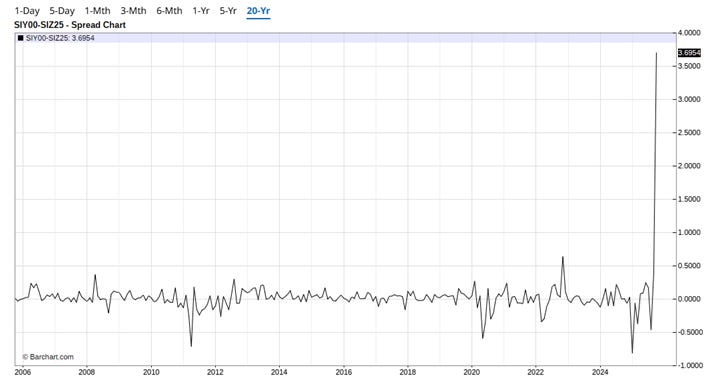

#SilverSqueeze in 1 chart (spot vs Dec contract):

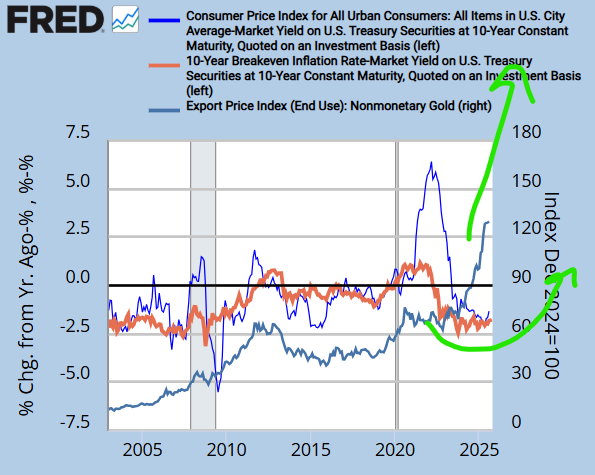

It might be reasonable to hold gold here… (no shit Sherlock!)

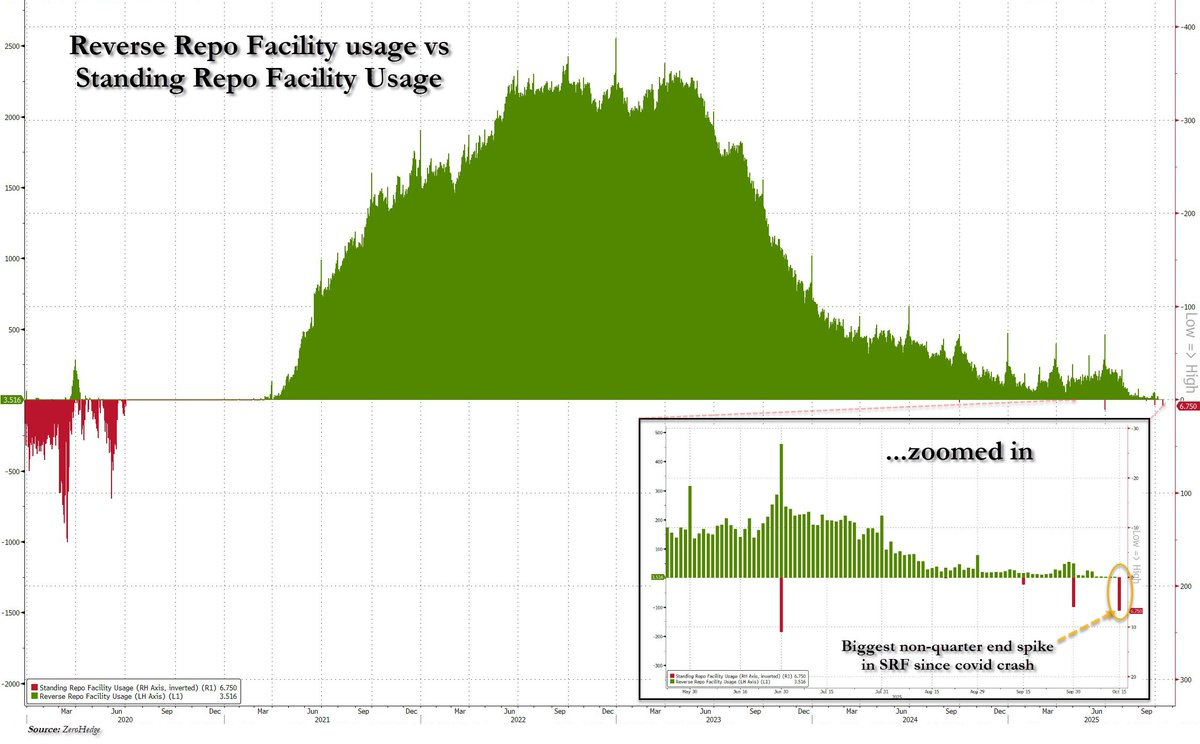

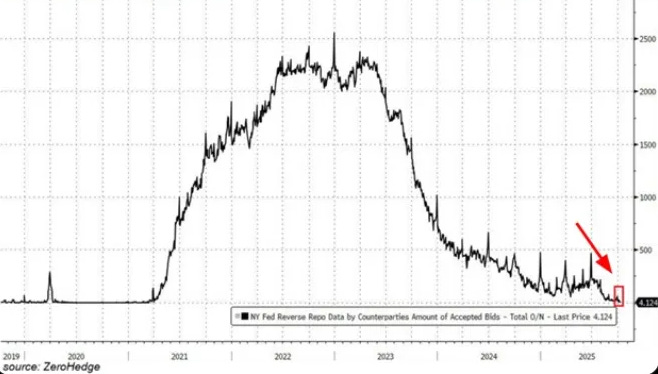

Reverse (ample liquidity) vs Standing (scarce liquidity) Repo:

#BTC ain’t looking very good here:

Possible move for #Silver:

Dunno if true. Been waiting for this for a LONG time already!

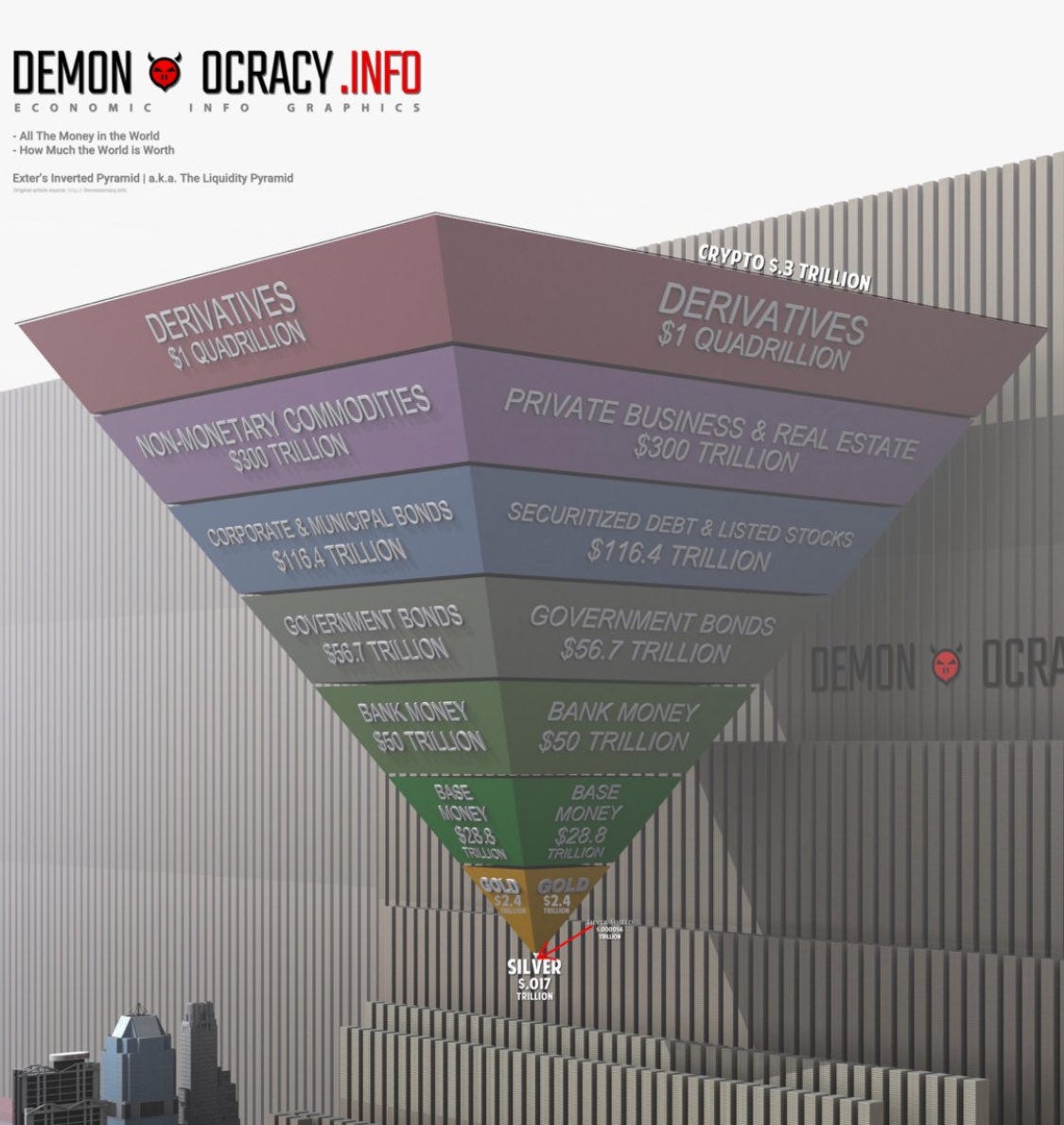

Exter’s inverted pyramid… You don’t even SEE silver!

Cost vs price:

BTC: 105k/oz ←→ 105k

Silver: 26.9/oz ←→ 50.6

Gold: 1400/oz ←→ 3990

Copper: 6k/ton ←→ 10.5k

Take your own conclusions

RRP usage by banks is at the lowest since like. ever. This means banks are less likely to lend money, and can cause market spikes and even bank failures. Something to watch!

If you want to add silver. Maybe now is a good time. Dunno if the 50-51 area will hold? Next area would be 47-48$. Anyhow. If you want physical and have been waiting: now’s your chance!

Did something blow up and do they need cash? FAST?! Or simple market manipulation? Or was silver overstreched? Probably, because I’ve seen reports of bank failures. Let’s see over the weekend what news trickles out.

Silver crashing, but borrowing fees up… Make that make sense! The squeeze is on. Get yours while there are discounts! DEFINITIVELY. Something is breaking.

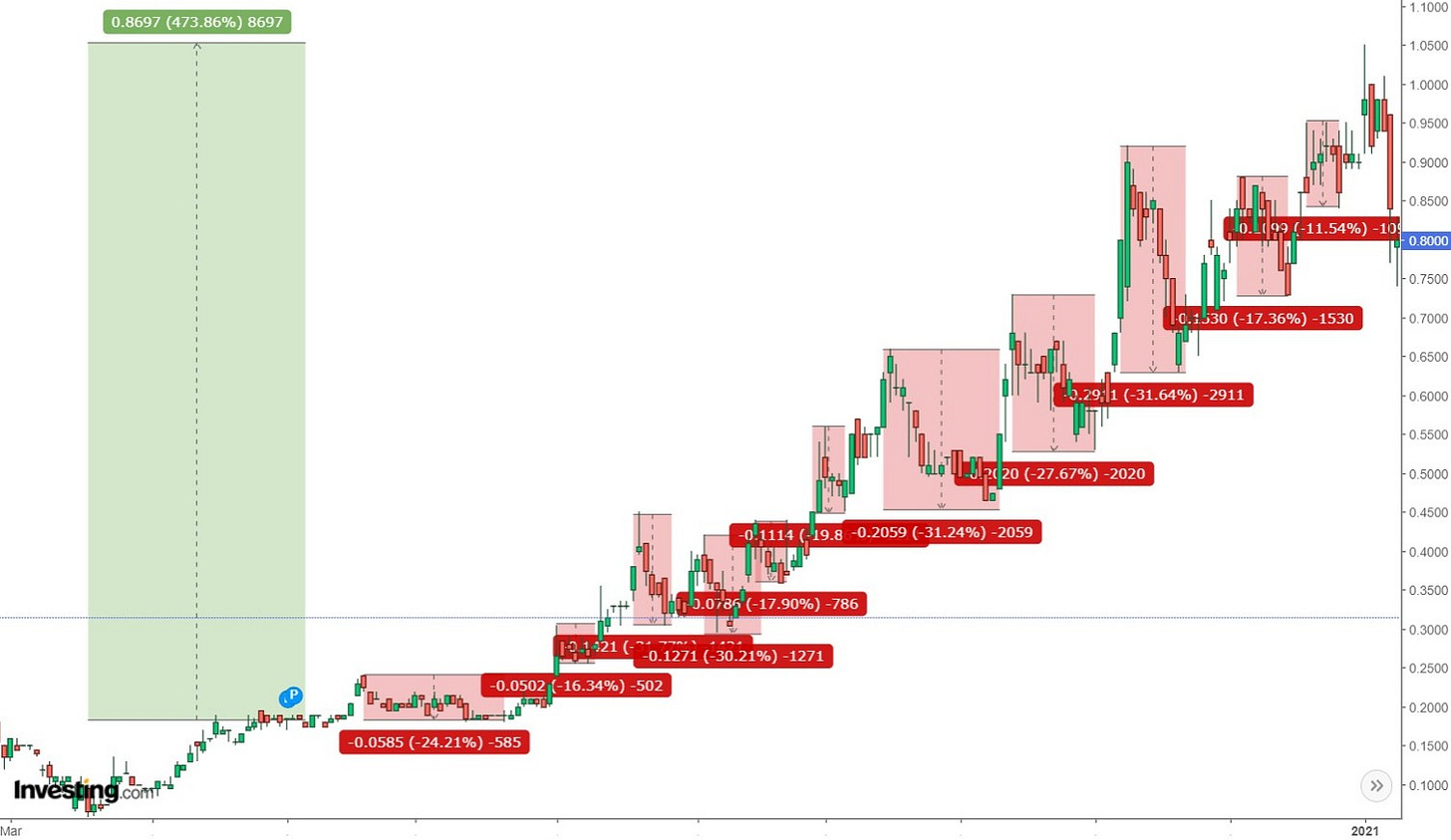

Investing in juniors: not for the faint of heart:

Excellent collage of graphs, NO1.