The Thanksgiving Job

The perfect crime

Chen lit a cigarette and spread the papers across the table. March trading data. COMEX warehouse reports. Open interest charts for April gold.

“Look at this,” he said.

Viktor and Marcus leaned in.

“Last trading day before first notice on April gold. Historically, open interest drops by about 10,000 contracts on that final day. Players roll their positions forward, reduce exposure. Standard.”

“What happened?” Marcus asked.

“42,000 new contracts. Added to open interest. On the final day.”

Viktor’s eyes widened. “That’s...”

“Unprecedented. Created 107,000 contracts standing for delivery. More metal than registered could handle.” Chen pulled up another chart. “The next day? 53,000 contracts vanished. Just disappeared.”

“They paid them off.”

“Exactly. Someone walked up to COMEX’s window and said ‘I want my gold.’ COMEX looked in the vault, realized they couldn’t deliver, and made them an offer. The player took cash and walked away.”

Marcus studied the price chart. “Gold was at $3,050 when this happened.”

“Week later it started a $500 move.”

The room went quiet for a moment.

“So we know three things,” Chen continued. “One: COMEX can’t actually deliver if you demand it. Two: they’ll negotiate and pay premiums to make you go away. Three: the mere threat of a delivery crisis moves prices dramatically.”

“But they contained it,” Viktor said. “One player. They bought him off.”

Chen smiled. “That’s because it was one player. And that was gold. What if it wasn’t one player? What if it was... dozens? All demanding delivery. Some willing to take the cash settlement - that’s expected, that looks normal. But others? Others who refuse to negotiate. Who keep demanding the physical metal.”

“And silver instead of gold,” Marcus added. “Smaller market. Thinner float. Already running seven years of deficits.”

“The March test proved the concept,” Chen said. “Someone showed us COMEX’s vault doesn’t have the metal. They showed us the playbook - COMEX will pay to make you go away. But they also showed us the weakness: it only works if everyone’s willing to take cash.”

He pulled out a new spreadsheet.

“COMEX registered silver inventory: 75 million ounces. We file delivery requests for 50 million. December. Some of our people take the cash settlement when offered - maybe 30-40% of them. But the rest? They keep demanding the metal. One contract. Then another. Then another.”

Viktor poured another vodka. “They can’t deliver what they don’t have.”

“And this time,” Chen said, stubbing out his cigarette, “we’re not one player they can pay off. We’re a coordinated extraction. Shanghai sovereign wealth. European family offices. American independent traders. All filing legitimate delivery requests. All refusing to back down.”

Marcus nodded slowly. “The March player knocked on the door to see if anyone was home. We’re breaking down the door.”

“Not breaking. Walking through it. Legally. With valid contracts demanding physical delivery.”

“When do we start?”

“October. Build positions quietly through November. Hit them the week of Thanksgiving when markets are thin and they’re understaffed.”

Viktor raised his glass. “To the March test. May they never realize it was a warning.”

October began quietly.

Marcus coordinated the Shanghai crew. Twelve institutional players, all connected to sovereign wealth. The kind of money that doesn’t negotiate when they want something. They had been watching the March test with interest. Now they wanted in.

“They understand the playbook,” Marcus reported. “COMEX will offer cash settlements. Some of our people will take it - that maintains the illusion this is normal market activity. But the core group? They’re demanding physical. Period.”

Viktor handled the European angle. Old money. Families who’d survived multiple currency collapses and understood the value of physical assets. The March gold test had caught their attention.

“They’re intrigued,” Viktor said. “One player proved COMEX can’t deliver. Now we’re showing them how to exploit that weakness systematically.”

Chen worked the American side. Independent traders who’d been watching the silver manipulation for years. Who’d seen JPMorgan pay $920 million in fines and keep manipulating anyway. The March test had given them hope.

“They want payback,” Chen explained. “And they’re willing to demand delivery even if COMEX offers them cash. This is personal for them.”

By mid-November, the positions were built. No sudden moves. No algorithmic alerts. Just steady accumulation across multiple markets, multiple accounts, multiple time zones.

“Silver’s climbing,” Marcus noted. “They’re defending $54 hard.”

“They’re nervous,” Chen said. “They remember March. They know someone tested them. They just don’t know we studied that test and learned from it.”

November 20th. Final coordination call.

“First wave goes in Wednesday before Thanksgiving,” Chen confirmed. “About 7,000 contracts. Let’s see how they respond.”

Viktor checked his list. “My people are ready. Half will take cash if offered. Half won’t.”

“Same here,” Marcus said. “Shanghai’s clear on the plan. Some negotiate. Others demand delivery.”

“And if they panic?” Viktor asked.

Chen smiled. “Then we find out if the March playbook still works when the entire crew wants their metal.”

Wednesday afternoon, November 27th. The first wave hit.

7,330 contracts demanding delivery. Nearly 37 million ounces.

Chen watched from Hong Kong as silver spiked. Then markets started getting choppy. Erratic price action. Something was wrong.

11:47 PM Eastern time. The CME went dark.

“Cooling system failure.”

Viktor called from London. “This wasn’t us.”

“I know. They shut it down themselves. Same as March - they need time to negotiate.”

But this wasn’t March. This time there wasn’t one player to call. There were dozens. Spread across three continents. Some willing to take cash. Others demanding metal. And COMEX had no idea who was who.

Ten hours of darkness while desperate phone calls were made.

“They’re offering settlements,” Marcus texted at 3 AM Hong Kong time. “Premium of $1.75 per ounce.”

“Who’s taking it?”

“About half. The Western players mostly. Same as we planned.”

“And Shanghai?”

“Refusing. They learned from March. They know COMEX pays you to leave. So they’re not leaving.”

Friday morning. Markets reopened. Official story: technical difficulties, cooling failure, everything resolved.

Chen checked the warehouse reports.

JPMorgan had moved 13.4 million ounces from registered to eligible during the outage. Pulled it off the board. Made it unavailable for delivery.

“They’re protecting inventory,” Viktor observed.

“Same as March. They negotiate with some. Pay others off. Move metal around to cover the deliveries they can’t avoid.”

“Did it work?”

Chen pulled up the delivery data. About 6,200 contracts settled in cash during the outage.

“That’s less than half of what we filed.”

“Check Monday’s numbers.”

Monday, December 2nd.

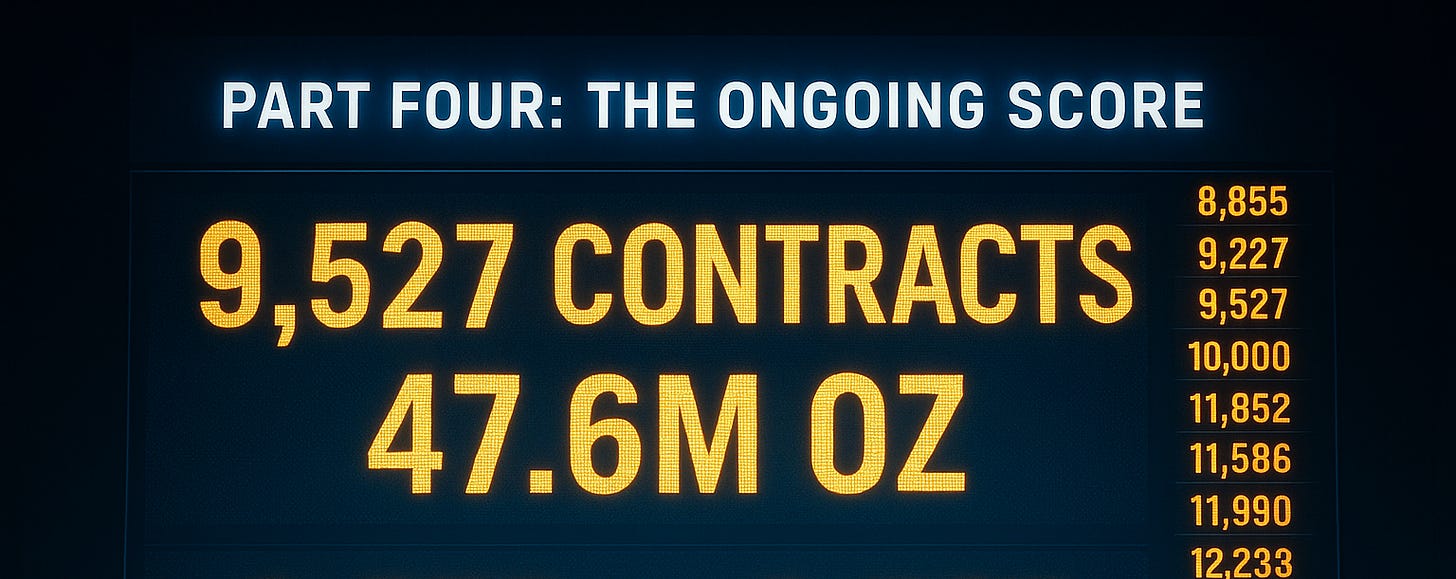

8,855 contracts standing for delivery. Over 44 million ounces.

Chen stared at the number. They’d bought off thousands of contracts with cash. But nearly 9,000 still remained.

“In March they paid off one player and the problem disappeared,” Viktor said over the phone. “This time they paid them off, but there is still a truckload of them left.”

“They used the March playbook. It didn’t work.”

Tuesday brought more bad news. Another 672 contracts demanding delivery.

New total: 9,527 contracts. Almost 48 million ounces.

“That’s half the free float,” Marcus reported from Shanghai. “In one month. December.”

“And it’s not stopping,” Chen said. “Some of our people took the cash - as planned. But enough refused that the problem’s still growing.”

Wednesday. More delivery requests.

“They’re realizing this isn’t March,” Viktor observed.

Chen watched the data. Dropping. The EFP premium staying elevated above $1 per ounce. Shanghai silver premiums climbing.

“The metal’s leaving,” Marcus confirmed. “Every delivery that goes through? It’s going East. Not coming back.”

“How much registered is left?”

“About 75 million ounces. They’re facing delivery requests for nearly 48 million in December alone.”

“What happens in March?”

Silence.

“March is a major delivery month,” Viktor finally said. “Historically bigger than December.”

Chen pulled up the calendar. December. Then March. Then May. Each one a major delivery month. Each one bringing new delivery requests.

“In March they tested the vault and found it empty,” he said quietly. “We just proved that everyone else can see it’s empty too.”

February 2026. Viktor met Chen at the same Hong Kong office where they’d planned everything.

“Did you see COMEX’s announcement?”

Chen smiled. “New position limits. Enhanced reporting requirements. Emergency powers to suspend delivery requests during ‘market disruptions.’”

“Closing the barn door.”

“After the horses left.” Chen pulled up the data. Registered inventory at 40 million ounces. Down from November levels. Shanghai premiums at record highs. Price discovery had shifted east.

“The amusing part?” Chen lit a cigarette. “Everything we did was completely legal. They’re changing the rules because we used their own system against them.”

Viktor poured drinks. “Speaking of which. I’ve been wondering about something.”

“What?”

“March. That gold test.”

Chen looked at him.

“That was you, wasn’t it?” Viktor said.

Chen exhaled smoke slowly. “Marcus knows. You’re the first to ask.”

“So the whole story about learning from someone else’s test...”

“Was technically true. We learned from our own test. March proved COMEX couldn’t deliver. Proved they’d negotiate. Proved they’d pay premiums. And proved that one player could be contained.” Chen stubbed out his cigarette. “So we came back with fifty players.”

“And the ones they bought off…”

“Were always part of the plan. COMEX thought they’d won. Didn’t realize those were the contracts we intended to settle anyway.” Chen checked his screens. “The beauty wasn’t making them pay. It was making them think they’d solved it.”

Viktor raised his glass. “To March. Your proof of concept.”

“To the perfect heist,” Chen countered.

Chen’s screens showed new delivery requests still coming in.

March deliveries would be interesting.

A real life thriller ! Wow ! Absolutely brilliant NO1 ! If that doesn't have you on the edge of your seat, you don't have a seat (at one of the most exciting markets in the history of the world).

Terrific read which is plausible and probable. The thing that is challenging is this information has been known for a long time yet had very few challenges to the status quo. The question is why now and who is behind it to figure out where we go from here. There is plenty of unlevered money to see this out if that is the intent. What is worrisome is what the potential losses would be in the banking system due to shorts and derivatives and whether thus issue has the ability to seize the banking system once again. Tough to gauge and doubtful anyone comes on to save LBMA if and when this dam finally breaks. Fascinating times ahead!