About a Chinese silver pirate

and a huge flipfloping bank

Silver’s monthly RSI hit 87.28 this week. That puts it alongside the most extreme readings in modern history - the Hunt Brothers’ attempted corner in 1980 and the COVID chaos in 2020. If we would be talking normal situations… short sellers would be all over this like sharks.

It’s strangely quiet out there…

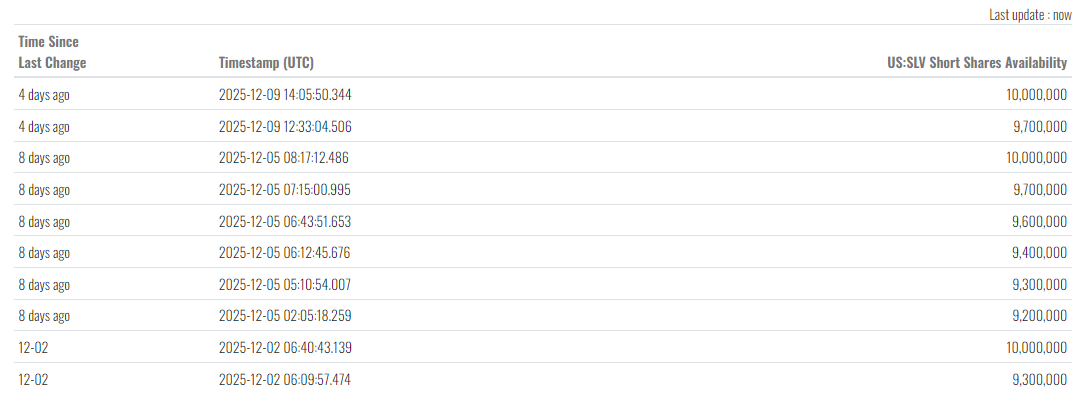

SLV short interest dropped from 56.38 million shares to 51.89 million while the RSI climbed into the stratosphere. Shares available to short? Still sitting at 9-10 million, ready and waiting. Unlike a month back where there were none available.

The technical setup is literally begging: “fade this rally.”

But … crickets …

Professional traders are walking away. Because something fundamental shifted in the market structure, and the smart money is in on it, whilst retail -as usual- is not.

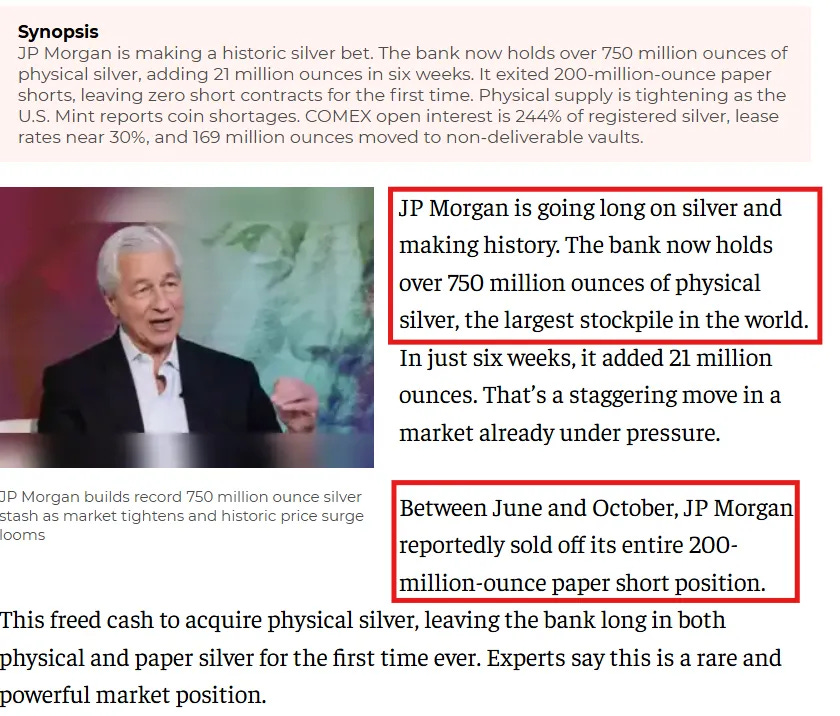

For over a decade, JP Morgan was silver’s most notorious short. The bank manipulated the market so brazenly they eventually paid $920 million in fines. They were the bear case. The ultimate paper pusher keeping prices suppressed while accumulating physical on the cheap.

That chapter might have just ended.

JP Morgan now holds over 750 million ounces of physical silver. At current prices, that’s north of $40 billion in metal. The largest private stockpile on the planet. They didn’t merely stop shorting. They flipped and became the world’s biggest long.

In the last six week alone, they added 21 million ounces. While simultaneously closing out their entire 200-million-ounce paper short position. Think about the mechanics of that. They’re removing paper shorts that suppressed the prices while simultaneously buying physical that drives prices higher.

Plus JPM moved 169 million ounces to non-deliverable vaults. That’s metal that exists in the COMEX system but legally cannot be delivered against for futures contracts. It’s there but you can’t have it. Like being starving outside a restaurant with the door locked.

This is not neutral market making anymore. This smells like a strategic shift.

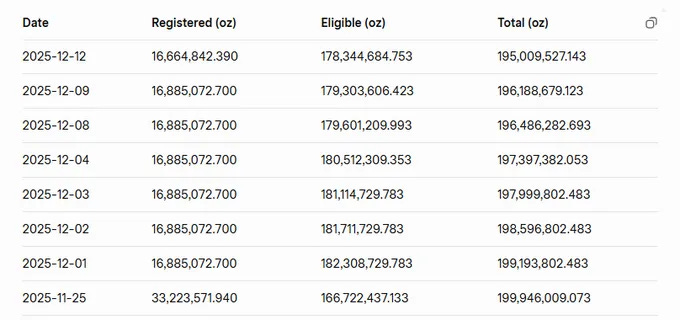

Since the CME “technical difficulties” shutdown on November 25th - which coincidentally happened during silver’s moonshot - JP Morgan has systematically gutted their registered inventory:

Registered silver removed: 16.6 million ounces

Eligible silver reduced: 4.0 million ounces

Total inventory down: 4.9 million ounces

But this metal didn’t just convert from registered to eligible. It converted from registered to gone.

Now when registered silver becomes eligible, it stays in the vault but exits the delivery system. It’s still there, just not available for COMEX futures settlement. That’s protective but not extreme.

But when registered silver gets removed entirely, it leaves the vault system. It’s no longer part of COMEX’s available inventory at all. That’s bunker mentality.

From December 1st forward, JP Morgan went full defensive. They’re not just protecting their inventory from delivery demands. They’re pulling metal out of the system entirely. Shrinking what they’ll make available. Limiting obligations. Preserving optionality.

If you ask me what I would be doing if I had their wallets…? This would be very close to my playbook when I am reading the tealeaves and smelling the winds of change. I guess they want (need?) to be on the right side when it goes kaboom?

While JP Morgan was pulling physical out, COMEX started raising margin requirements. Their first signaled increase so far: 10%. Now when an exchange raises margin requirements during a rally - especially a physically-driven rally - they’re either wanting to cool down the rally, or they’re managing an implosion. Take a guess what I think?

Why does this even work? Well, COMEX open interest sits at ~244% of registered silver. That means for every ounce of physical metal available for delivery, there are 2.44 ounces of paper claims against it. We’re all used to fractional reserve banking, so this is normal right? Not some over-leveraged insanity, right? RIGHT?!

Let me get this straight: registered inventory keeps shrinking. Delivery requests keep building. And the shorts can’t safely roll their positions forward without blowing up open interest in future months. So the exchange steps in with margin increases.

Totally normal, organic driven market behaviour. “Managing risks”. Right? R… Oh well.

These higher margin requirements force leveraged longs to liquidate positions. Can’t meet our just made up increase in margin? Boom! Position gets closed. You need to sell. Which pushes the price down. Consequently , fewer contracts outstanding means fewer ounces the shorts might need to deliver. It’s a pressure-release valve - not on price, but on physical delivery obligations.

The goal is simple: Reduce paper claims faster than physical metal drains.

If they can’t do that, the squeeze accelerates and the delivery system breaks. What we’re watching now is COMEX’ attempt at a controlled demolition of their own market to prevent a catastrophic failure.

But there is just one tiny teeny little problem: It’s not working.

Monthly lease rates are sitting now near 7% (down from October highs of up to 200%). That’s the cost to borrow silver. Normal lease rates are around 0.5%. When they remain elevated like this, it means physical silver is so tight that lenders won’t part with it.

So COMEX is simultaneously:

Raising margins to reduce open interest

Watching lease rates spike (multiple times)

Seeing massive amounts of metal become non-deliverable

Losing registered inventory to vault withdrawals

This is what a slow-motion delivery default looks like. The exchange knows it. The shorts knows it. The smart money knows it. WE know it. But there ain’t a thing they can do about it. Physical reality trumps paper fantasy eventually.

Yesterday’s selloff revealed once again just how broken this entire market structure has become. Price dropped on heavy paper selling. Futures got hammered. You’d expect physical to follow, right?

It didn’t.

The spot-futures spread moved toward backwardation during the selloff. That should be impossible. In a genuine risk-off liquidation, paper and physical move together. Sellers dump everything. The correlation stays intact.

Instead, we got a paper-physical disconnect. Derivatives getting crushed while physical barely budged. The spread moving toward backwardation means spot prices stayed elevated relative to futures even as futures tanked.

This tells you the selling pressure was entirely in derivatives, not in the real metal.

Paper can be created infinitely. COMEX can keep raising margins and squeezing out longs. But physical can’t be conjured from thin air. And physical is tightening beneath the surface while the paper market thrashes around trying to manage an unsustainable structure.

When during these selloffs paper and physical decouple, it means the market is fracturing. One price for paper claims. Another price for actual metal. Eventually, that spread widens until the paper market loses credibility entirely.

I would be using a slo-mo-train-wreck, but that has been abused already so many times before…

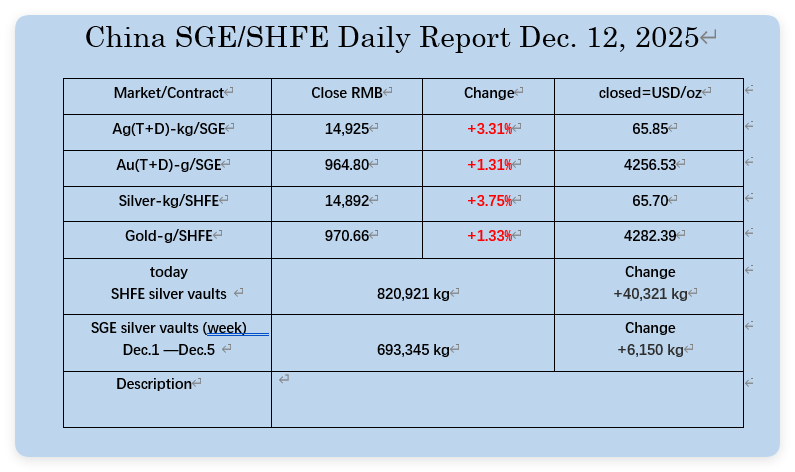

Next up: Dec 11: China’s Ministry of Commerce issued Announcement 2025-No. 68. Buried in bureaucratic language about “environmental protection and resource management” was a simple policy change: Starting January 1st, 2026, silver exports require state-trading licenses.

The restrictions run through 2027 minimum.

China controls around 60-70% of global refined silver. Not just from domestic Chinese mines - from processing doré imports from all over the world. Those imports get refined in China and historically got re-exported to Western markets.

That flow stops in two weeks.

Spot silver in China trades $2 above LBMA prices. That’s pure arbitrage - you buy in London, ship to Shanghai, sell for instant profit. That arbitrage should close instantly as physical metal flows from low price to high price.

It’s not closing. It’s widening.

On Dec 12, the Shanghai Gold Exchange halted trading on the 161226 silver contract for an hour. The reason? Premiums hit 20%. The exchange literally stopped the market because Chinese buyers were willing to pay too much.

In a functioning market, high prices attract supply. In Shanghai, high prices triggered a trading halt. Just your every day “normal price discovery” I guess.

My best guess? Panic accumulation before the export door closes.

Physical silver is hemorrhaging from Western vaults heading east. London and COMEX bleeding inventory while Shanghai stockpiles. The Shanghai Futures Exchange lost 300 tons in October - metal leaving China for Western markets where premiums were more attractive at the time. Now those inventories are rebuilding as Chinese entities stockpile before January 1st.

This is strategic resource nationalism. China watched how rare earth export restrictions gave them leverage over Western manufacturers. They saw the panic when they briefly restricted rare earth exports, then suspended restrictions as a “trade concession.”

Now they’re applying the same playbook to silver while everyone’s focused on the rare earth headlines.

Silver is simultaneously a monetary metal and an industrial commodity. Electronics manufacturing, solar panels, defense systems, AI data centers - all require significant silver inputs. China is keeping theirs while cutting off competitors.

Enough about silver already you say? Ok, ok… Let’s switch to the completely unrelated, non-invasive use of force on the high seas against a non-violent boat that happens to trade between two of your “enemies”. Nope, not talking about Venezuela and the US blowing fishermen out of the water there.

I’m talking about that in the very same week that China announced these export restrictions, the United States seized a cargo ship traveling from China to Iran. Headlines framed it as geopolitical tension over Iran’s nuclear program. “Dual use tech” was seized. I’m guessing a radar installation for detecting other ships qualifies?

Very predictably, Iran seized an oil tanker yesterday. Retaliation.

Totally isolated incidents. Each one entirely unrelated to the others. Scout’s honor. Pinky promise. Cross my heart.

The US has spent years incrementally controlling international shipping lanes while attacking China’s Belt and Road alternative. Seizing ships. Blockading Russian energy. Sanctioning Iranian and Venezuelan tankers. Now interdicting cargo.

Is the one a reaction to the other? Or vice versa? Doesn’t really matter. We’re in a financial war, and it’s starting to show. The US is using the only tools it knows: force, but China’s response is more like a scalpel. Applying pressure where it hurts, without actually being the “bad guy”.

Last month, under Section 232, the US finally declared silver a “critical mineral”. But you know, a declaration doesn’t magically create refining capacity. The infrastructure to process raw ore into industrial-grade refined silver exists. In China… Building comparable Western capacity requires years and billions in capital investment.

And if the Baltimore’s bridge is any indication (down like 1.5y ago, up in ‘30), or California’s high speed rail project (way over budget, way over time), it will likely take many decades to build up that capacity.

By the time that that capacity comes online, China will have stockpiled years of supply while Western manufacturers scramble for secondary sources at premium prices.

This is what economic warfare looks like. Dressed as trade policy. Both sides tightening the screws. Testing responses. Building strategic stockpiles.

China controls the materials. The US controls shipping lanes. Each leveraging their advantage while the other figures out how to respond.

And silver sits at the intersection - monetary metal, industrial commodity, defense necessity, technology input. Whoever controls the supply controls who can build the infrastructure for modern economies.

And whilst all this is happening, retail is dumping physical silver like it’s radioactive.

Bullion dealers report they’re being overwhelmed with sellers. Refineries have months of inventory queued up from retail dumping. Buy prices have collapsed - some dealers even offer $4 below spot on wholesale products like kilos and 100oz bars.

Four dollars below spot. On wholesale. That’s distressed pricing.

Retail sees that silver doubled year-to-date and thinks “take profits before it crashes.” They don’t see what I’ve been detailing on my blog. They see a number on a screen. So they sell.

The dealers offering $4 below spot aren’t idiots. They’re managing exposure while accumulating positions they can monetize later. They understand that new supply will become limited, and that the silver now being dumped by retail won’t be available at any price in the future.

This is a textbook weak-hands-to-strong-hands transfer. Retail thinks they’re taking profits. But they’re actually providing supply for institutions that understand what happens when physical becomes genuinely scarce.

Every ounce that retail sells now is an ounce that won’t come back to the market at $100, or $150, or $200. They’re removing future supply while institutional players like JP Morgan lock down present supply and China locks down future production.

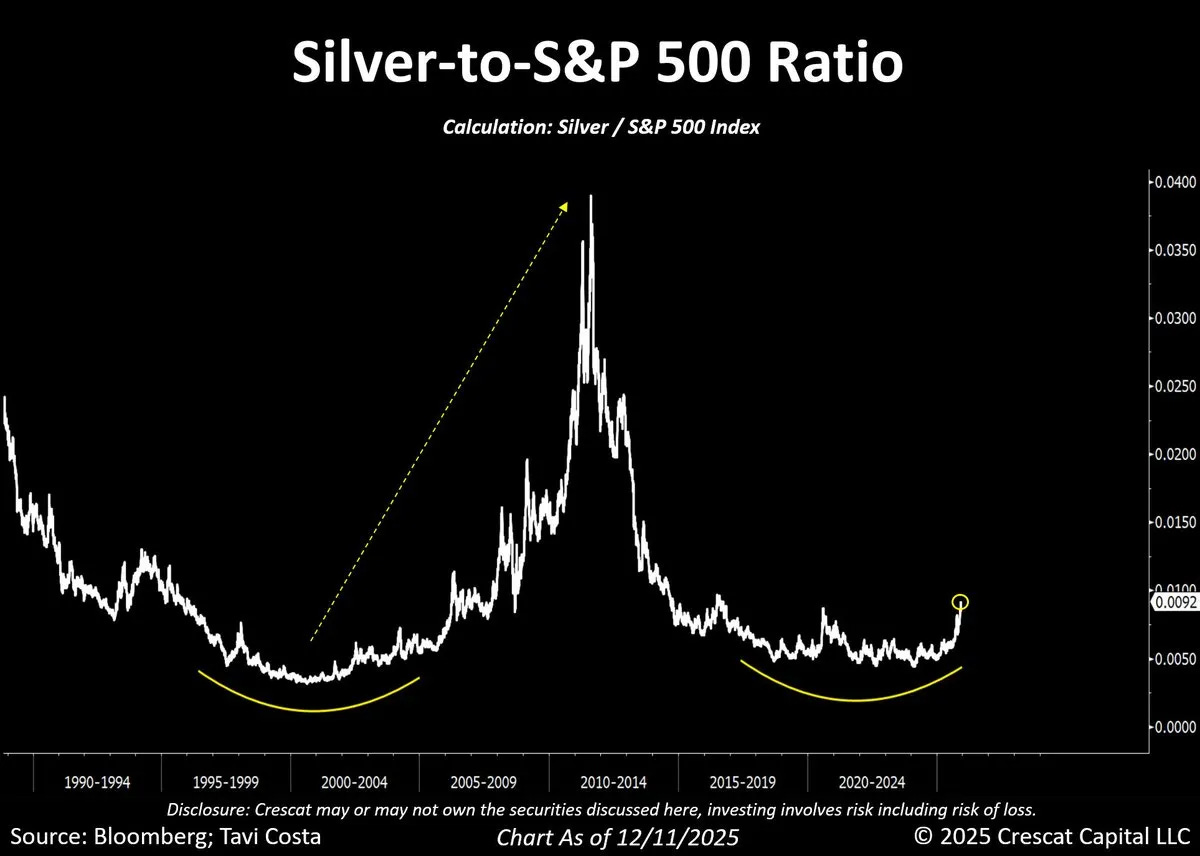

The silver-to-S&P 500 ratio currently sits at 0.0092. And it looks to be breaking out right about now.

When silver led the last major bull market in the late 2000s, this ratio climbed from 0.005 to 0.04. That’s an 8x move. Silver didn’t just outperform stocks - it repriced its entire relationship to equities.

This time, the biggest drivers of this move aren’t monetary policy or investment demand. It’s being driven by:

Strategic resource competition between great powers

Physical supply shocks from export restrictions

Market structure breakdown at major exchanges

The largest player in the market flipping from short to long

Industrial demand colliding with constrained supply

The sequence is playing out like a textbook. Gold breaks out first as the monetary safe haven. Then silver catches up and overtakes. Then miners explode as the most leveraged bet on the underlying metals.

We’re in phase two. Silver starting to lead. Miners haven’t really moved yet - the most explosive part of the trade is still coiled.

What makes this different from previous cycles is the geopolitical dimension. Previous silver bull markets happened because central banks printed money or industrial demand surged or investment flows poured in.

This one is happening because two great powers are fighting over who controls the materials needed to build modern infrastructure. And one of those powers just locked down 60% of refined supply while the other power’s largest bank accumulated 750 million ounces.

So far we got vault data, JPM, COMEX margin increases, China tightening exports and maritime piracy.

They all see what’s coming. JPM just declared it to the world. COMEX through cooling failures sees the writing on the wall. Beijing definitely sees it.

Retail will figure it out eventually.

The US Mint is already reporting coin shortages. COMEX registered inventory keeps dropping. Shanghai premiums keep climbing.

The financial war started months ago. Most people haven’t noticed because they’re watching political theater and stock market moves. The real action is in tech (deepseek comes to mind), force projections and commodities.

The squeeze is here. It’s just happening so slowly that most people think they have time to frontrun it.

Don’t be most people.

PS: for those that are still wondering about the Chinese silver pirate — I was just tired of looking for some catchy title, so I took the main themes of this article and fumbled them together. Sorry. No Jack Sparrow for you 😁.

May be your best article yet. I’m co-owner of a coin shop in Seattle and can confirm that in our case way more people were selling, than buying silver. And we’ve got absolutely no problem stacking as much of it as we can get. The West is so blind, in general, to what’s happening

Awesome economic intel and well-written too. Many thanks!