What if Bitcoin was one big mining company?

Doing my due diligence

H/T to TheApeOfGoldStreet for this idea.

Let’s play a game. Take Bitcoin and pretend it’s not a revolutionary digital asset or a hedge against fiat debasement or whatever narrative is trending this week. Strip all that away. Instead, imagine Bitcoin is a single publicly-traded gold mining company called Bitcoin Mining Co., ticker symbol BTC.

Now let’s run it through a standard mining company analysis. Production metrics, cost structure, reserve life, margins. The same due diligence you’d apply to any commodity producer. See what the numbers actually say when you remove all the revolutionary language and just focus on the fundamentals.

Let’s start with the basics. Every mining company prospectus begins with production metrics. What’s in the ground, what’s coming out, what’s left. For Bitcoin Mining Co., the numbers are straightforward enough.

The company has circulating shares - sorry, “coins” - of roughly 19.97 million BTC as of today. Maximum reserves total exactly 21.0 million BTC. That’s it. That’s all there will ever be. No exploration upside, no chance of discovering a new deposit, nothing. The reserve base is fixed and fully known. Remaining reserves in the ground stand at approximately 1.03 million BTC.

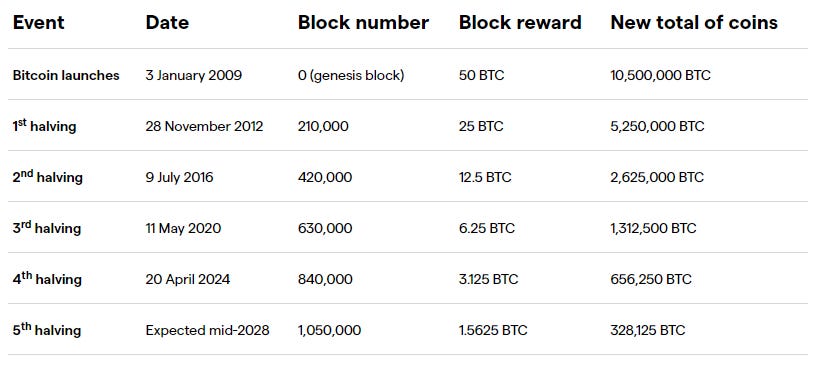

Current annual production runs at about 450 BTC per day, which works out to roughly 164,250 BTC per year. That production figure isn’t stable though. It’s programmed to decline. The company just went through a “halving” event in April 2024 that cut production from roughly 328,500 BTC per year to the current 164,250. Another halving is scheduled for 2028. Then another. And another.

Annual dilution to shareholders currently sits at about 0.82% per year. That percentage keeps shrinking as the denominator grows and production drops. At first glance, that actually looks almost responsible compared to some gold miners. Low dilution, predictable schedule, transparent reserve base. Not bad on paper.

The declining production curve is unusual but not unprecedented. Plenty of mining operations face depleting reserves. The difference is most companies explore for new deposits, acquire other properties, or eventually wind down. Bitcoin Mining Co. just... continues. Same network, same protocol, gradually declining output. No exploration budget, no M&A strategy, no life-of-mine flexibility.

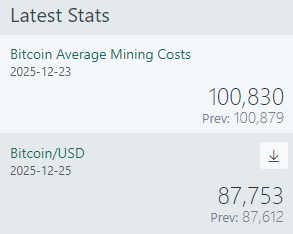

Now let’s talk price and cost structure. Bitcoin is trading around $87,753 today. That’s the spot price for the commodity this company produces.

What does it cost to produce that commodity?

Current analysis as of December 23, 2025 shows Bitcoin average mining costs at approximately $100,830 per BTC. This represents the weighted average cost across the global mining network, accounting for electricity consumption, hardware, and operational expenses.

Production cost: $100,830. Spot price: $87,753…

Bitcoin Mining Co. is operating at a loss of roughly $13,077 per Bitcoin produced. Negative operating margin of approximately 13%. The company is burning cash on every single unit that comes out of the ground.

This isn’t a temporary squeeze from a commodity price dip. This is the baseline economics right now, today, with Bitcoin trading near $88,000. The network difficulty recently peaked at 155 trillion in mid-November before pulling back to around 148 trillion currently. The hashrate currently sits around 1.1 billion TH/s (1,100 EH/s or 1.1 ZH/s), after surpassing the 1 Zettahash milestone back in August - representing unprecedented competition for block rewards.

Transaction fees, which used to provide a revenue cushion, collapsed to historic lows - representing less than 1% of block rewards (mainly due to ETFs hoarding BTC). Miners are almost entirely dependent on the block subsidy now, with virtually no fee revenue to soften the margin pressure.

The economics get worse when you consider the full picture. Network difficulty keeps climbing as more efficient hardware comes online. The halving schedule guarantees revenue per unit of infrastructure drops 50% every four years. Energy costs aren’t falling. And transaction fees aren’t coming back to rescue margins anytime soon.

Some operators with access to extremely cheap power might still be profitable. But the weighted average across the network? Losing money on every coin.

But maybe that’s fine. Mining is a tough business. Margins fluctuate. Costs rise. Sometimes you operate at a loss for a quarter or two while you wait for commodity prices to recover or you optimize operations. That’s just the industry. So let’s see how Bitcoin Mining Co. stacks up against actual mining companies operating today.

Take the gold mining sector. These are commodity producers dealing with depleting reserves, rising input costs, energy dependence, geopolitical risk. Sound familiar? The best operators in the space - Barrick Mining, Newmont - these aren’t marginal operations. They’re well-run, profitable businesses with strong balance sheets and decades of experience optimizing extraction economics.

Barrick’s all-in sustaining costs for 2025 are projected at $1,460-$1,560 per ounce. With gold currently trading around $4,480 per ounce - having just set a record high above $4,525 this week - they’re running extraordinary margins of roughly $3,000 per ounce. Newmont’s AISC runs slightly higher at around $1,630 per ounce for 2025, still generating massive profits with margins north of $2,800 per ounce at current prices. These companies are printing money. Gold is up 70% year-to-date, and these miners generate real free cash flow, pay dividends, reinvest in exploration, and still manage to return capital to shareholders.

Operating margins in the gold mining industry, when gold is trading well above production costs, deliver strong profitability. Companies consistently operating at losses get flagged as distressed assets, face restructuring pressure, asset sales, management changes. Or they shut down until commodity prices recover.

Bitcoin Mining Co., at current production cost of $100,830 versus spot price of $87,753, is operating at a 13% loss per unit produced. This isn’t a premium operator. This isn’t even a marginal operator barely breaking even. This is a business burning roughly $13,000 on every single coin it produces.

For a traditional commodity producer, that would trigger immediate strategic action. Cut production. Suspend operations. Hedge forward. Something. But Bitcoin Mining Co. can’t do any of that. The protocol just keeps running, churning out coins at a loss, with no ability to throttle back or wait for better prices.

Reserve life is another standard metric. How long can the company maintain current production before depleting known reserves? Gold miners typically aim for 10+ years of reserve life, constantly replenishing through exploration and acquisition. Some of the best operations maintain 15-20 year reserve lives or more.

Bitcoin Mining Co. has roughly 1.03 million BTC remaining out of a maximum 21 million. At current production of 164,250 BTC per year, that’s about 6.3 years of reserve life. But remember, production halves every four years. So really you’re looking at maybe 10-12 years until the reserve base is effectively exhausted, with production dwindling to near-zero. No exploration potential. No new discoveries. Just a declining curve to depletion.

For a traditional mining company, that would trigger serious strategic questions. What’s the acquisition pipeline? Where’s the exploration budget? How do we extend mine life? Bitcoin Mining Co. has no answer to any of those questions. The protocol just... runs until it doesn’t.

So far we’ve got: negative operating margins, declining production, finite reserves with 10-12 year effective life, no growth optionality, no ability to adjust production to market conditions. Not exactly a premium asset. Actually not even a viable operation at current prices. But let’s see what the market thinks.

Let’s talk valuation.

Annual revenue from new production is simple math. Take 164,250 BTC per year, multiply by $87,753 per BTC, and you get roughly $14.4 billion per year in gross revenue. All of it from new production. No other revenue streams. No byproducts. No diversification. Just newly mined coins hitting the market.

With production costs at $100,830 per BTC, you’re looking at total costs around $16.6 billion against that $14.4 billion revenue. The company is burning approximately $2.2 billion per year. Negative $13,077 per coin. Negative 13% operating margin.

This isn’t a profitable business. This is a cash incinerator.

Even more striking: just two months ago, Bitcoin hit its all-time high of $126,210 on October 6, 2025. At that price, Bitcoin Mining Co. would have been profitable - generating roughly $25,380 per coin, about 20% operating margins, and $4.2 billion in annual profit. The company went from highly profitable to deeply unprofitable on a 30% commodity price decline. That’s the definition of a marginal operation with no flexibility to adjust production when prices move against you. Traditional miners can idle facilities when margins compress. Bitcoin Mining Co. just keeps burning cash, block after block, regardless of economics.

Bitcoin Mining Co. has 19.97 million BTC outstanding, trading at $87,753 per coin. A simple multiplication further and you get a market cap of approximately $1.75 trillion.

That’s the valuation. $1.75 trillion for a company producing $14.4 billion in annual revenue while losing $2.2 billion per year. Even at ATH: market cap swells to $2.52 trillion on $20.7 billion revenue and $4.2 billion profit.

Price-to-sales ratio in both cases: 122x.

Barrick and Newmont? They trade at 5-6x sales.

If you walked this into a traditional mining analyst’s office, they’d stop you at “currently unprofitable”. Everything after that would be academic.

And yet.

Bitcoin itself trades at exactly that $1.75 trillion market cap. Every single day. People buy it at $87,753 per coin knowing the production economics. They buy it knowing the “company” would never pass traditional due diligence.

They buy it anyway.

The mining company framework doesn’t exist to tell you Bitcoin is bad or overpriced. It exists to strip away the narrative and show you the raw economics underneath. What you’re actually buying when you buy Bitcoin, evaluated purely as a commodity production business.

Fixed supply. Declining production. Operating at a loss. Extreme valuation relative to output.

If that was a mining company, every traditional investor would run. But Bitcoin isn’t a mining company. It never pretended to be. That’s the entire point of the exercise.

Bitcoin trades on network effects, decentralization, censorship resistance, digital scarcity. Things that don’t appear on a traditional mining company’s balance sheet. Things that can’t be measured in operating margins or reserve life or price-to-sales multiples.

Maybe those things are valuable enough to justify ignoring every traditional valuation framework. Maybe digital sovereignty and trustless transactions really are worth $1.75 trillion regardless of production economics.

Or maybe we’re all just pretending the math doesn’t matter because the price keeps finding buyers.

The thought experiment doesn’t answer that question. It just forces you to ask it.

The gap between traditional analysis and actual market price is where all the real questions live. Whether that gap represents revolutionary value discovery or collective delusion depends entirely on what you think Bitcoin actually is.

A commodity production business? Absurd valuation.

Something else entirely? Maybe the traditional framework never applied in the first place.

The mining company lens just shows you what happens when you try to value it like the former while the market treats it like the latter.

One BTC is like one gold bar, as another reader pointed out, not a share in a company, and most of the “gold” has been mined, so yes, stop mining and trade the gold. But it’s hard to make jewelry out of BTC, so one BTC is more like one of a limited edition of a famous artists print. The value is what the buyers and sellers agree on. And mostly the wealthy are bidding. Not a one-of-a-kind like a Rembrandt, but not an infinite supply either. Maybe it’s like a rare coin that they only minted a certain number of. As a reserve currency/asset there is no better design, but adoption is the problem. Miners are not profitable until BTC is actually adopted beyond an investment/speculation fad. BTC needs a very high price for mining to make sense. And without miners, there is no network, and no BTC… but BTC is designed so that anyone can run a node on a small computer and capture the transaction fees and use BTC as a form of payment. But for that to make sense, BTC needs to be used as a currency.

High praise for these breakdowns you provide. Sanity, precision and quality delivery in a manic world. Killer take.