Weekend thoughts

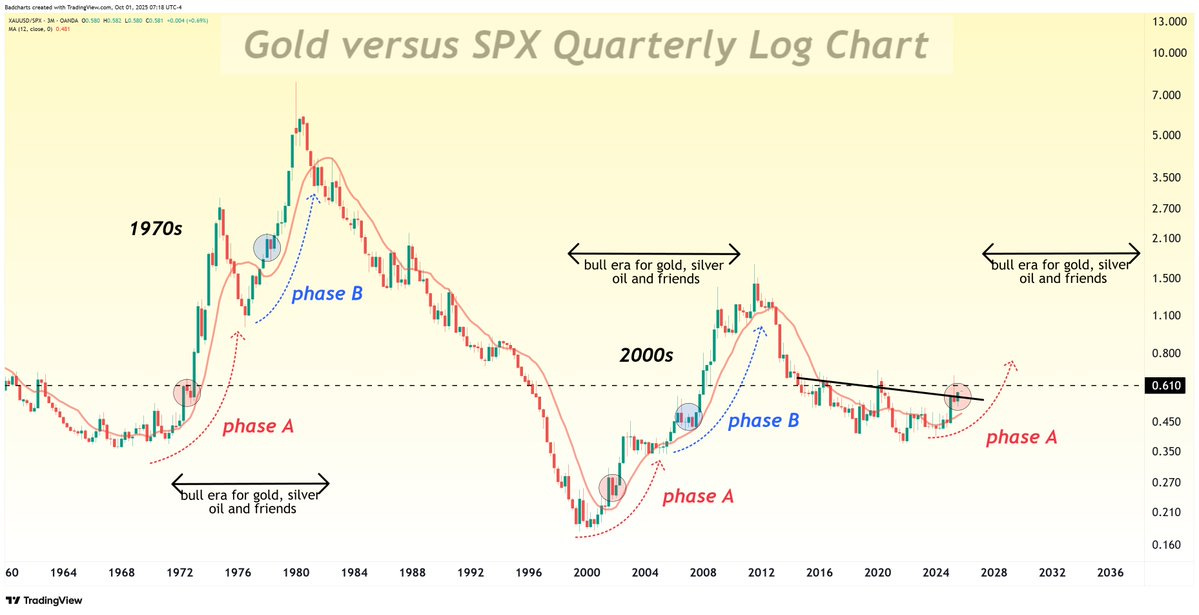

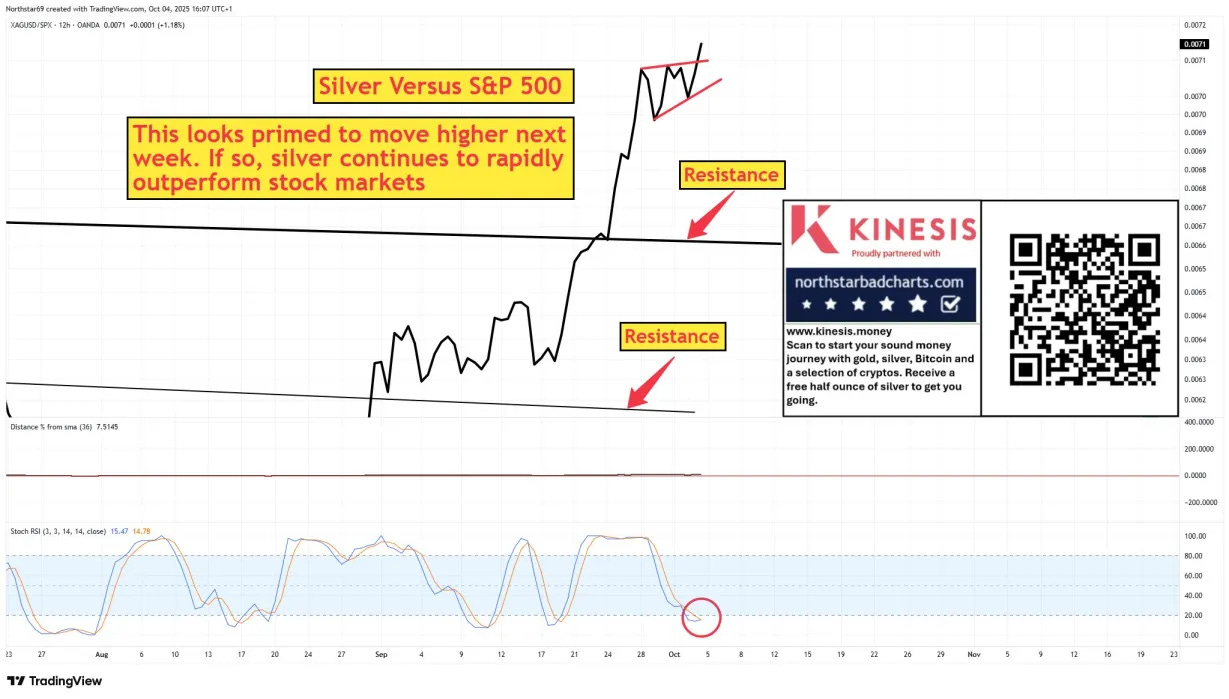

S&P vs silver: we’re not even started yet (can be silver massively higher, or S&P massively lower — or a combination)

Will it be “different this time”?

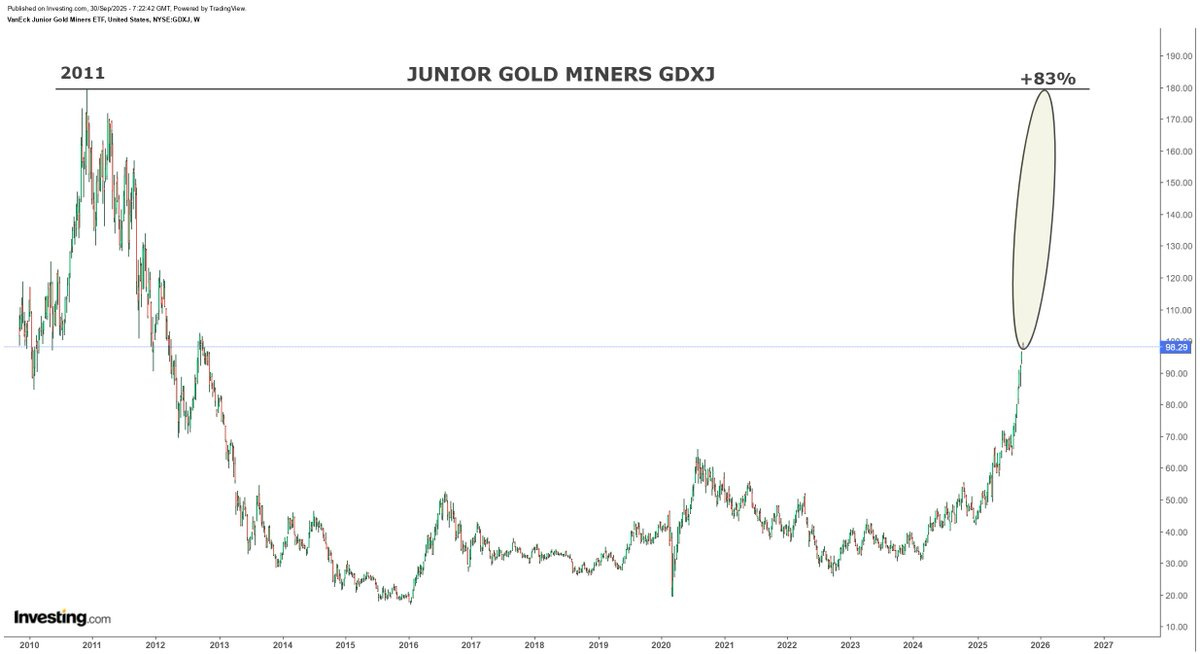

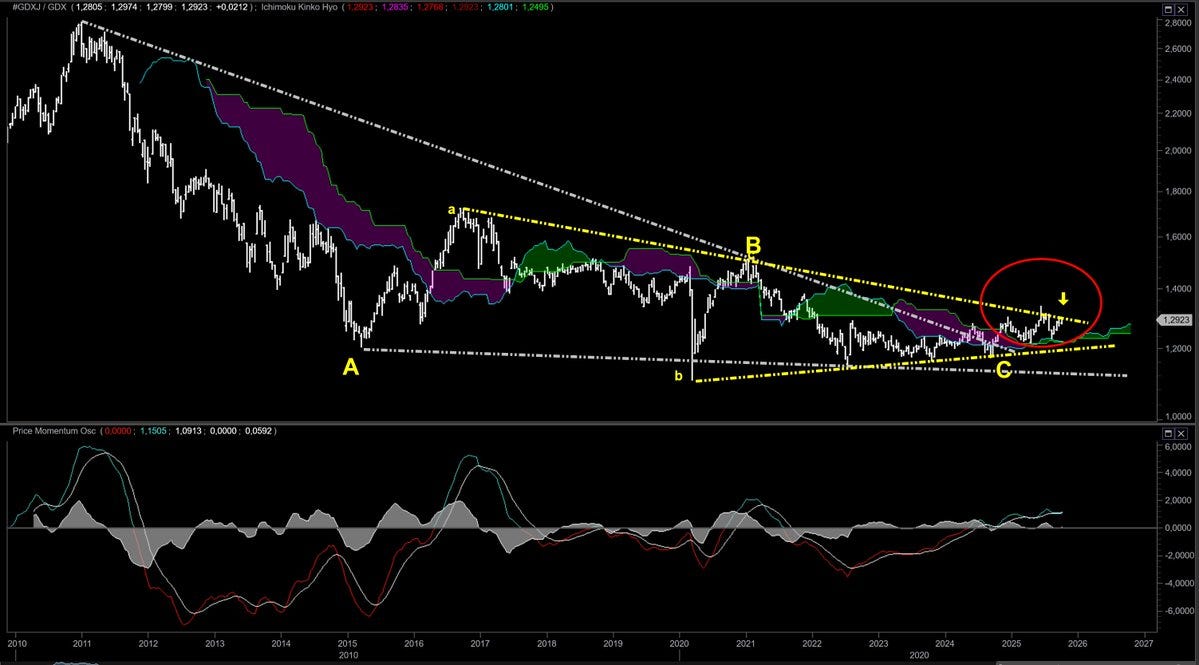

Juniors have still a way to run (disclaimer: I’m HEAVILY into juniors - not for the faint of heart!)

GDX/GDXJ… Juniors are ready to roll!

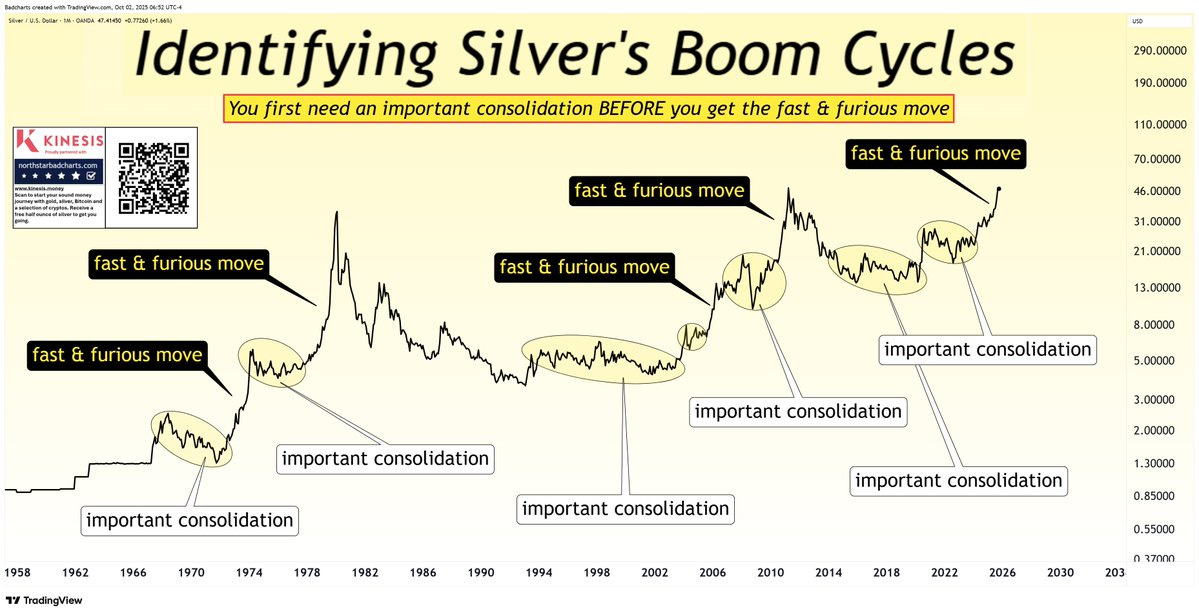

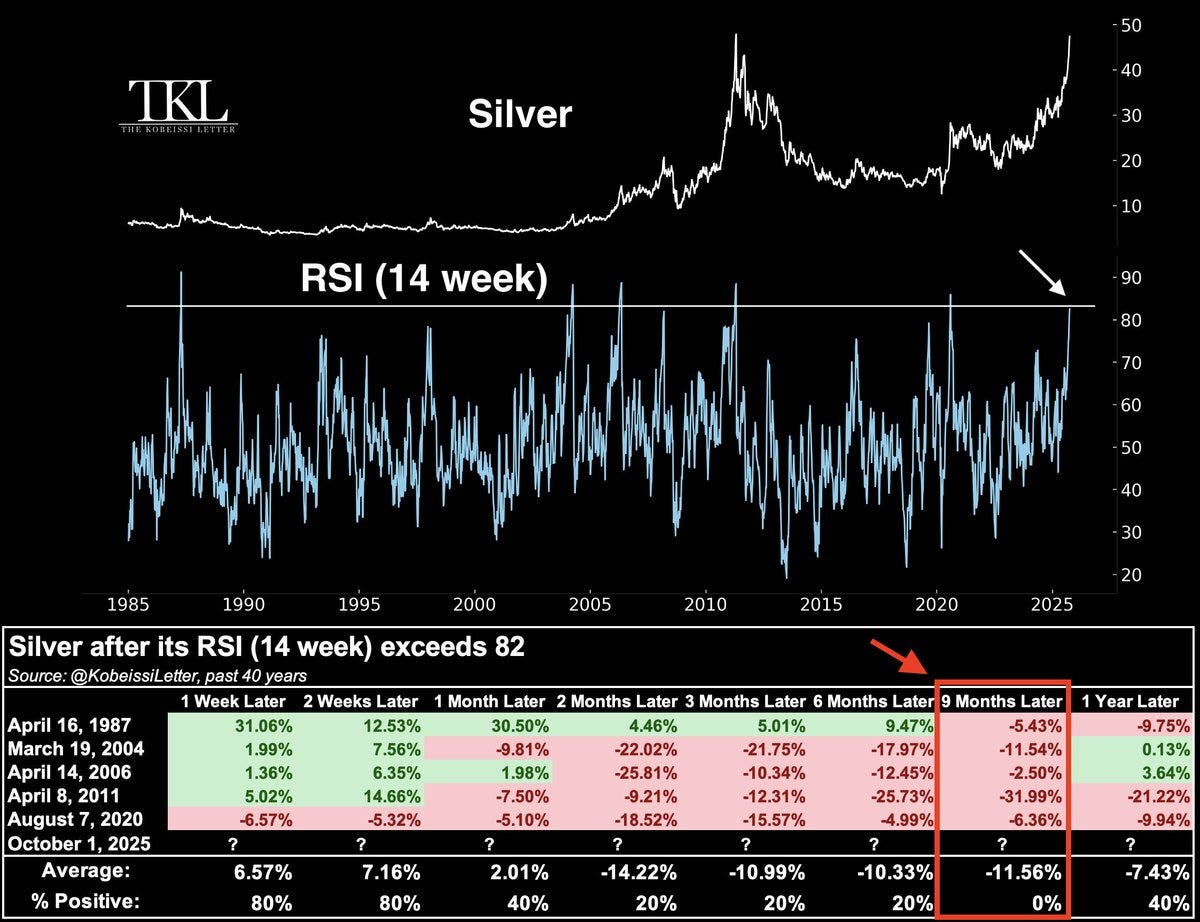

In any stock, and yes, even silver, you need consolidation. Nothing can keeps being extended forever.

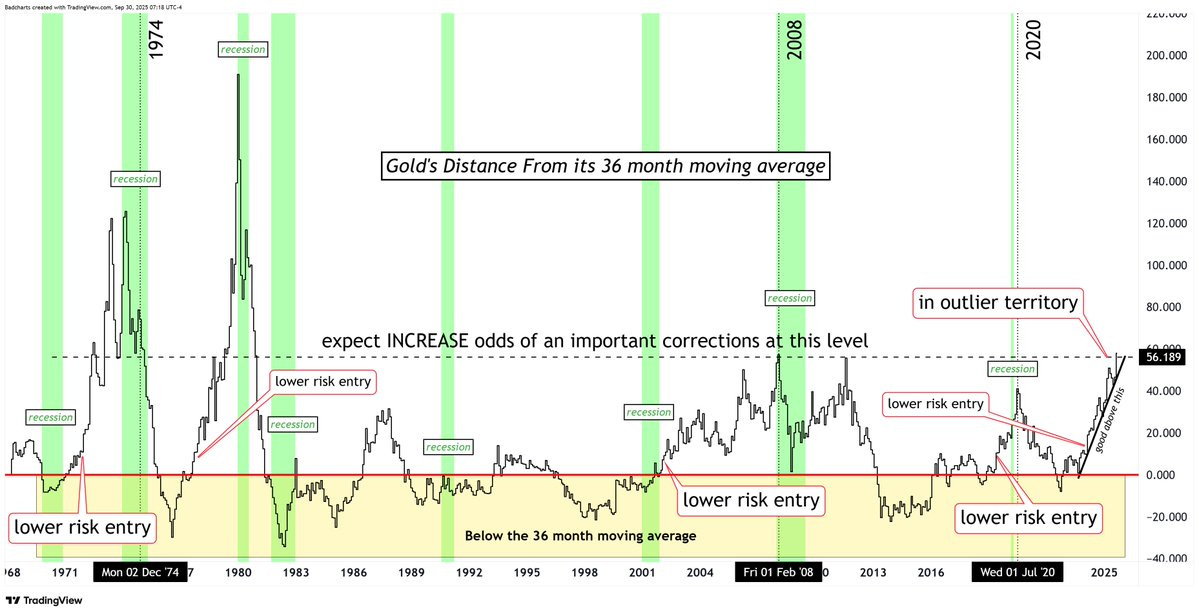

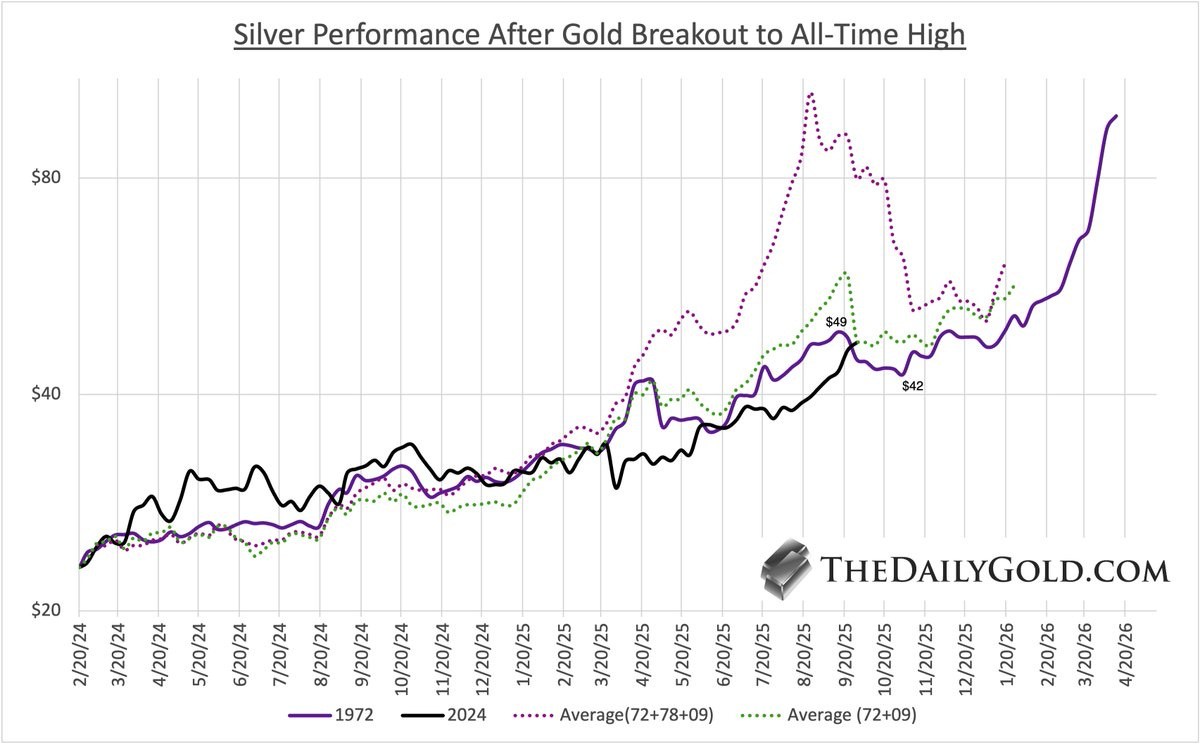

On track for a 1973 move…

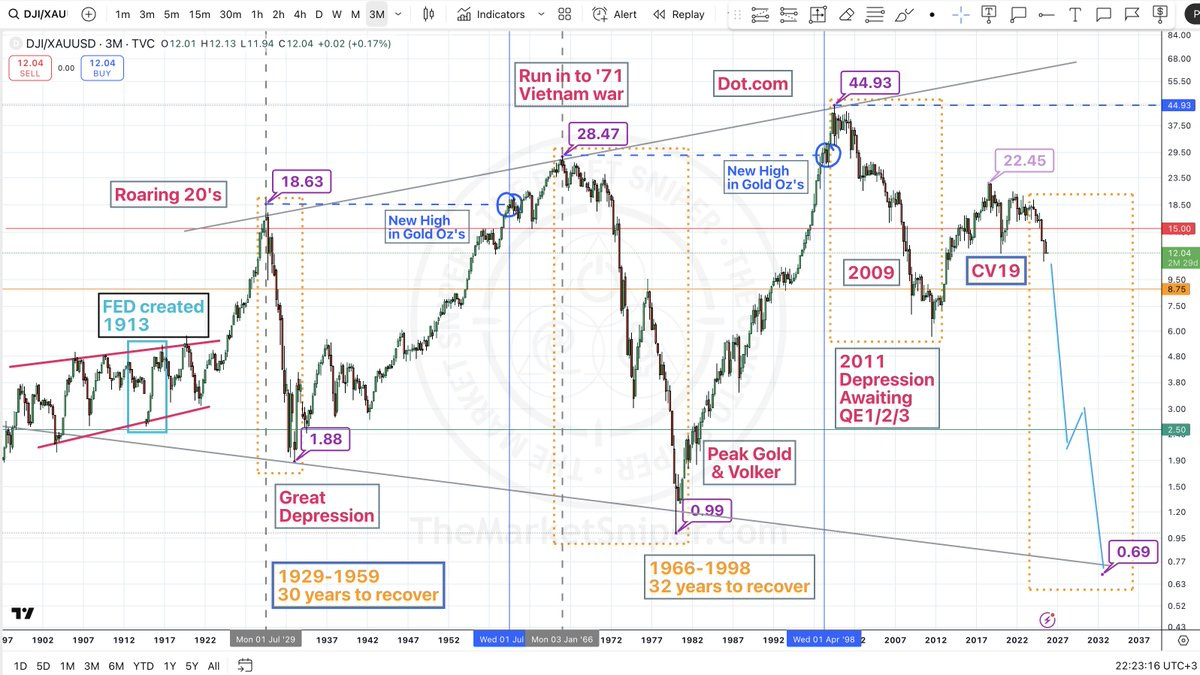

Since the FED creation: “stable markets”

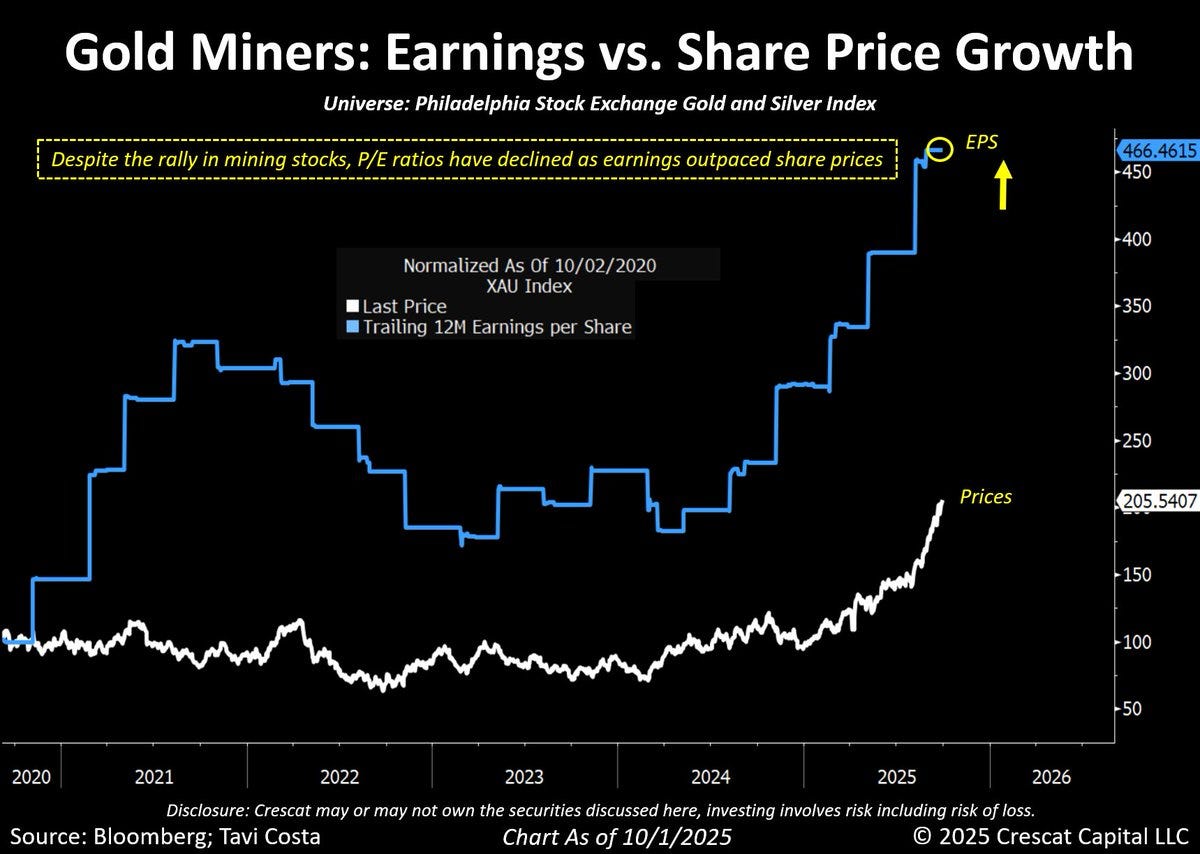

P/E have actually declined for gold miners

Cleaning up the upwards momentum in silver: (ie: remind everyone that nothing goes up in a straight line)

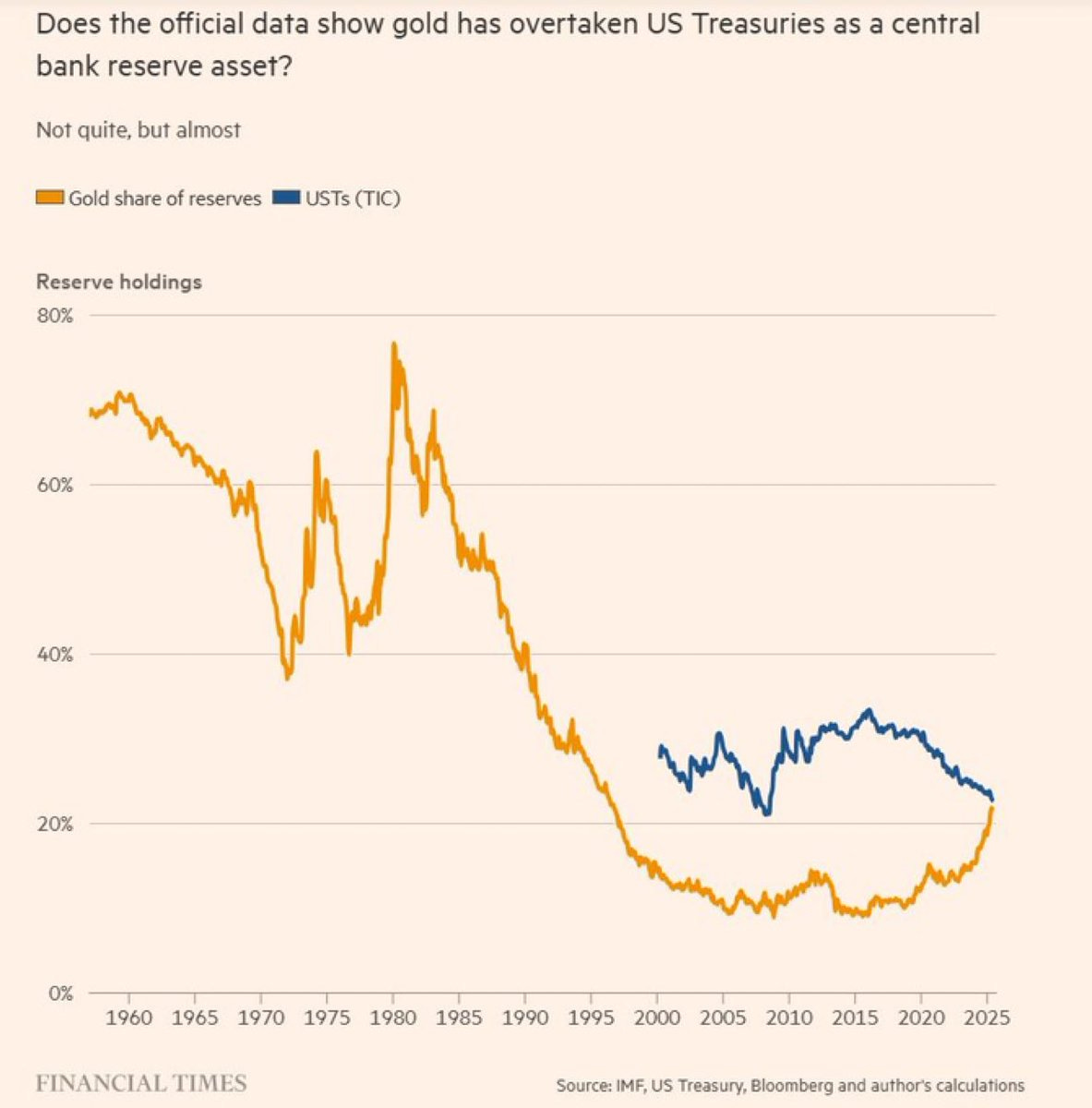

CBs own more gold than USTs:

Watch out getting into silver now (it nearly never “is different this time”):

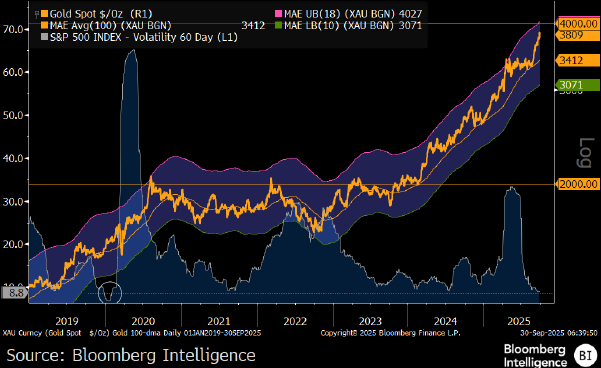

Gold at ATH. S&P volatility at ATL. This is going to end well. /s

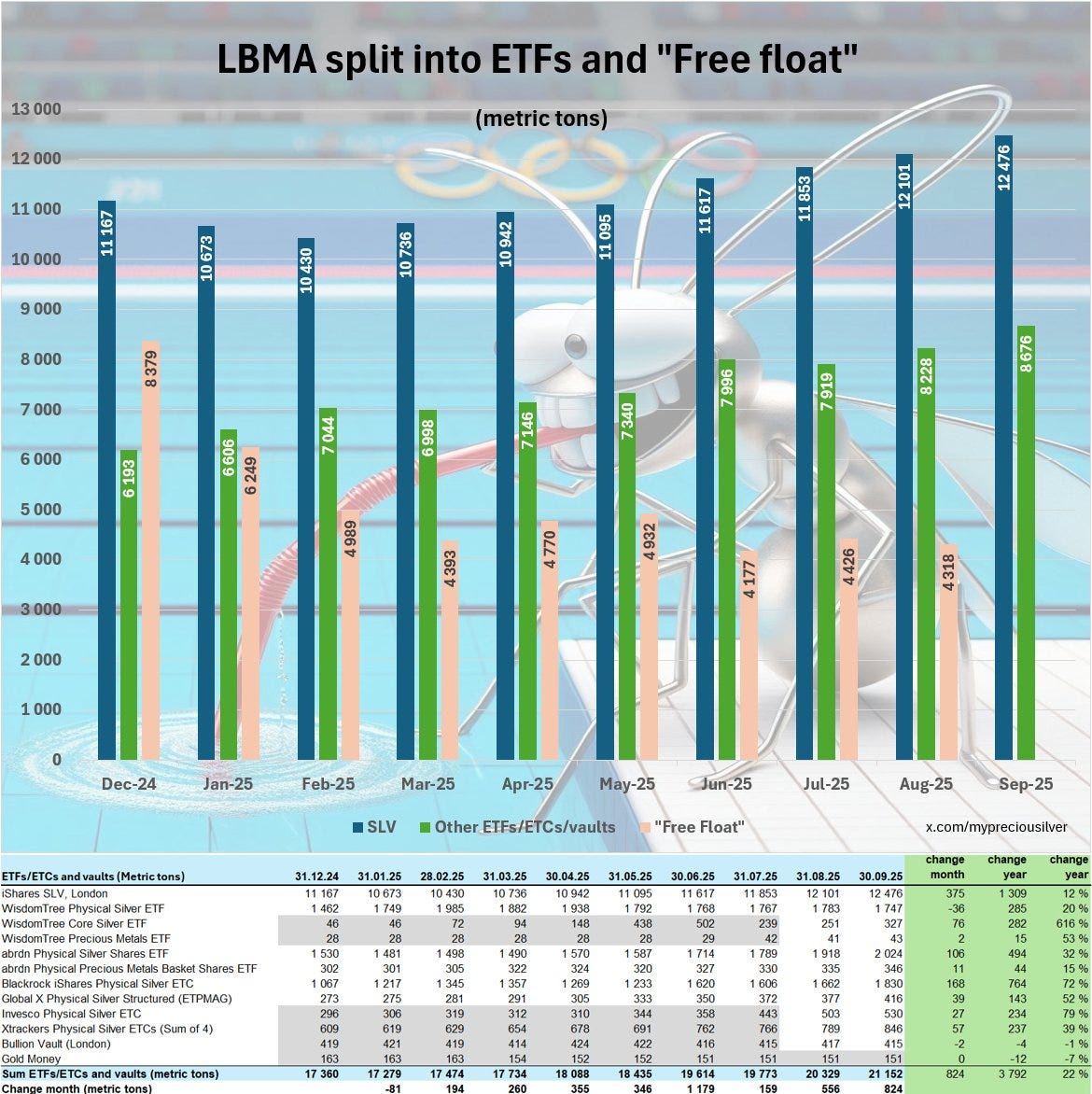

Free float in London is about to take a HUGE hit:

Are we still in the bottoming process, or in the genuine entries of a “phase A”?

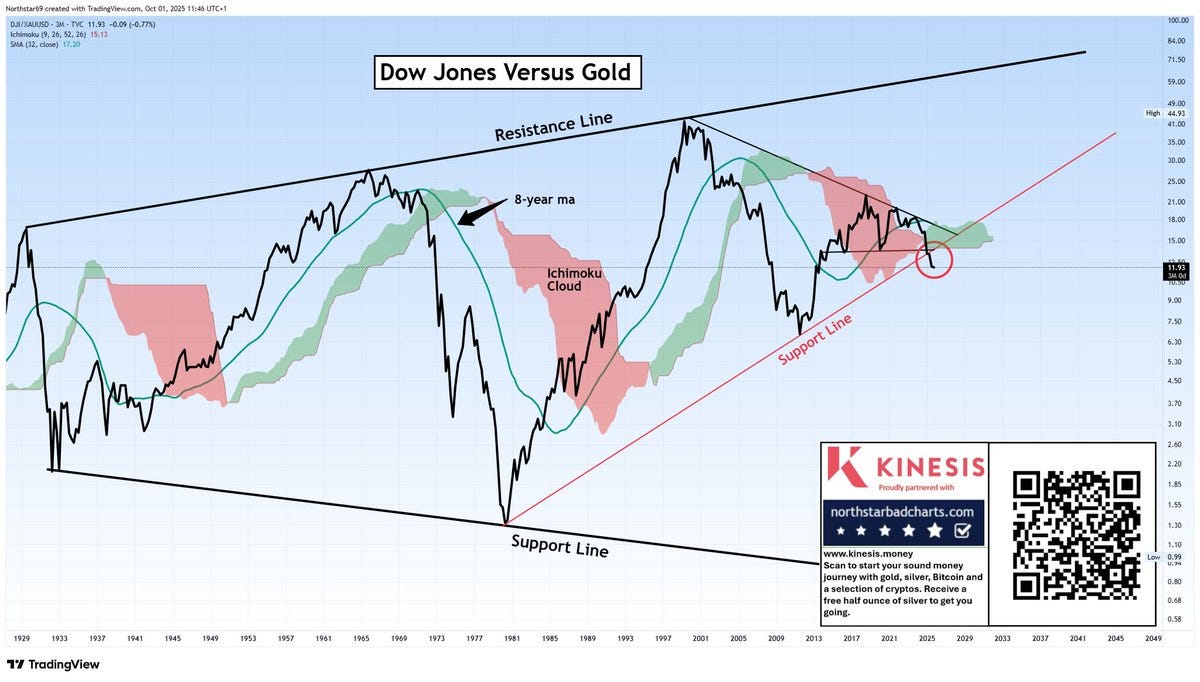

Dow Jones/Gold (quarterly chart). This baby is going down!

Ridiculously long-term silver chart:

It’s maybe better to wait a bit to buy. Or to trim profits and wait a bit. No-one can tell the future. But in general, a bit of profit taking wouldn’t hurt the overall direction of your portfolio.

But no-one really knows:

UST 10y - UST 2y (yield curve inversion chart)

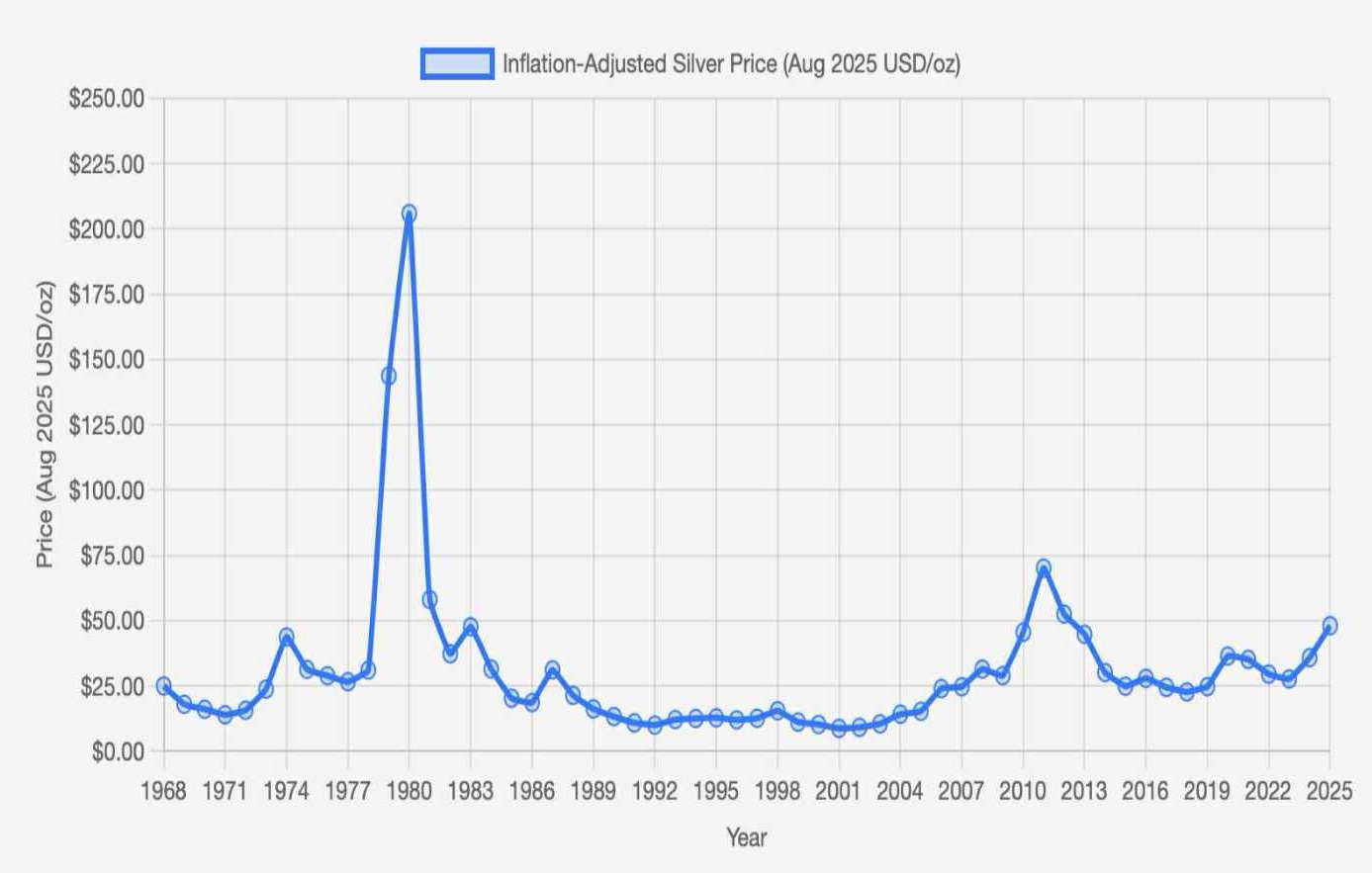

Inflation adjusted silver prices (the ‘80 peak were the Hunt Brothers, so doesn’t really count in my opinion - unless we see a bullion-bank short covering):

https://www.youtube.com/watch?v=K3qMpcjLZGg

Excellent observations based on this collage of graphs.