If nothing changes, BTC is finished in a decade

It's only ~~natural~~ math

Remember when I talked about quantum computers potentially cracking Bitcoin? Turns out we might not need to wait for quantum computing. Bitcoin’s own design might kill it first.

Justin Bons just dropped this thread that should terrify every Bitcoin holder. Not because he’s predicting some external attack or regulatory crackdown. Because the math simply doesn’t work. And even though he’s talking his book (he owns a crypto-security company), unlike most crypto doomposting that I read, this one isn’t speculation. It’s arithmetic.

Let me walk you through why Bitcoin has a built-in expiration date. And why almost nobody seems to (want to) understand what’s going on.

How Bitcoin Security Actually Works

Think of Bitcoin like a fortress. The walls are built from mathematics - cryptographic puzzles that are insanely hard to solve. Miners are the guards patrolling those walls. They use electricity and computing power to solve these puzzles, and in return they get paid. This payment is what keeps them showing up for work.

Right now, miners earn money two ways. First, they get the newly created bitcoin - fresh coins that didn’t exist before. This is called the “block reward”. Second, they collect transaction fees from everyone moving bitcoin around.

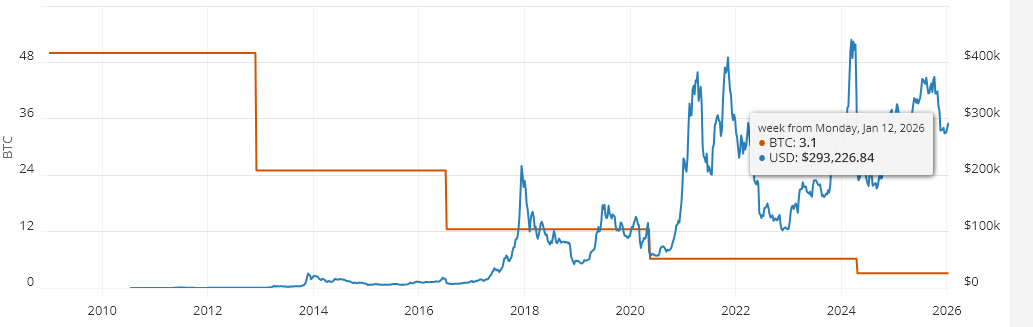

The block reward started at 50 BTC per block back in 2009. Every four years, it gets cut in half. This is the “halvening” that Bitcoin fans celebrate like some kind of religious event. 50 became 25 in 2012. Then 12.5 in 2016. Then 6.25 in 2020. Then 3.125 in 2024. Next halvening in 2028 drops it to 1.5625 BTC.

The halvening continues forever until the number becomes so small it’s basically zero. By 2140, the last bitcoin gets created and the block reward disappears completely.

Bitcoiners will tell you this scarcity is brilliant. Fixed supply. No inflation. Sound money. And they’re not wrong about the scarcity part. There will only ever be 21 million bitcoin. That’s guaranteed by the code.

What they don’t tell you is what happens to security when you keep cutting miner revenue in half every four years.

Because those guards patrolling the walls? They need to get paid. And if you keep cutting their salary in half, eventually they stop showing up. When enough guards leave, the fortress becomes vulnerable. Someone can bribe the remaining guards cheaper than the fortress is worth defending. That’s when the raids begin.

The timeline? Three more halvenings. 2028, 2032, 2036. Somewhere in that window, Bitcoin’s security budget drops low enough that attacking it becomes profitable. Not theoretically profitable. Actually profitable. Like, you’d be stupid NOT to attack it profitable.

Why Price Can’t Save This

Bitcoin maximalists have a simple answer. Price goes up. If bitcoin costs twice as much, then half as many coins equals the same dollar value for miners. Problem solved.

Except Bitcoin would need to double in price every four years. Forever.

Let’s run those numbers. Bitcoin is near $100k today. Next halvening in 2028, it needs to be $200,000 to maintain current security. Fine, maybe that happens. Then $400,000 in 2032. Then $800,000 in 2036. Then $1.6 million in 2040. Then $3.2 million in 2044. Then $6.4 million in 2048.

By 2060, one bitcoin needs to be worth over $100 million. By 2080, over $6 billion per coin. Bitcoin’s total market cap would be larger than the entire global economy. Multiple times over.

Michael Saylor keeps predicting Bitcoin will hit $1 million, $5 million, $13 million. Great. That buys you maybe another halvening or two. Then what? $26 million? $52 million? At what point do we acknowledge that “number go up forever” isn’t a security model, it’s hopium?

This is not a “maybe it works” scenario. This is a “basic arithmetic says no” scenario. There is not enough wealth on Earth for Bitcoin to maintain its current security through price appreciation alone.

You can’t exponential your way out of an exponential problem. The halvening IS exponential decay. You need exponential price growth to compensate. Exponentials always win these races. Always. The numbers get absurd within decades, not centuries.

So price can’t save this. What about fees?

The Fee Trap

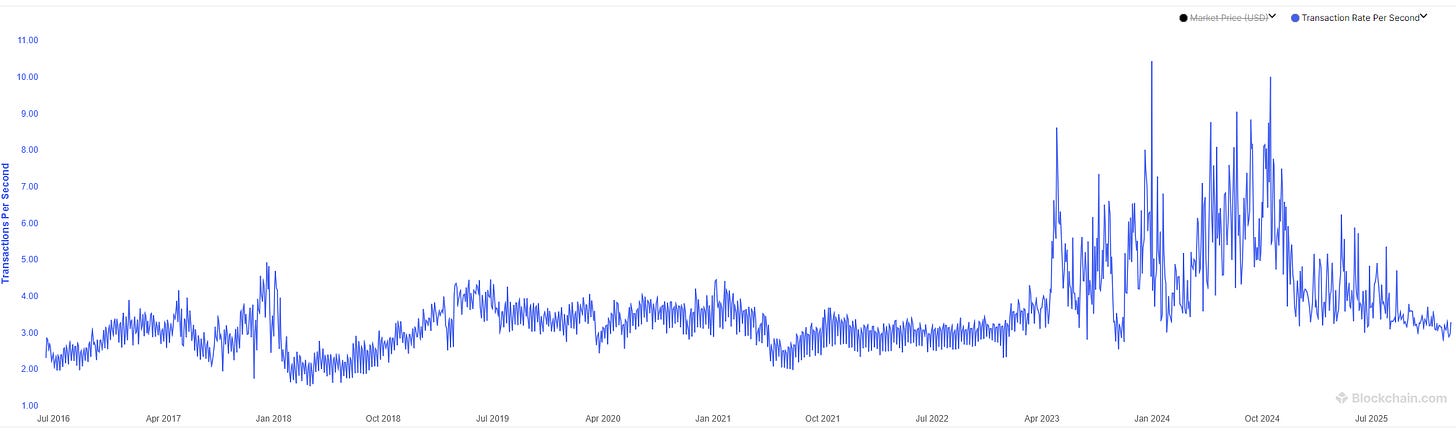

Bitcoin processes about 7 transactions per second. That’s roughly 600,000 transactions per day. For miners to earn the same revenue they get from block rewards today, each transaction would need to pay enormous fees once the block reward disappears.

How enormous? Let’s do the math.

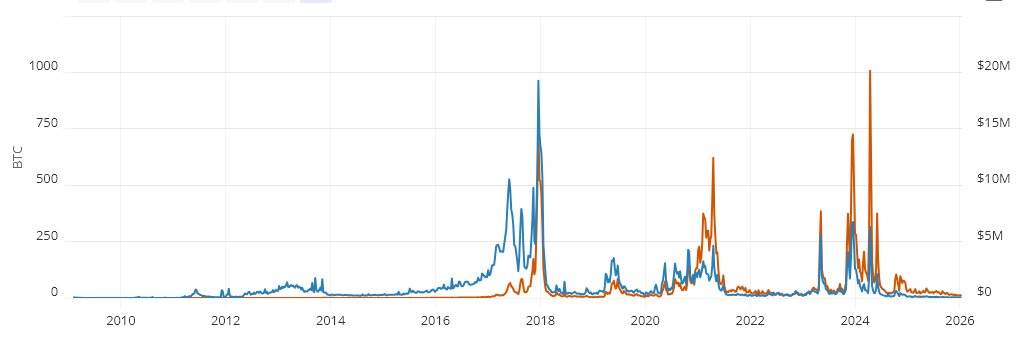

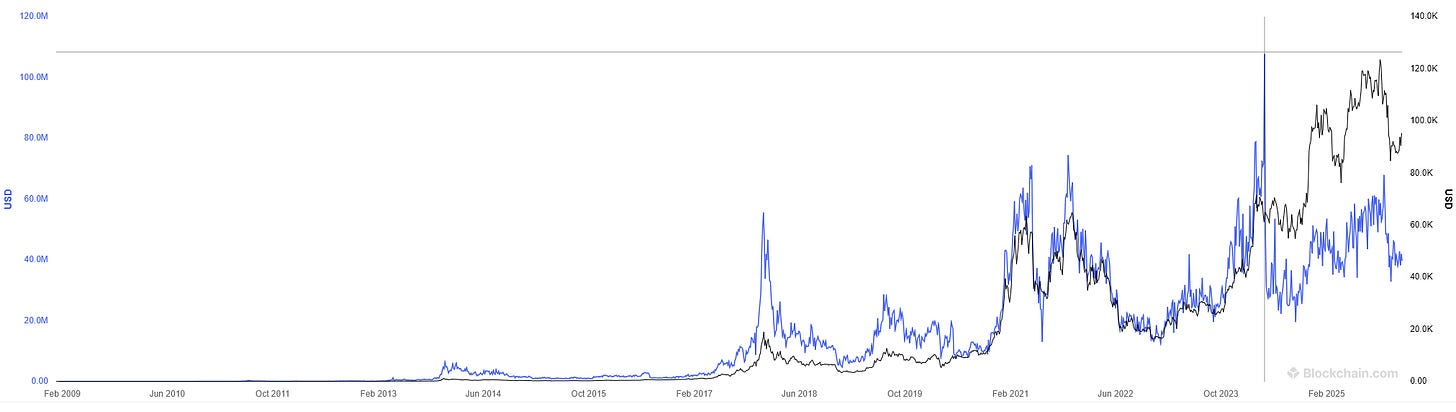

Currently, miners earn about $17 billion per year total (block rewards plus fees). Almost all of that comes from block rewards. Fees contribute maybe $140 million - less than 1% of the total.

Fast forward to 2036, after three more halvenings. The block reward contributes only $2 billion per year instead of $16.5 billion. To maintain the same total revenue, fees need to make up the $14.5 billion difference.

That’s 600,000 transactions per day times 365 days. About 219 million transactions per year. Divide $14.5 billion by 219 million and you get roughly $66 per transaction just to maintain current security levels. And that’s assuming the number of transactions stays constant, which it won’t if fees spike.

Here’s where the trap closes.

When Bitcoin fees hit $50 or $100 or $200 per transaction, people stop using Bitcoin. They go use something else. Lower volume means even higher fees per transaction to hit the same revenue target. Higher fees drive away more users. It’s a vicious cycle.

We’ve seen this happen already. December 2017, fees spiked to over $50. Users fled. May 2021, fees hit $60. Users fled. Every time fees explode, Bitcoin becomes unusable for normal people. They leave. Transaction volume collapses. Fee revenue crashes.

Bitcoin maximalists call this “fee market dynamics” and claim it’s working as intended. What they mean is the network deliberately prices out normal users to preserve scarcity. Cool. Cool cool cool. So Bitcoin’s security model requires pricing out the very users who would pay the fees necessary to fund security.

What most people don’t understand is that most Bitcoin aren’t even moving on-chain anymore. It’s sitting in cold storage for ETFs. BlackRock’s IBIT holds over $50 billion in bitcoin that never moves. Those coins generate zero transaction fees. Billions more sit on exchanges where people trade paper claims - again, zero on-chain fees. The actual number of on-chain transactions that could pay meaningful fees is tiny compared to Bitcoin’s total value.

So not only do you need fees to skyrocket, you need them to skyrocket on an ever-shrinking base of actual on-chain activity. Good luck with that.

Why Hashrate Is A Lie

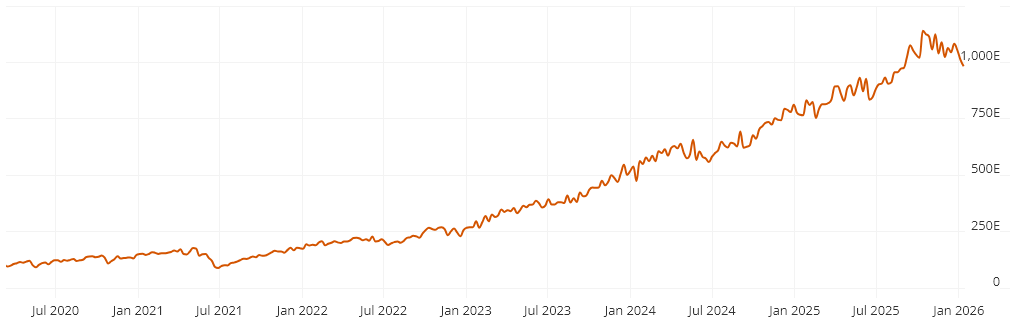

Bitcoin influencers love talking about hashrate hitting all-time highs. They treat it as proof that security is fine. Look at all those hashes! All that computing power! Bitcoin has never been more secure!

They’re lying to you. Probably unintentionally, but still lying.

Hashrate measures how many computational puzzles the network solves per second. That number is completely meaningless for security. What matters is how much it would COST for someone to solve 51% of those puzzles and take control of the network. (Why 51%? Because controlling more than half the mining power lets you rewrite transaction history. I’ll explain exactly how that works in a moment.)

Imagine two scenarios.

Scenario A: Bitcoin’s network produces 1 trillion hashes per second. Mining equipment is expensive and inefficient. It costs miners $100 million per day to produce those hashes.

Scenario B: Bitcoin’s network produces 10 trillion hashes per second. Mining equipment is cheap and efficient. It costs miners $50 million per day to produce those hashes.

Which scenario is more secure? Scenario A. Even though Scenario B has 10 times the hashrate.

Because security is not about how many hashes exist. Security is about how expensive it is for an attacker to produce 51% of those hashes. In Scenario A, attacking costs $51 million per day. In Scenario B, attacking costs $25.5 million per day. Scenario B has higher hashrate but lower security.

This is not complicated. Mining hardware improves every year. New machines are more efficient. They produce more hashes per kilowatt-hour. As hardware improves, the same amount of money produces more hashes. Hashrate goes up while security - measured in dollars needed to attack - goes down.

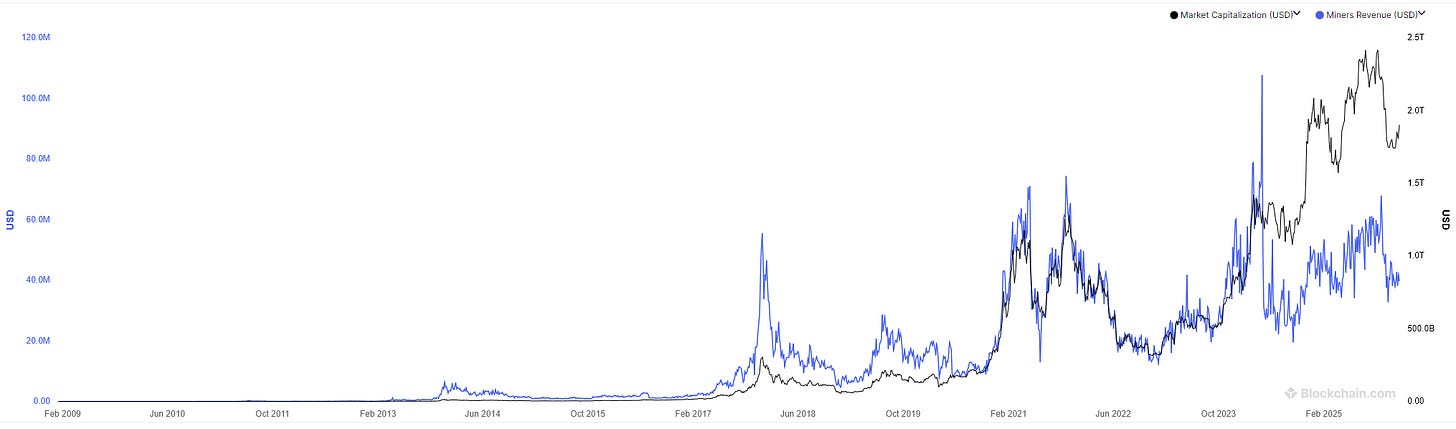

And that’s exactly what’s happening. Look at miner revenue vs BTC price graph above. It spikes during bull runs - around $70M in early 2021, then up to $107M during the 2024 rally. But these spikes don’t last. Revenue drops back down after each peak. Currently it’s around $50M despite Bitcoin trading at much higher prices than 2021.

The security budget as a percentage of market cap is collapsing. As Bitcoin's market cap has grown into the trillions, miner revenue hasn't kept pace. The network is becoming exponentially cheaper to attack relative to its value.

Because the halvening keeps cutting miner revenue. The guards keep getting paid less. At some point, the cost of bribing the guards falls below the value of what they’re guarding.

Attack Economics 101

Earlier, I said that controlling 51% of the hashrate lets you rewrite history? Here’s what that means in practice.

You need to control 51% of Bitcoin’s hashrate. That lets you determine which transactions get added to the blockchain. More importantly, you can reverse your own transactions. This is called a double-spend attack.

You buy $100 million worth of bitcoin. You send that bitcoin to five different cryptocurrency exchanges. You trade it for other cryptocurrencies - ones that aren’t Bitcoin. You withdraw those other cryptocurrencies to wallets you control.

Now you have $100 million in various other cryptocurrencies. And the exchanges think they have your bitcoin.

But you control 51% of Bitcoin’s mining power. So you go back in time - blockchains let you do this if you have enough control. You rewrite history. You create an alternate version of the blockchain where those transactions to the exchanges never happened. Your version is longer, so it becomes the “real” version. The old version gets deleted.

You still have your original bitcoin. And you have the $100 million in other cryptocurrencies you withdrew. The exchanges lose everything. You just doubled your money.

This isn’t even theoretical. Smaller cryptocurrencies have been hit with this exact attack. Bitcoin Gold in 2019 - someone rented enough mining power to double-spend $70,000. Ethereum Classic has been attacked multiple times. These were smaller networks with lower security budgets. Bitcoin is heading toward those security budget levels.

Right now, attacking Bitcoin would cost roughly $6 billion in hardware and infrastructure - about 0.3% of Bitcoin’s total market value. [link to research]

You don’t need to be a rational profit-seeker to make this work.

If you’re a nation state? You already manufacture the hardware (China). Or you control miners that represent 30-40% of the network (China, again). Your actual cost is just electricity - maybe $20-30 million for a week-long attack. You could coordinate a massive double-spend hitting every major exchange simultaneously, stealing hundreds of millions before they freeze operations. Or you could just crash Bitcoin entirely while holding massive short positions in derivatives markets.

Spend $30 million. Short $10 billion in Bitcoin futures. Execute the attack. Bitcoin crashes 60%. You walk away with $6 billion. That’s not a gamble. That’s printing money.

And this assumes you’re motivated by profit. What if you just want destruction? What if China wants to wreck America’s strategic Bitcoin reserve? Spending $2 billion to crash a $2 trillion asset your adversary is holding? That’s a 1000x force multiplier. The cost of two fighter jets to potentially destroy their entire crypto position.

Bitcoin becomes a geopolitical liability at these security levels. Not because governments hate freedom or whatever (they do). Because the cost-benefit analysis becomes absurdly favorable to attack.

The Blockchain Run

Bitcoin processes 7 transactions per second. About 600,000 per day. There are roughly 33 million people with bitcoin stored in addresses they control - actual on-chain holders, not people keeping bitcoin on exchanges.

If every current Bitcoin holder tried to move their coins just once, the queue would be 55 days long.

Except Bitcoin can’t actually handle queues longer than a few days. Unconfirmed transactions start getting dropped from the mempool - the waiting room for transactions. After 72 hours or so, if your transaction hasn’t been confirmed, it disappears. You have to try again. Pay higher fees. Hope you get in this time.

During a panic, people don’t try once. They try multiple times. They keep bumping their fees. The network clogs completely.

This is the bank run scenario. Not a traditional bank run - as there’s no bank involved. But the same dynamics. Everyone rushes for the exit at once. The exit is a tiny door. And most people won’t make it through.

Your bitcoin becomes worthless if you can’t move it. If the network is jammed for weeks and the price is crashing and you’re stuck watching your wealth evaporate because your transaction won’t confirm... what good is “self-custody” then?

The trigger could be anything. News about a security budget crisis spreading. A successful attack happening. Institutional investors suddenly wanting out. Doesn’t matter. Once enough people try to exit, the network chokes. That choking causes more panic. More panic means more people wants to exit. The network chokes worse.

And that’s the death spiral mechanics that kick in.

The Death Spiral Mechanics

Bitcoin adjusts mining difficulty every 2,016 blocks - roughly two weeks in calendar time. This adjustment keeps blocks coming at a steady 10-minute pace. More miners, difficulty goes up. Fewer miners, difficulty goes down.

The problem is that the adjustment period is measured in block time, not calendar time.

If half the miners quit because Bitcoin’s price crashed and they’re no longer profitable, blocks take twice as long. For two weeks - until the next adjustment. So that two-week adjustment period? That becomes four weeks in real time.

During those four weeks, Bitcoin’s capacity drops in half. From 7 transactions per second to 3.5. Your 55-day backlog just became 110 days. More panic. More price crash. More miners quit. Blocks take even longer. The adjustment period stretches even more.

This is a compounding feedback loop. Price crash → miners quit → network slows → bigger backlog → more panic → bigger price crash → more miners quit → network slows more → even bigger backlog → even more panic.

This is not even speculation. It’s in the code. It is how Bitcoin’s difficulty adjustment algorithm works. It’s verifiable. When miners leave during a crisis, the network doesn’t just lose security. It loses capacity. And that lost capacity makes the crisis even worse.

Bitcoin has no circuit breakers for this. No emergency protocol. No way to speed up the adjustment. The only solution is an emergency hard fork, which requires coordination across thousands of independent operators during a crisis, which is saying: impossible given Bitcoin’s governance structure.

I wrote about similar dynamics in my quantum computing piece. The technical threat isn’t necessarily the killer. The panic is - as always. Markets can collapse on fear long before the actual problem materializes. And Bitcoin’s design amplifies panic rather than absorbing it.

I must not fear.

Fear is the mind-killer.

Fear is the little-death that brings total obliteration.

I will face my fear.

I will permit it to pass over me and through me.

And when it has gone past, I will turn the inner eye to see its path.

Where the fear has gone there will be nothing. Only I will remain.— Litany Against Fear

The Tragic Irony

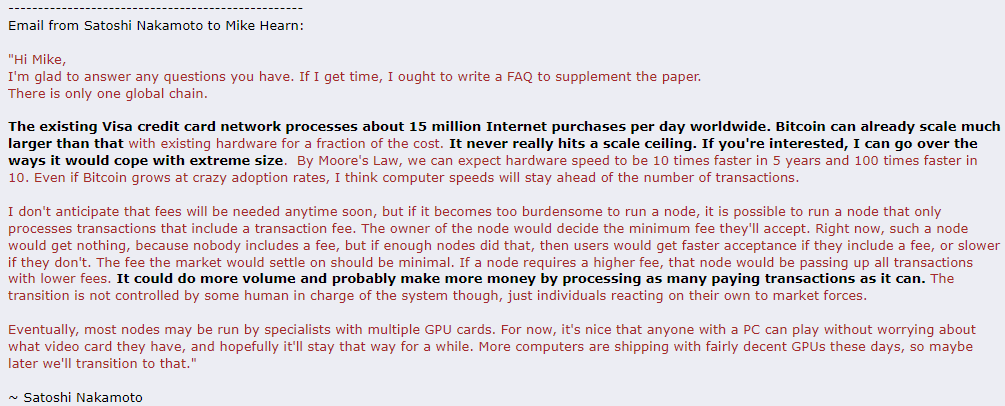

Bitcoin wasn’t designed this way.

Satoshi Nakamoto explicitly planned for massive capacity increases. He wrote that Bitcoin could “already scale much larger than Visa with existing hardware for a fraction of the cost”. The original design anticipated billions of users, each paying small fees, generating massive aggregate revenue for miners.

That’s a sustainable model. Billions of users paying pennies creates enormous miner revenue without pricing anyone out. High volume, low fees, sustainable security. Everybody wins.

Then the Block Size Wars happened.

A small group of developers controlling Bitcoin Core - the dominant software client - refused to increase block size. They claimed it would centralize the network. They said bigger blocks required specialized hardware, would drive out home users running nodes, would destroy Bitcoin’s decentralization.

All of which turned out to be completely false. Bitcoin Cash runs 32 times larger blocks than Bitcoin. Litecoin processes transactions faster. Other blockchains do 10,000 transactions per second. None of them are more centralized than Bitcoin. You can run a Bitcoin Cash node on a laptop from 2015. The hardware requirements are trivial.

But the narrative worked. The blockers won the propaganda war. Bitcoin’s capacity was frozen at 7 transactions per second. Anyone who disagreed got pushed out. Gavin Andresen, Mike Hearn, Jeff Garzik - the developers who wanted to scale - all left.

What remains is a network that can’t serve users, can’t generate fee revenue, can’t sustain its own security model. Seven transactions per second in a world where Visa processes 5,000 and competing blockchains do 10,000+.

This was sold as preserving decentralization. But Bitcoin’s governance is now effectively controlled by six people with commit access to Bitcoin Core. That’s not decentralized. That’s a dictatorship with decentralization aesthetics.

They won’t fix this. The demographics are wrong. Everyone who fought for scaling left. Everyone who remains supports the status quo. The culture actively punishes anyone suggesting changes. Proposing a competing software client is seen as “attacking Bitcoin”.

Layer 2 companies built businesses on Bitcoin never scaling Layer 1. They profit from Bitcoin being broken. The incentives are completely misaligned.

By the time the crisis forces change, it will be too late.

What This Means

Bitcoin will hit a crisis point in the next 10 years. Maybe earlier if panic accelerates it. Maybe slightly later if price does something miraculous. But the trajectory is clear.

Miner revenue is declining on a predetermined schedule. Security budget as a percentage of market cap is collapsing. Attack profitability threshold is being crossed. The math is not ambiguous.

When the crisis hits, Bitcoin faces an impossible choice. Inflate beyond 21 million coins - breaking the one promise that supposedly made Bitcoin special. Or watch the network get attacked into irrelevance while unable to evacuate because 7 transactions per second can’t handle a mass exodus.

The maximalists promising “21 million forever” are setting everyone up for betrayal. Several Bitcoin Core developers already acknowledge the problem. Peter Todd publicly advocates for inflation. They know the math doesn’t work. They’re just not telling retail buyers.

This isn’t about hating Bitcoin or wanting it to fail. This is about reading the code and doing the arithmetic. The numbers say collapse within three more halvenings. Show me the math that says otherwise. Show me how 7 transactions per second serves billions. Show me how fees skyrocket without destroying demand. Show me how price doubles every four years forever without exceeding planetary GDP.

Those explanations don’t exist. Just faith that somehow, magically, the exponential decay reverses itself.

Exponents don’t reverse. They compound until something breaks.

Roger veer's book made similar plausible arguments

Excellent thought/position piece. As someone said earlier, it makes me feel better about my disdain for crypto.

Everyone who looks into crypto can see it as a possible solution to the fiat currency problem. However, as with everything else that initially shines, the devil is always in the details--many of which you elucidated so well.

Thanks for this article. I hope it's widely read.