Weekend thoughts

no penny for my thoughts

This is a weekly digest of unassociated pictures (graphs mostly) I saw during the week. Not much context is given.

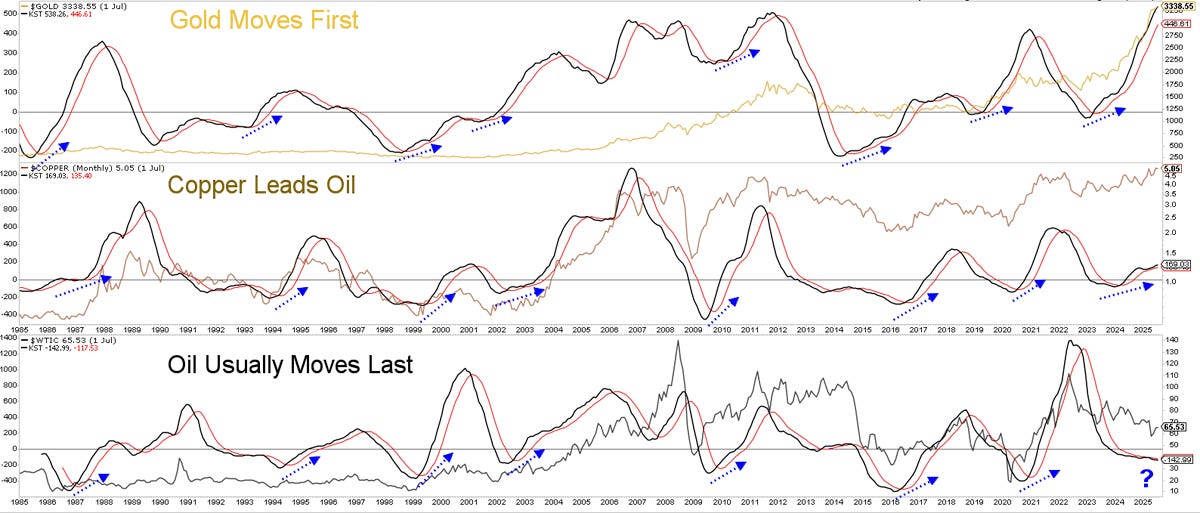

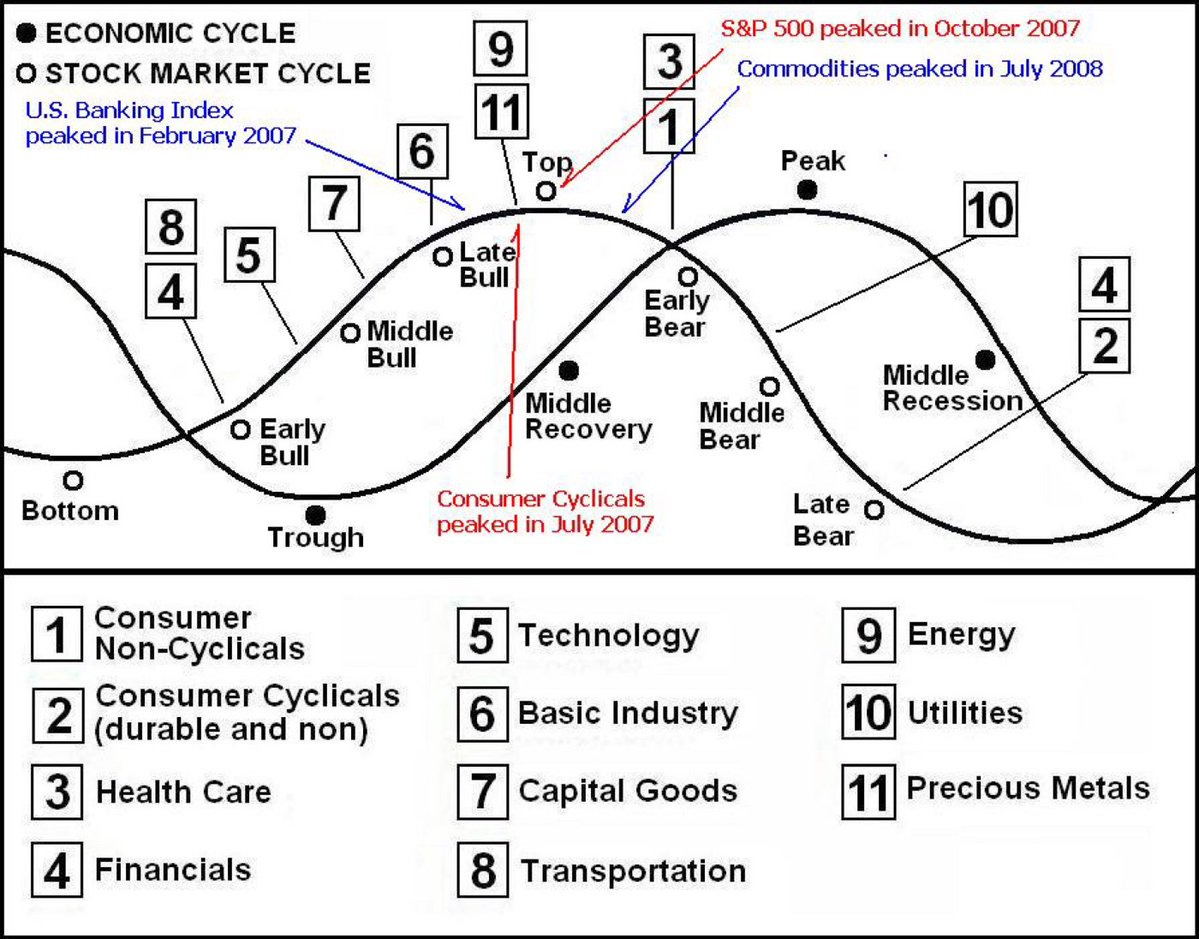

Commodity cycles:

Platinum vs Silver

Bitcoin priced in silver:

Don’t short in an uptrend

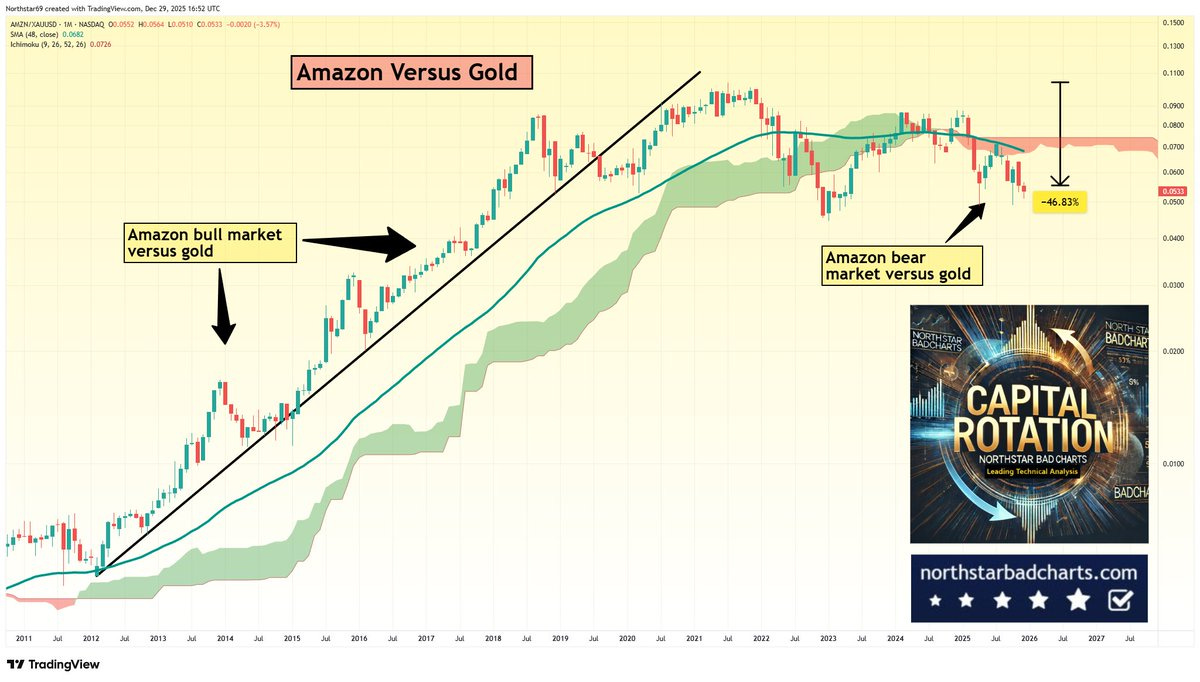

Amazon vs gold:

Tesla vs gold:

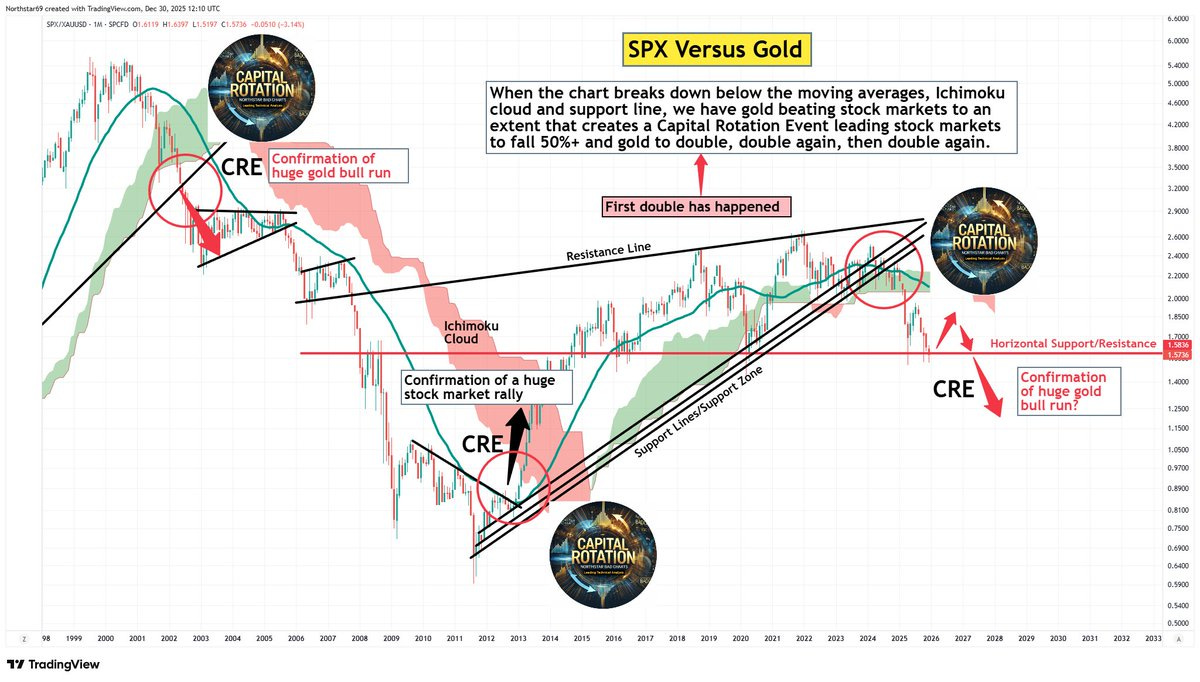

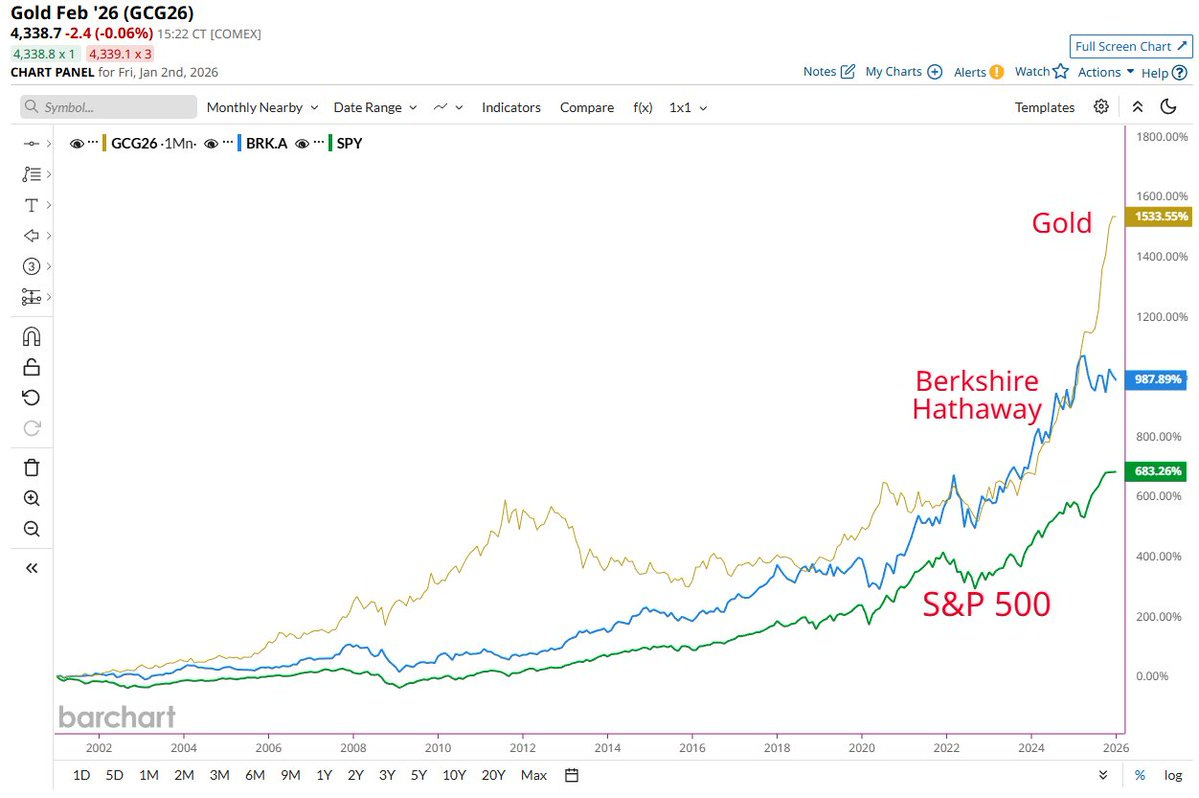

S&P vs gold:

Something on my radar:

Down and down it goes…

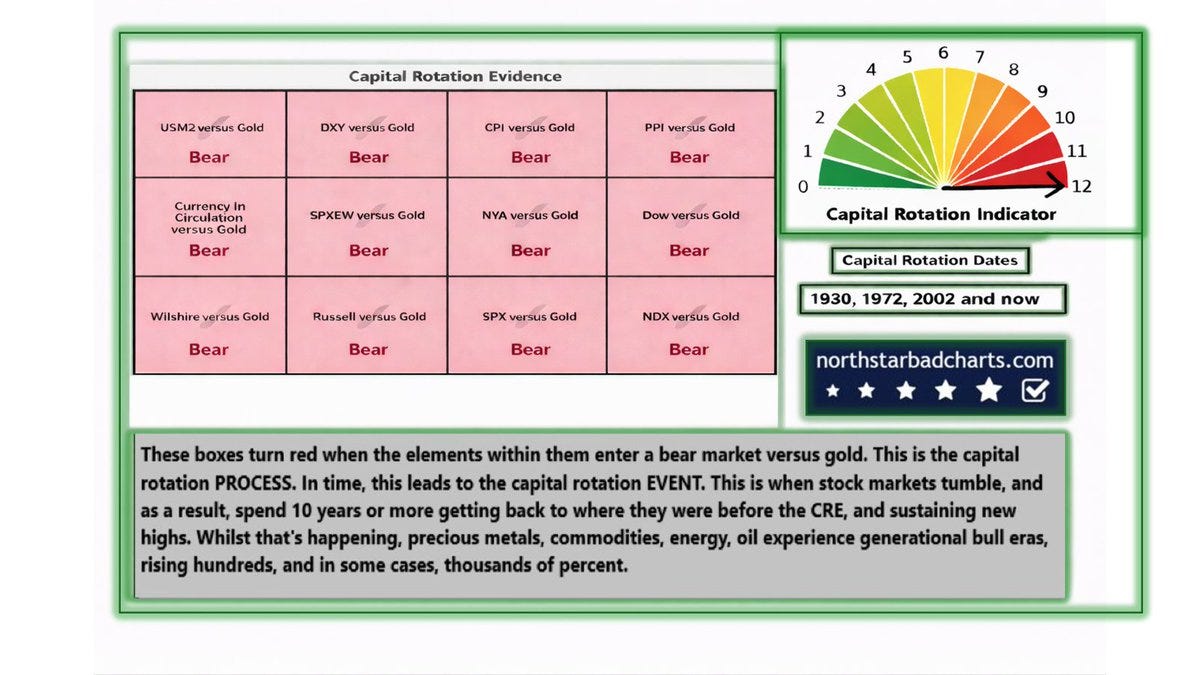

CRE in play. Once in a generation event.

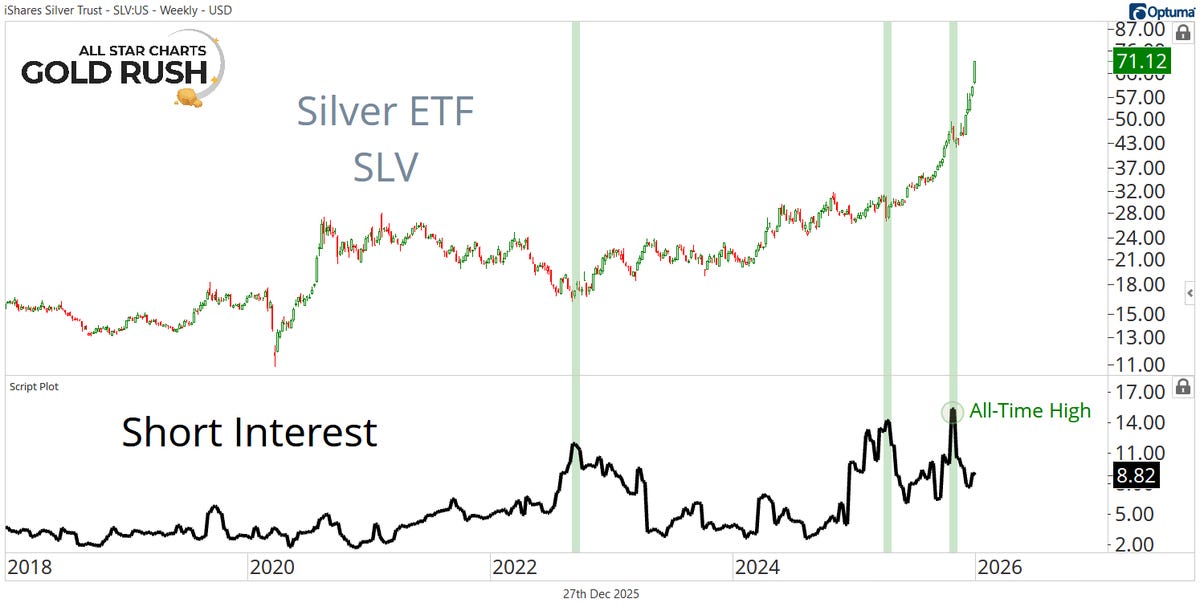

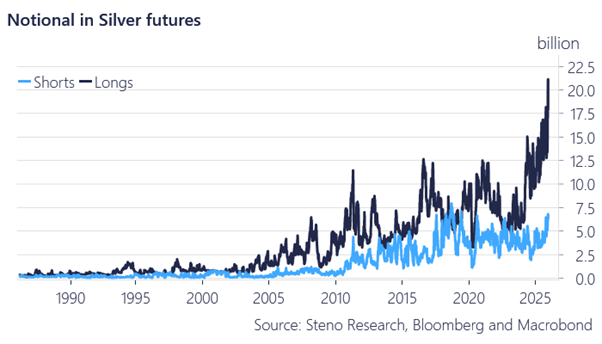

Notional in silver futures

SLV chart

Interesting concept:

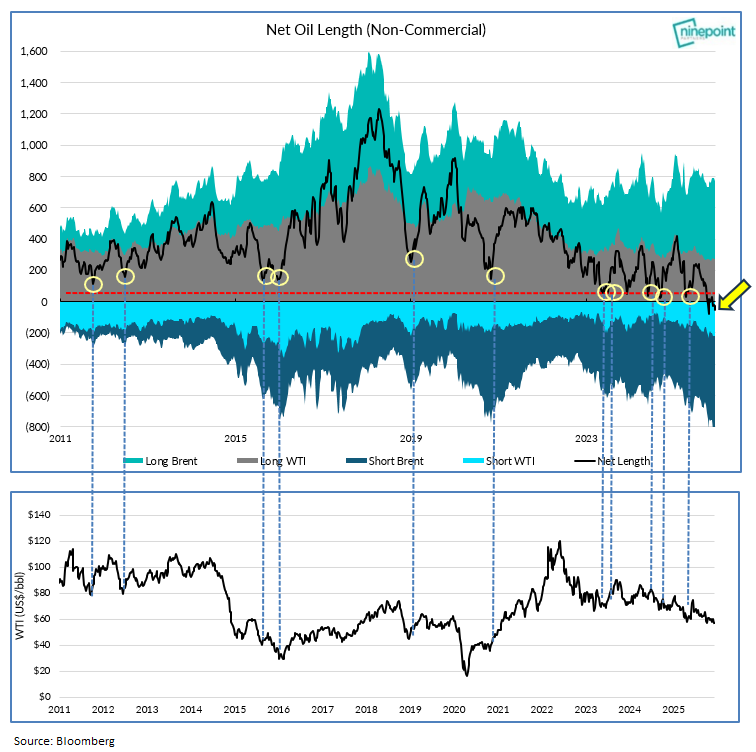

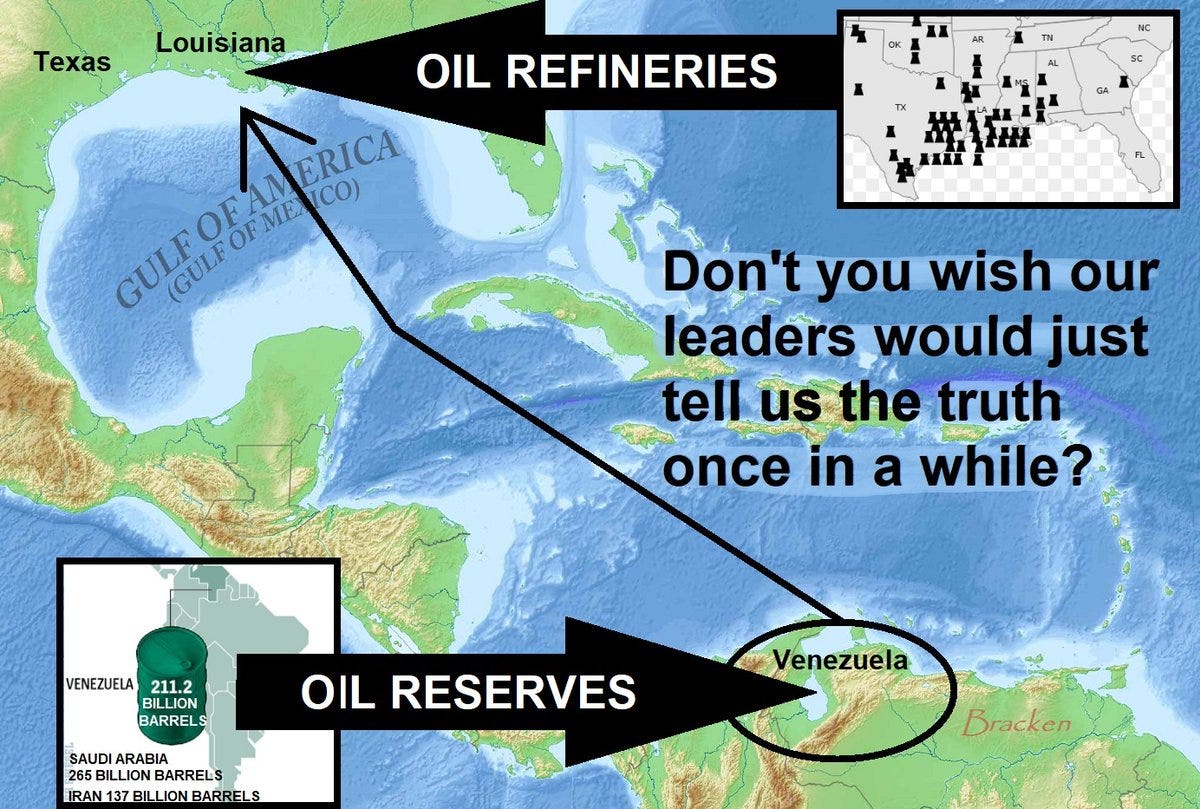

Watching oil:

Silver bullish triangle

Miners vs the metal, not broken out yet it seems (or am I coping?)

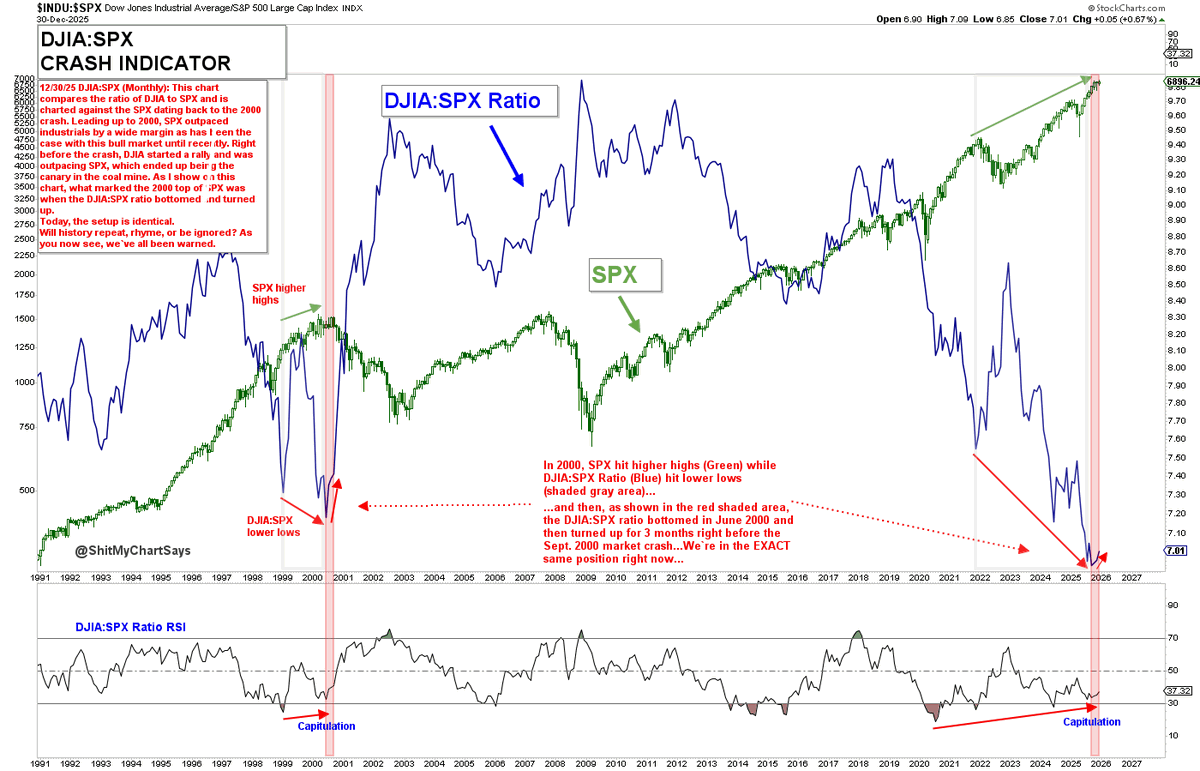

DJIA/S&P

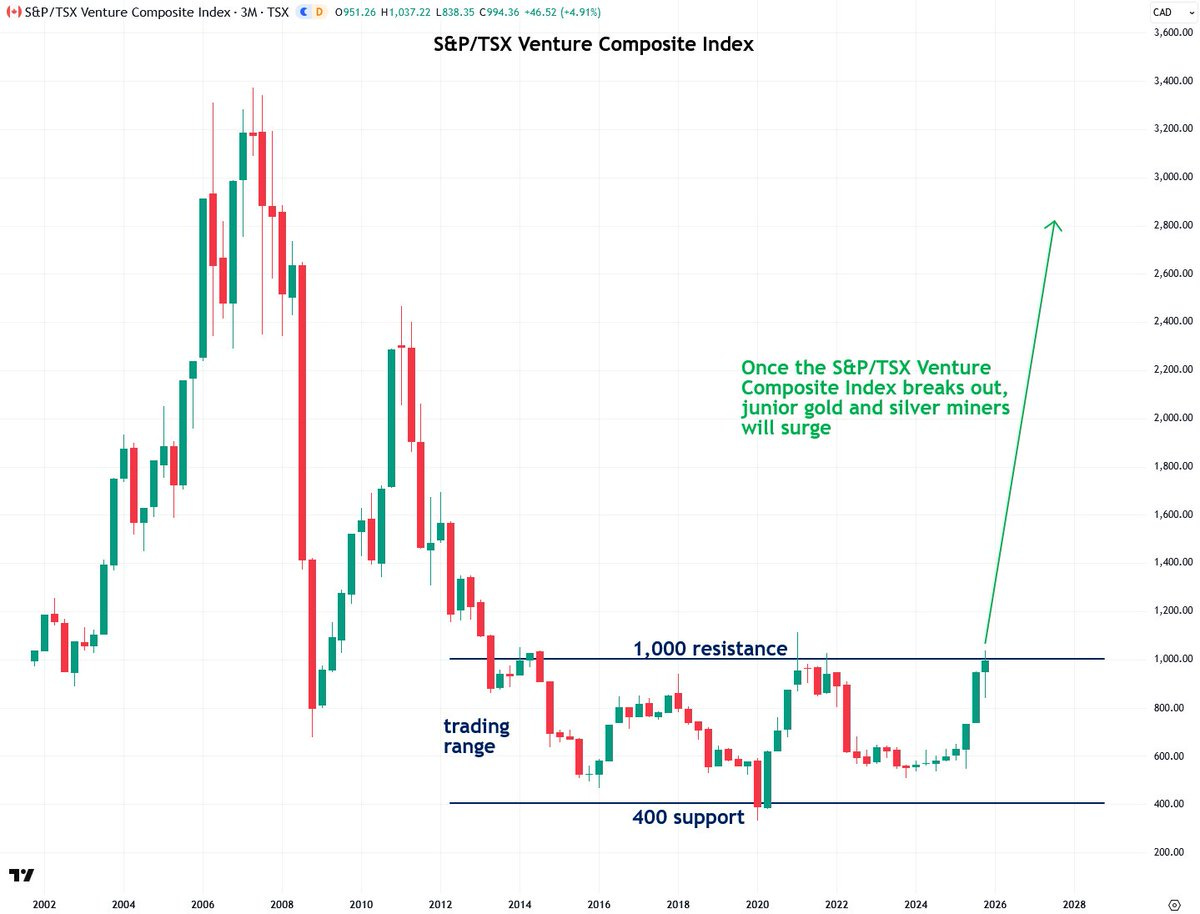

S&P vs TSX (Canadian microcaps mainly):

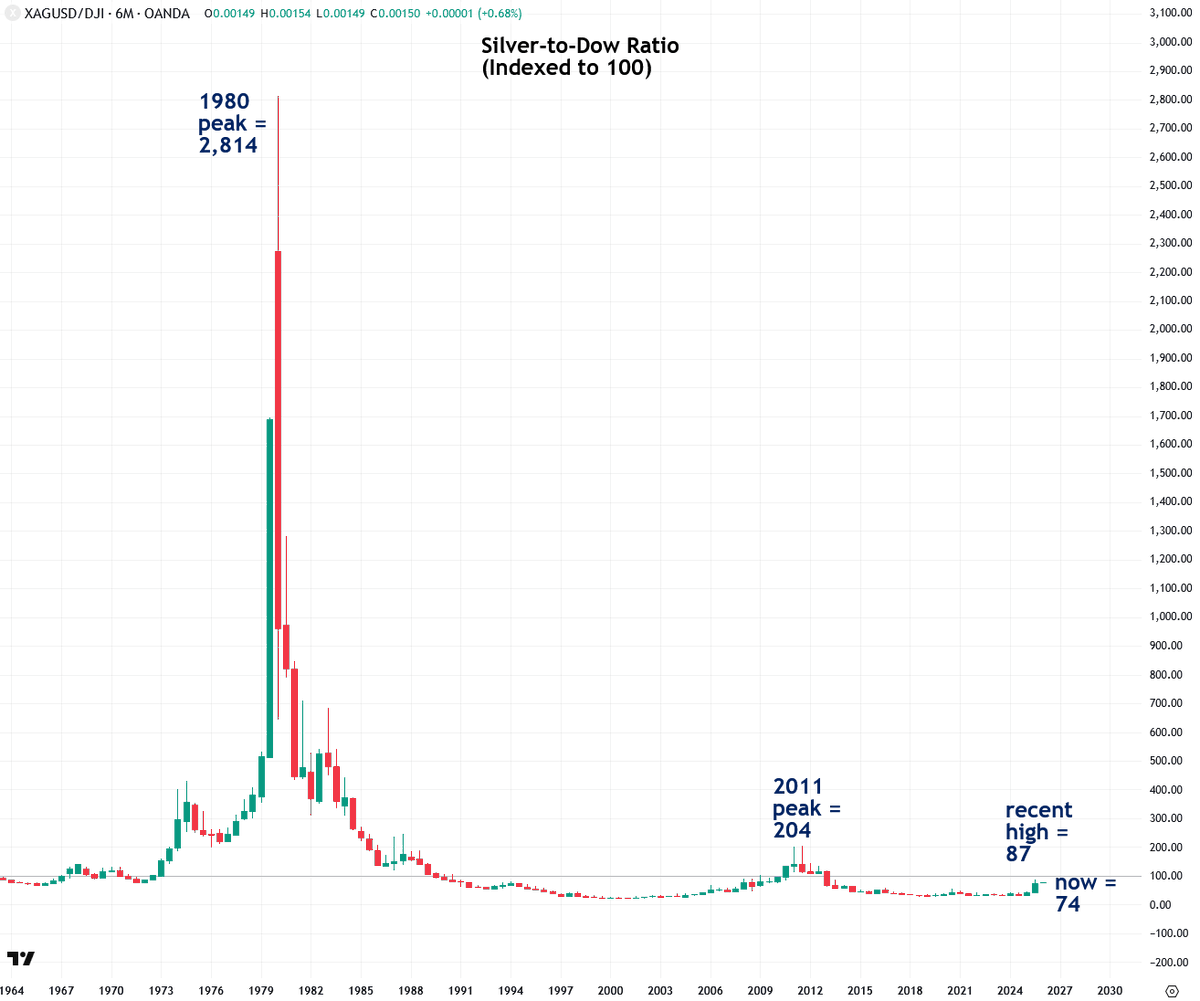

Nominal vs relative:

BTC bottoming soon?

Just coincidence right?

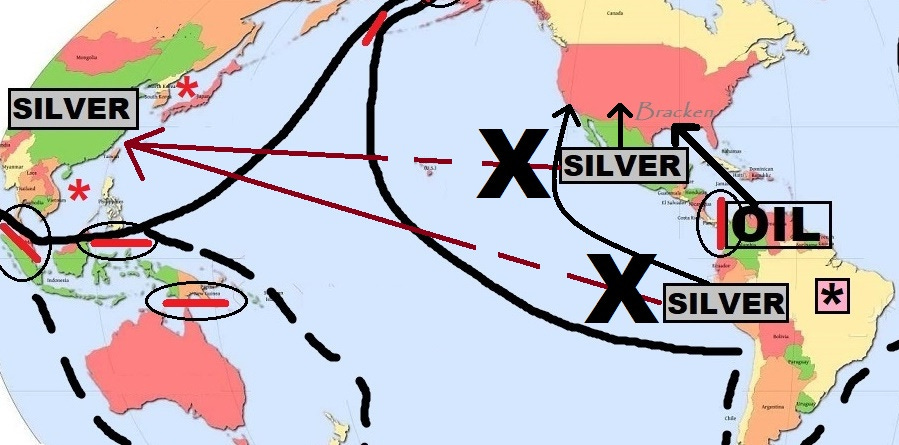

Redirecting resource flows.

No comment

Regarding the Dow to S&P500 ratio, it is said that the Dow represents international capital while the S&P500 represents domestic investors (401k, etc.).

A bottom in the ratio therefore could represent international capital "smelling a rat" and getting out before the little guy gets it.

Also note that the ratio bottomed two years before Black Friday 1987.

Great piece as usual! Two thoughts to consider that i can't wrap my head around. One - pslv has a redemption feature and if silver is as in demand as we all seem to think why wouldn't it get raided? Two - been reading that an entity sold silver short in serious size in shanghai where delivery is expected. Not sure about position limits etc but they would want prices down in london or ny to try to cover these or have to source metal in either location to close out their position. Wonder if this helps us explain some of what is happening in the different markets regarding price points. Perhaps people like vince lanci or eric yeung or yourself could explore/explain this better. Thanks for the continued great content which helps navigate these wild times!