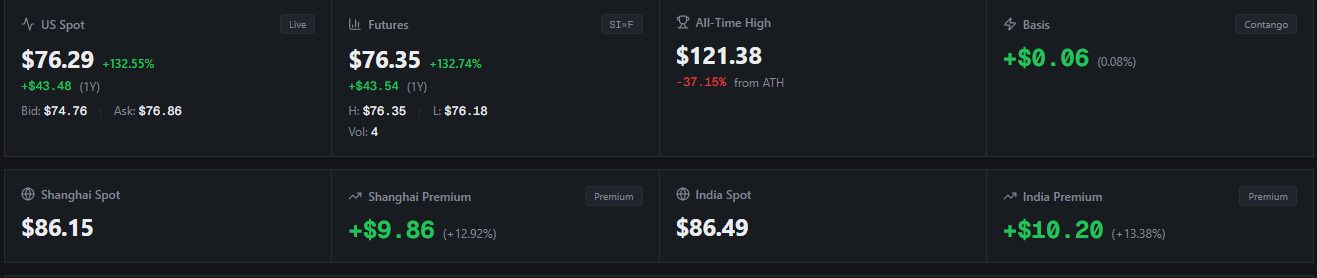

Silver futures in Shanghai crashed from around $107 equivalent down to the high $80s. The Western markets followed in lockstep - COMEX got slammed right when SHFE trading began, taking the price down from $90. Same algorithm. Same timing. Same goals.

But something did not break.

Despite this violent moves the physical market refused to capitulate. Shanghai premiums compressed from around $15 to $9 per ounce over COMEX - but they did not disappear. Backwardation persisted. Near-term metal still commands a premium, which only happens when physical is tight.

And the inventories? Still draining. SHFE silver vaults dropped another 10.7 tons. The Shanghai Gold Exchange lost another 11.3 tons last week. When prices crash, inventories are supposed to rise as holders dump metal. Except that is not what is happening. The physical keeps leaving.

You see the problem, right? Plenty of paper silver. The physical market says: No Way José.

The SHFE is now implementing new measures starting Monday - daily price limits increased to 20%, margin requirements jacked up to 21-22%. Too little, too late? Maybe. But at least they are acknowledging the problem exists.

Meanwhile, COMEX continues business as usual. Over 3,500 contracts stood for delivery in the first four days of February alone - about 17.5 million ounces. The registered inventory keeps shrinking every week. But sure, everything is fine.

Massive concentrated shorts. Coordinated smashes across exchanges. Perfect bottom-timing by the connected players. And through it all, the physical market keeps sending the same signals that scream shortage.

Friday’s crash and this morning’s Shanghai massacre... Similar players. Similar methods. Same crime. Different continents.

What should happen when you have an insane amount of silver shorts while the physical vaults empty? You should lose. But Wall Street titans do not like getting squeezed, and they really don’t like losing to others.

This aint retail versus Wall Street anymore. This is titans versus titans, and we - the little fish - are getting eaten alive in the process.

When silver stays artificially below equilibrium, the physical bleed won’t stop.

The further from this equilibrium, the faster the bleed.

Guess what happens when those vaults hit zero?

Thats why I’m an investor not a trader, the big boys have the big guns, I have a pea shooter. If the the fundamentals are still good I’ll add on weakness. To quote Graham “ in the short term, the market is a voting machine, but in the long run it is a weighing machine

To think I thought I knew what corruption meant. The current world “ hold my beer”. 🤦♀️