How to protect your gains

Nothing goes up in a straight line. Not even silver.

Silver hit ~$75 in New York. In Shanghai physical metal is trading at ~$82. That is around a $7 premium. The people willing to pay cash for actual metal are in control now. Not the paper traders. Not the COMEX. Physical is pulling paper along for the ride, and the paper market is fighting it every step of the way.

All-time highs. Up 154% this year alone.

You’d think I’d be ecstatic. I’ve been writing about this for months. Called it when silver was trading in the $20s and everyone said I was delusional. Well… Not laughing anymore now are we?

But I’m not celebrating. I’m looking at my positions and thinking very carefully about protection.

I’m a contrarian by nature. I like buying when things are cheap. Hated. Ignored. I wait for value to be realized, then I try to exit before true euphoria strikes. Do I sell too early? Almost always. But I get most of my gains from dirt-bottom entries anyway, so leaving the last 20% on the table for someone else doesn’t bother me.

And right now, this is starting to feel uncomfortably familiar. Remember the “Chinese grandmas buying bitcoin” episode from a few years back? When your taxi driver is giving you crypto tips and retail investors who’ve never touched an asset class are piling in at the top? That’s the signal.

I’m starting to see similar patterns now. Silver’s on CNBC. Mainstream finance start to touch the once-hated precious metals. People who couldn’t tell you the difference between spot and futures are suddenly experts on COMEX delivery stress.

This rally feels like vindication. But it also feels like standing on a beach watching the water recede before the tsunami hits.

Let me explain why - and more importantly, what I’m going to do about it.

As I mentioned earlier, NY sees the price as $75. That’s the paper price. The price you see on your screen. The price the banks want you to believe is real. In Shanghai, physical silver commands an 7-8 premium over Western spot prices.

The people who actually want physical metal are paying 10% more than the derivatives market says it’s worth. This isn’t a small spread. This is the market screaming that something is fundamentally broken.

And it gets worse.

The COMEX - that’s the New York exchange where silver futures trade - just experienced what some are calling a “vault drain emergency”. In the first four trading days of December, someone stepped up and demanded delivery on 47.6 million ounces. That’s 60% of everything available to deliver. In four days.

Previous articles for more context:

More than half the registered silver inventory claimed for physical settlement in less than a week. The total registered silver at COMEX is down to maybe 73-82 million ounces. That’s down 73% from where it was in 2020.

Meanwhile, silver lease rates - the cost to borrow physical metal - spiked to 39% in some markets. Thirty. Nine. Percent. The normal rate is basically zero. When you’re paying 39% to borrow something, you’re not borrowing it for fun. You’re borrowing it because you’re desperate. Because you’re short and the squeeze is on and you need metal NOW.

The LBMA vaults in London holds 874 million ounces. Sounds like a lot, right? Except 75% of that is backing ETFs and can’t be touched. The actual liquid “free float” that can be traded? Maybe 140-155 million ounces. But there are other allocated accounts that are double counted as free float. So real float? Effectively zero.

Silver went into backwardation. That means spot prices are trading ABOVE futures prices. This isn’t supposed to happen with commodities you have to store and secure. It happens when physical supply is so tight that people are willing to pay a premium for metal today versus metal six months from now.

This is not normal market behavior. This is end-game behavior.

The options market is completely lopsided. SLV - the big silver ETF - has 4.95 million call contracts open versus only 3.05 million puts. The put/call ratio is sitting at 0.62 on open interest and 0.49 on volume.

Translation: everyone’s betting on higher prices. The crowd is massively positioned for continuation. But that doesn’t make protection cheap. With implied volatility at the 100th percentile, puts are as expensive as they’ve been all year. Everyone wants upside exposure. Almost nobody wants downside protection. Which makes sense until it doesn’t.

When silver broke through $70, market makers who sold all those call options suddenly found themselves massively exposed. They’re supposed to stay neutral - that’s their whole business model - so they had to start buying silver to hedge their positions. That buying pushed prices higher. Which meant they needed to buy even more. Which pushed prices higher still.

It’s a feedback loop. The very act of hedging accelerates the move. This is what a gamma squeeze looks like. And right now, implied volatility is at the 100th percentile. Options have literally never been more expensive this year.

The biggest concentration of call options sits around the $70-80 strikes. If silver breaks convincingly above $80, there’s another wave of mechanical buying waiting to kick in.

But I’ve seen this movie before. Twice, actually.

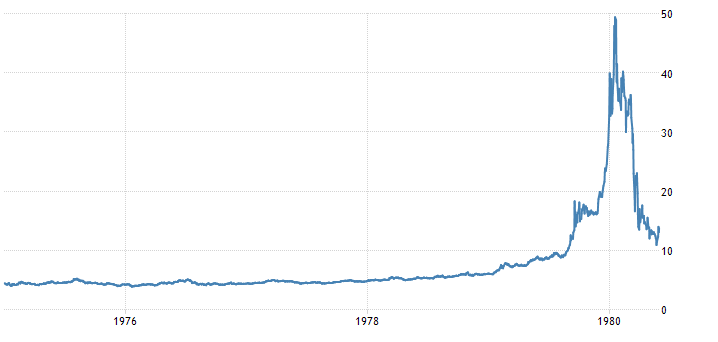

1980. The Hunt Brothers tried to corner the silver market. They succeeded for a while. Silver went from $6 to $49.45 in twelve months. A 713% rally. The gold/silver ratio hit 17:1 - meaning silver was absurdly expensive relative to gold.

Then it crashed. 78% decline to $10.80. The most violent phase saw silver lose 50% in four trading days. Four. Days. They called it Silver Thursday. Fortunes evaporated. Margin calls destroyed everyone who was leveraged.

2011. Silver rallied 500% over two years to $49.80. Then crashed 20% in one week. Including a 12% decline that happened in twelve minutes during thin Australian trading. Twelve minutes. The subsequent bear market took silver all the way down to $13.58 by 2015. A 72% total decline over five years.

Notice the pattern? Corrections happen 4 to 100 times faster than rallies. Both crashes were triggered by exchange intervention - margin requirement increases - combined with Fed policy shifts. Both times, silver was trading at extreme valuations versus gold.

Right now the gold/silver ratio sits around 60-65:1. That’s actually fair value historically. To hit the 30:1 ratio we saw in 2011, silver would need to reach $150 at current gold prices. To hit the 17:1 ratio from 1980? $265.

Is that possible? Maybe. Maybe we’re in the early innings of something historic.

But maybe we’re in the ninth inning and everyone’s too drunk on gains to notice.

Starting January 1st - six days from now - China implements new silver export restrictions. They’re not banning exports outright, but they’re requiring government licenses. Only companies producing at least 80 tonnes annually can apply.

China controls 15% of global silver production. They’re the second-largest miner in the world. And they’re about to make it much harder for that silver to leave the country.

Why? Because they need it. Solar panels, electric vehicles, electronics - China’s domestic industrial consumption is massive and growing. They exported a record 660+ tonnes in October as traders front-ran the restrictions. That flow is about to dry up.

The global silver market already runs a structural deficit. Mine supply can’t keep up with demand. These export restrictions could exacerbate that deficit overnight.

This should be bullish for silver prices. And it probably will be. For a while.

But it also means the physical market is about to become even more dislocated from the paper market. And dislocations this severe don’t resolve gently.

Gold hit all-time highs of $4,530. Silver hit all-time highs. Copper is up 36-40% this year to $5.64 per pound. Platinum is up 165% to $2,393. Palladium up 89%.

This almost never happens. When every major metal rallies at the same time, historically it means one thing: capital is rotating out of financial assets and into hard assets. Not because of inflation. Because of fear.

The notable exception? Oil. Brent crude is down 15.6% this year to $62.25. WTI down 17% to $58.56.

Think about what this means. Precious metals and industrial metals are screaming higher while energy collapses. This isn’t broad-based inflation. This isn’t economic growth. This is something else. Sector-specific supply constraints meeting a loss of faith in paper assets.

We saw this pattern before the dot-com crash. Before 2008. Before the repo crisis in 2019. Every time metals rally together while other commodities diverge, something breaks.

I’m not saying I know what breaks this time. But I know the pattern. And I know it doesn’t end well for the late arrivals.

I have substantial silver positions. Physical metal, junior mining stocks, SILJ calls that expire January 2027. My unrealized gains are... significant. Life-changing if I can keep them.

But I’ve been in markets long enough to know that unrealized gains are just that. Unrealized. They’re not real until you crystallize them. And in a market this parabolic, “unrealized” can become “vaporized” faster than you can log into your brokerage account.

So I’m buying protection. Even though it’s expensive. Even though it feels like I’m betting against my own thesis. Because protecting gains is more important than maximizing them.

Most people think protection means buying short-dated puts 10% below current prices. Pay $4-5 per contract, watch them expire worthless in 90 days, repeat every quarter. That’s expensive. With implied volatility at the 100th percentile, those near-the-money puts cost 6-7% of your position every three months.

There’s a better way. A way most retail traders completely miss.

Buy far out-of-the-money LEAPS puts. January 2027 expiration. Strikes so low everyone thinks you’re crazy. $15, $12, maybe $10 if you want to be really aggressive. With SILJ trading at $30, these strikes are 50-67% below current prices.

Why this works: silver doesn’t crash slowly. It doesn’t meander down over six months. It falls off a cliff in weeks. When that happens - and it will happen - implied volatility doesn’t just rise. It explodes. Goes from 60% to 120%+ overnight.

Those cheap $15 puts you bought for $1.00? When SILJ crashes from $30 to $20 in two weeks and IV doubles, those puts aren’t worth $1.00 anymore. They’re worth $6-8 each. Maybe more if the crash continues.

You make money from two sources: delta (the price falling) and vega (volatility expanding). The crash itself makes them valuable. The panic makes them extremely valuable.

Let me walk through the actual numbers for a portfolio similar to mine:

Say you have $50,000 in junior miner shares and $20,000 in SILJ Jan 2027 calls (up 200% from your original cost). Total position: $70,000 with about $45,000 in unrealized gains.

Protection strategy: Buy 50 contracts of January 2027 LEAPS puts, split between strikes.

30 contracts at $15 strike, cost ~$1.00 each = $3,000

20 contracts at $12 strike, cost ~$0.75 each = $1,500

Total cost: $4,500 (6.4% of total position, 10% of your gains)

This gives you ~12 months of coverage. One premium payment. No rolling. No quarterly theta decay eating your lunch.

Now silver crashes 50% - the 2011 playbook. SILJ goes from $30 to $15.

Your losses:

Shares: down 50%, lose $25,000

Calls: probably near worthless, lose ~$20,000

Total loss without protection: $45,000

Your puts:

30 contracts of $15 puts, SILJ at $15, IV at 120%

Worth at least $4-6 each (at-the-money with massive vol premium)

Value: $12,000-18,000 on the $15 strikes

The $12 strikes contribute another $3,000-5,000

Total put value: $15,000-23,000

You paid: $4,500

Profit: $10,500-18,500

Net loss: $26,500-34,500 instead of $45,000. You’ve cut your crash damage by 23-41%.

But it gets better. Those puts still have months of time premium left. You can hold them to see if the crash continues. Or sell them during peak panic when everyone is desperate for protection and IV is at 150%. That’s when you get the 8-10x returns.

The real advantage over short-dated puts: if silver keeps rallying for another six months, you haven’t wasted the premium multiple times. You paid once. You’re covered for the entire duration. You can sit there watching silver go to $100, $120, $150 knowing that if it crashes, you’re protected.

With SILJ at $30, I’m targeting the $15 strike primarily. That’s 50% downside protection. Exactly the 2011 crash scenario. The $12 strike is cheaper but needs a 60% crash to really pay off. I’m splitting between them - heavier weight on $15, some exposure at $12.

For my junior miner shares specifically, this is critical. SILJ dropped 64% in the 2011 crash. Individual junior miners went down 80-90%. When your $30 stock is trading at $10, you need that $15,000-20,000 in put profits to either preserve capital or - even better - use it to buy more shares at the bottom.

The timing matters too. January 2027 gives me coverage through all of 2026. Through China’s export restrictions taking effect. Through any potential COMEX margin hikes. Through whatever Fed policy shift might trigger the reversal. I’m not trying to time the crash. I’m just making sure I’m protected when it comes.

And when crashes happen in precious metals, liquidity evaporates. Bid-ask spreads on short-dated options blow out to insane levels. You can’t exit positions cleanly. LEAPS maintain better liquidity because they’re more widely held. You bought them cheap during the euphoria. You’re selling them expensive during the panic.

This costs me about $4,500 for protection on $70,000 in positions. That’s 6.4%. In a normal market, that would be expensive. In this market - with silver up 154% and sitting at all-time highs - it’s insurance I can’t afford not to have.

Fast way up means fast way down.

Silver rallied 154% this year. That’s not a normal market move. That’s parabolic. And parabolic moves end one of two ways: either they resolve in a slow, grinding consolidation that takes years... or they crash violently in weeks.

History says crash. Both times silver hit $50, it subsequently lost 70%+. Both times the crash happened far faster than the rally. Both times people who rode it all the way up gave back everything and more on the way down.

I don’t know if this is the top. I have no idea if silver goes to $80, $90, $100+ before it breaks. The squeeze dynamics are real. The physical shortage is real. The COMEX stress is real. China’s export restrictions are real.

But I also know that markets can remain irrational far longer than you can remain solvent works both ways. They can also become rational far faster than you can exit your positions.

The COMEX has a long history of changing margin requirements at precisely the moment it benefits the banks and destroys the longs. In 1980, they literally changed the rules mid-game. In 2011, they hiked margins five times in eight days. Both times it triggered cascading liquidations.

You think they won’t do it again?

Right now, everyone is long. Sentiment is at extremes. Options positioning is lopsided. Lease rates are at crisis levels. The COMEX is on the edge of a delivery default. China is about to restrict supply.

This is the kind of setup where something breaks. And when it breaks, it will break fast.

Despite everything I just said, I do think silver has further to run. A move to a 30:1 gold/silver ratio - which we saw as recently as 2011 - would put silver around $150 at current gold prices.

That’s my bull case target. Not tomorrow, not next week, but sometime in 2026 if this cycle plays out. My Jan 2027 calls give me exposure to that move. My mining shares give me leveraged exposure.

But I’m not willing to risk my existing gains on that prediction. I’ve seen too many people hold through tops because they were convinced it would go higher. I’ve been that person. It’s a painful lesson.

So I’m protecting what I have while staying positioned for further upside. If silver crashes tomorrow and my LEAPS puts pay off 8-10x, I’ll have preserved most of my gains. If silver goes to $150 and I’m still holding my calls and shares, I make even more. The puts cost me 6% but they protect 40%+ of my downside.

The goal isn’t to maximize theoretical gains. The goal is to not give back what you’ve already earned.

Those Jan 2027 puts at $15 and $12 strikes are my insurance policy for when the music stops.

Because in markets like this, protecting your capital isn’t bearish. It’s the only rational thing to do.

I see a global margin call coming. Everything is broken. Our Institutions, our backend plumbing, and the systems that make it work. When global credit freezes, supermarket shelves will go bare, and we will have widespread civil unrest. Capital markets will have to close. I have a lifelong retirement I’ll never see because of my States UCC Section 8. And at the end of this I’ll have two things in my hands: a 44 magnum and a couple rolls of ‘64 quarters. When there is nothing left, that will be more than most.

I remember the silver peaks and selloffs in the past, and there is one important difference between them and the current situation. In former times, the paper markets were completely confident in their supremacy--there was no threat from markets like Shanghai that require physical settlement. The COMEX and the London markets made all the rules, and by tweaking margin requirements, etc., they could always stifle these rallies before they got carried away.

No longer. The COMEX is in a predicament. Either they let nature take its course and let the markets find their true price levels, or they "cheat" again, and this time watch as the entire market heads to Asia and the COMEX and paper silver becomes history. What we are seeing is a painful adjustment period that will require them to either take their licks, or surrender the market completely.

The COMEX might like to do something different than the big bullion banks would like them to do. (Yes, many of the same people are at the helm in both institutions.) Perhaps they can eventually figure out a way to move to a physical delivery basis like Shanghai and survive, but tough times are ahead for them. Get out the popcorn...