Weekend thoughts

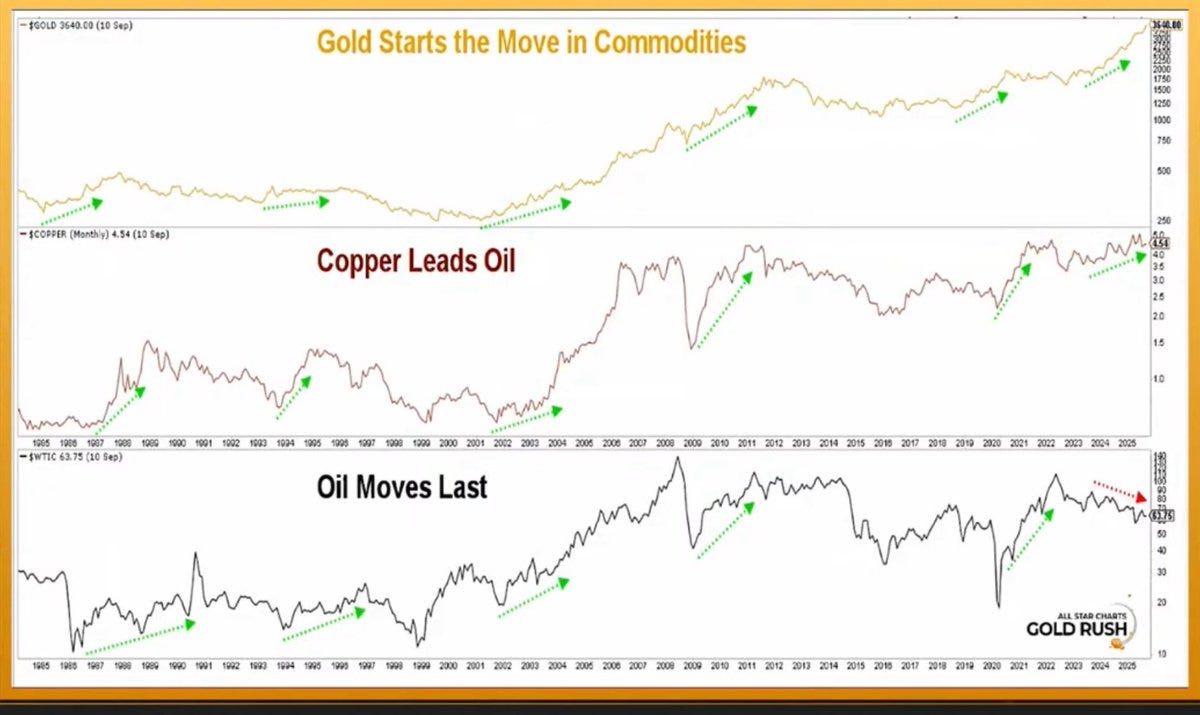

Gold moves first, then copper, then oil.

Silver/SPX (0.035 in 2011). Now stands at 0.0065. At current S&P prices: 230/oz is possible. Or silver doesn’t move, and S&P crashes to 1200. That’s the same ratio too.

(really) long term M2/silver ratio. I’m expecting at least it hit 150. Maybe even Hunter’s top. But 300 should be possible too.

SIL/SILJ: we’re still early

GDXJ/GDX

BTC vs Gold. Which is right? BTC bottoming or topping? My view is the latter.

Gold… It just keeps going.

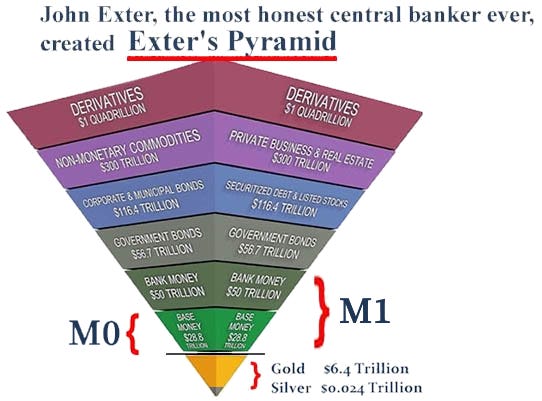

Exter’s pyramid. A bit outdated concerning the numbers (see this note), but still applicable.

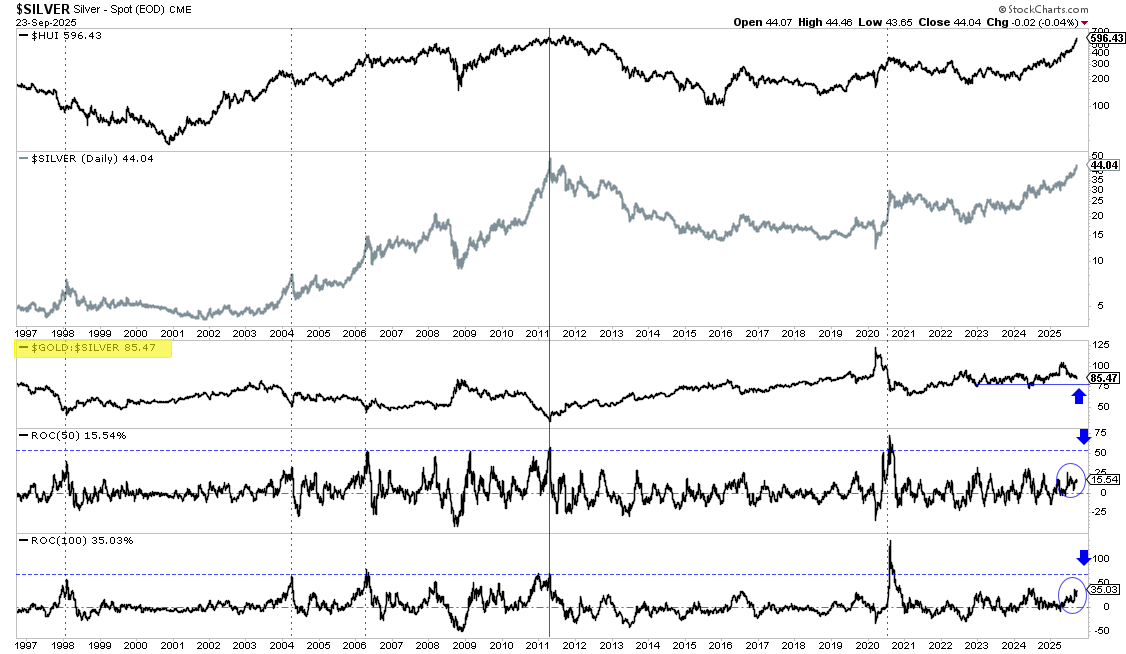

Silver’s Rate of Change (ROC) is nowhere near past (intermediary) peaks (2004, 2006). But things can move suddenly in such a tiny market when money floods in.

Coffee vs Tea

Reaction of different markets to the FED decision to lower the interest rates (from top to bottom: Platinum - Silver - Gold - Bonds):

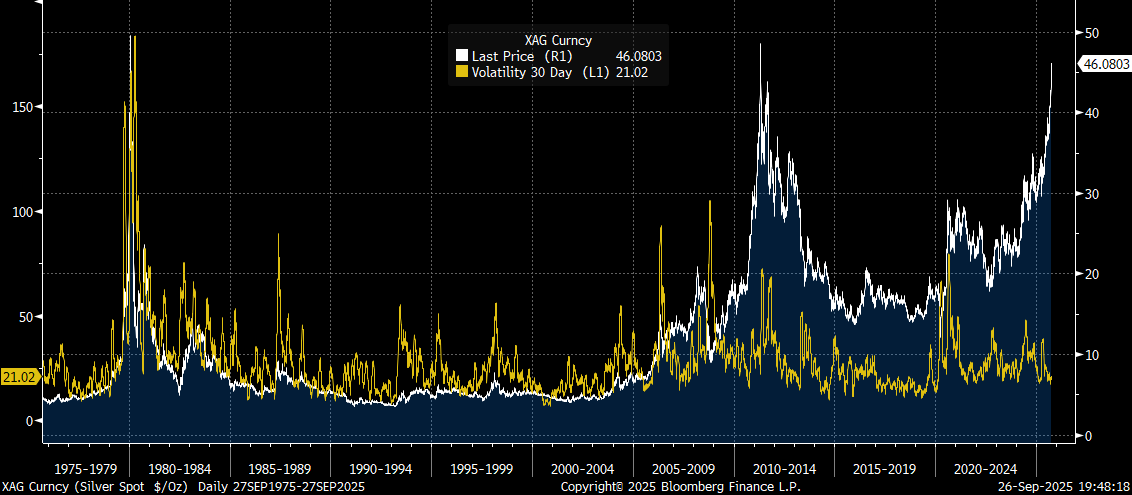

Silver vs its volatility. Not a sign of a top yet:

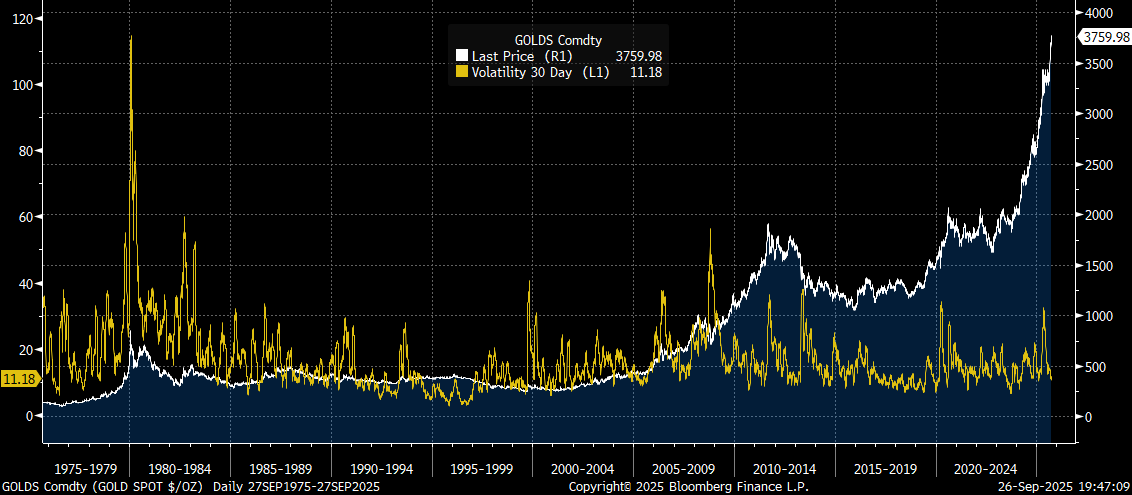

Gold same:

Gold threatening the middle band of this channel. Could get technically slammed down to around 3000 without loosing it’s bull-market. And providing anyone listening for a nice entry point.

GDXJ: not even close to the top yet. Still 50% to go. And those things seldom go in a straight line. So opportunity enough to get in.

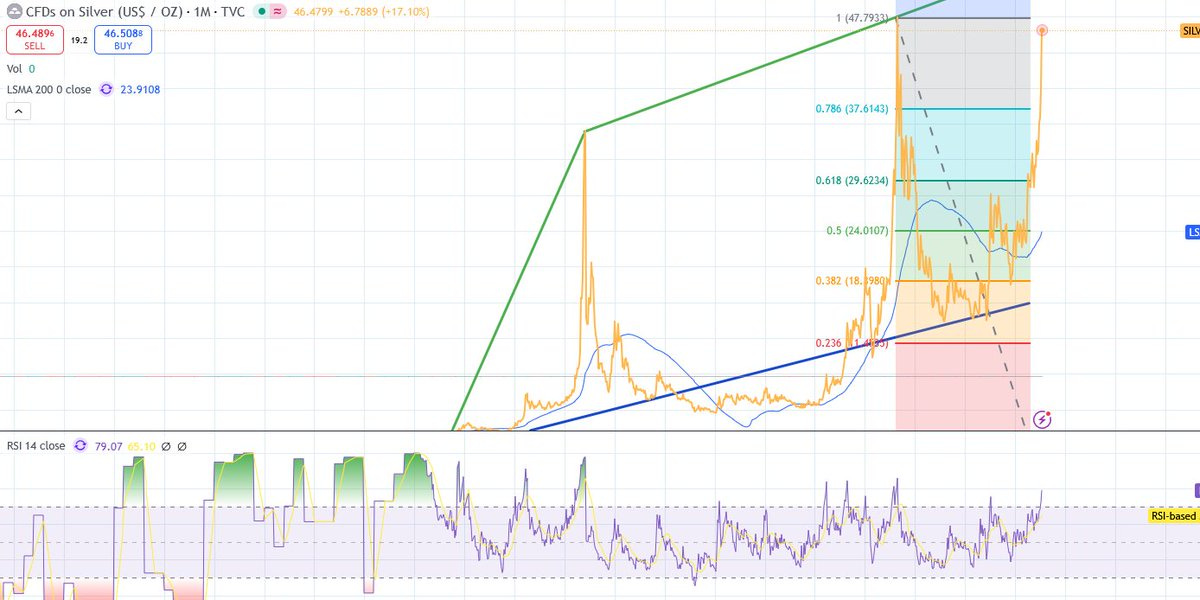

Parabolic up in silver.

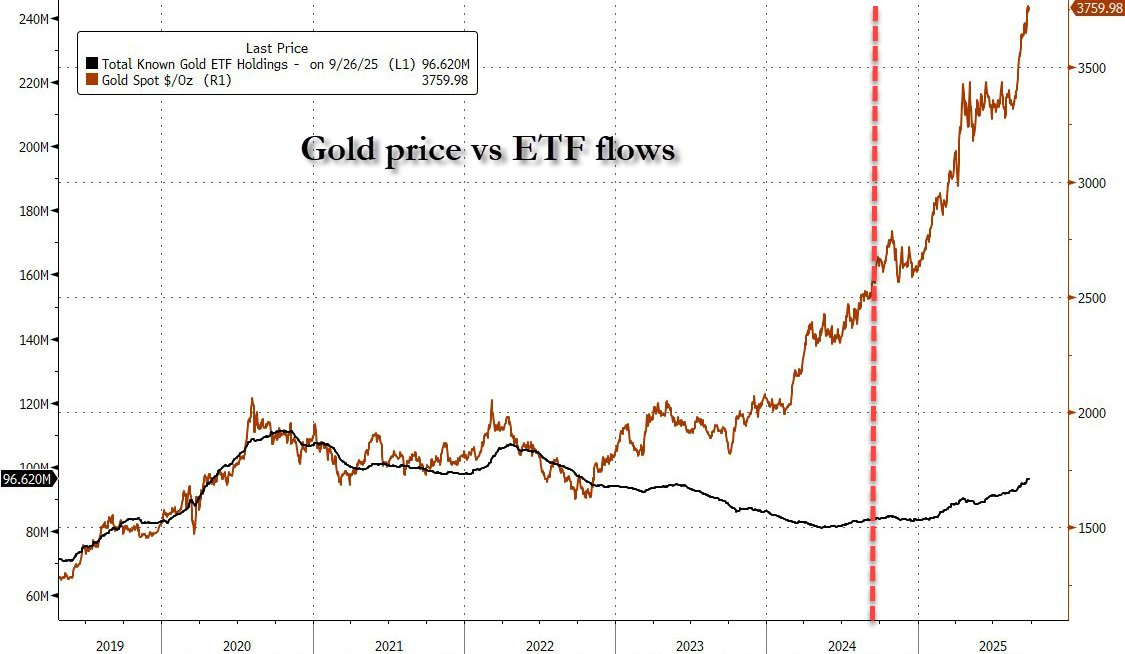

Gold price vs ETF flows

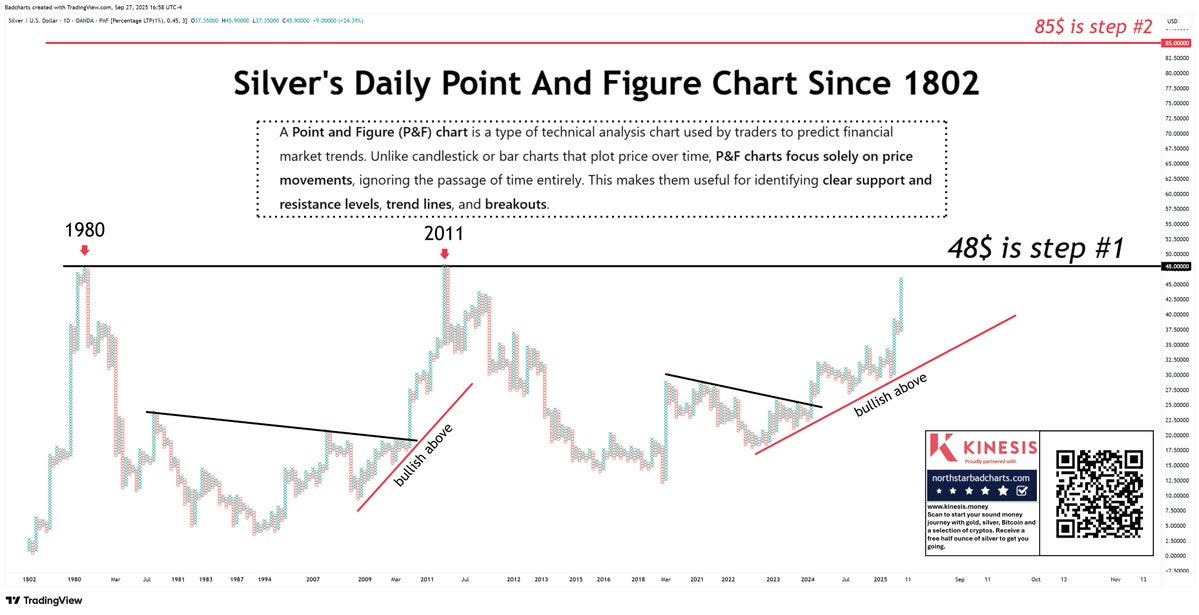

45 years cup & handle in silver. Will we, or won’t we close above this quarter?

Silver at $50 next week?

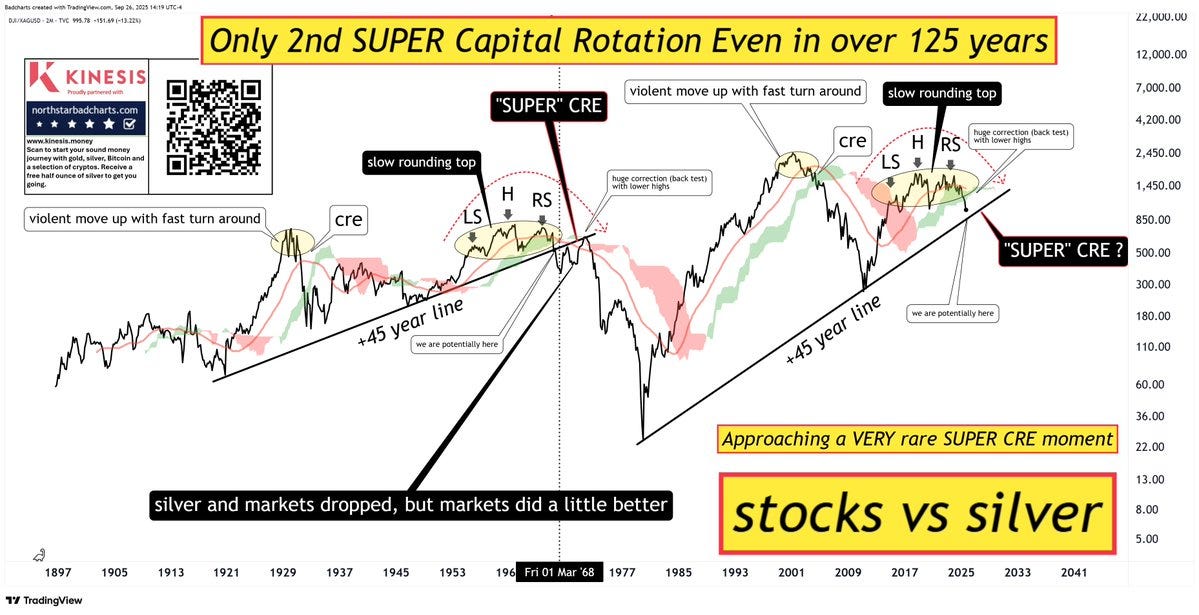

Stocks vs silver:

Fibonacci levels:

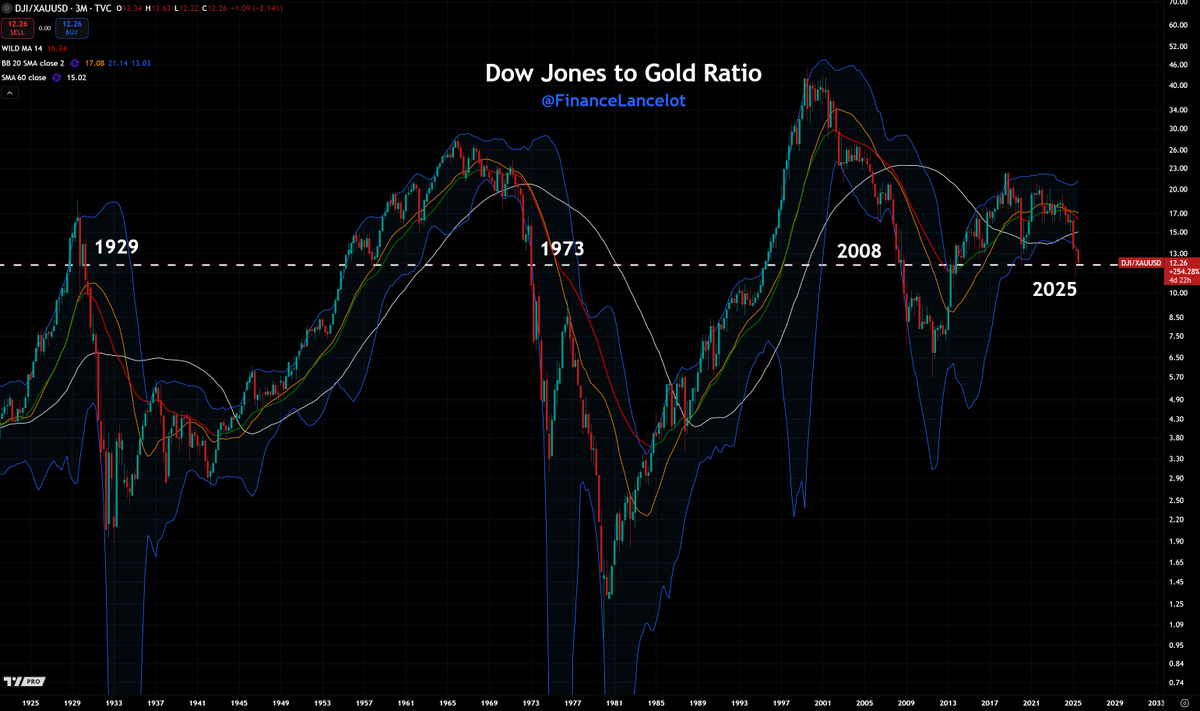

Dow Jones/Gold

Silver miners vs Gold miners:

Palladium seems to be getting ready as well:

45 years long term chart: