Water always finds a way

The global economy's great rerouting

August 8, 2025 marks the convergence of multiple financial and geopolitical fractures that reveal the dollar's existential crisis. The spectacle unfolds like watching someone setting their own house ablaze while frantically boarding up the exits—the US government simultaneously debases its currency through reckless spending while imposing tariffs that prevent citizens from fleeing to traditional safe havens. These aren't strategic maneuvers but the flailing of a system that recognizes, perhaps unconsciously, that it can no longer compete on merit alone.

The Treasury market reveals the most immediate danger. Yesterday's auction of $42 billion in 10-year notes barely scraped by with a 2.35x bid-to-cover ratio versus the recent 2.51x average, forcing primary dealers to absorb 16.2% of the issuance—their largest takedown in a year. Foreign buyers, who once eagerly financed American spending, increasingly view US debt as radioactive. Ten-year yields jumped to 4.241% as the auction's 1.1 basis point tail signaled fundamental demand weakness. When combined with staggering employment revisions—May's numbers slashed by 125,000 jobs, June's by 133,000—the picture emerges of an economy far weaker than official narratives suggest. The bond vigilantes aren't coming; they're already here, quietly walking away from a market that depends on their continued participation.

Switzerland's gold tariff ruling perfectly captures the desperation. By imposing 39% duties on Swiss bullion bars, the administration essentially admits the dollar cannot compete with gold as a store of value. They're not taxing Swiss refineries; they're taxing the exit door. Consider the mathematics of madness: gold trades at $3,500 internationally, but with tariffs, Americans must pay $4,865 per ounce—a premium that transforms the metal from inflation hedge to luxury good. Meanwhile, the shorts scramble to cover positions with physical metal that simply doesn't exist in sufficient quantities. COMEX and London vaults hold paper claims far exceeding actual bullion, and now those claims face a delivery squeeze that could send prices parabolic even before adding the 39% tax.

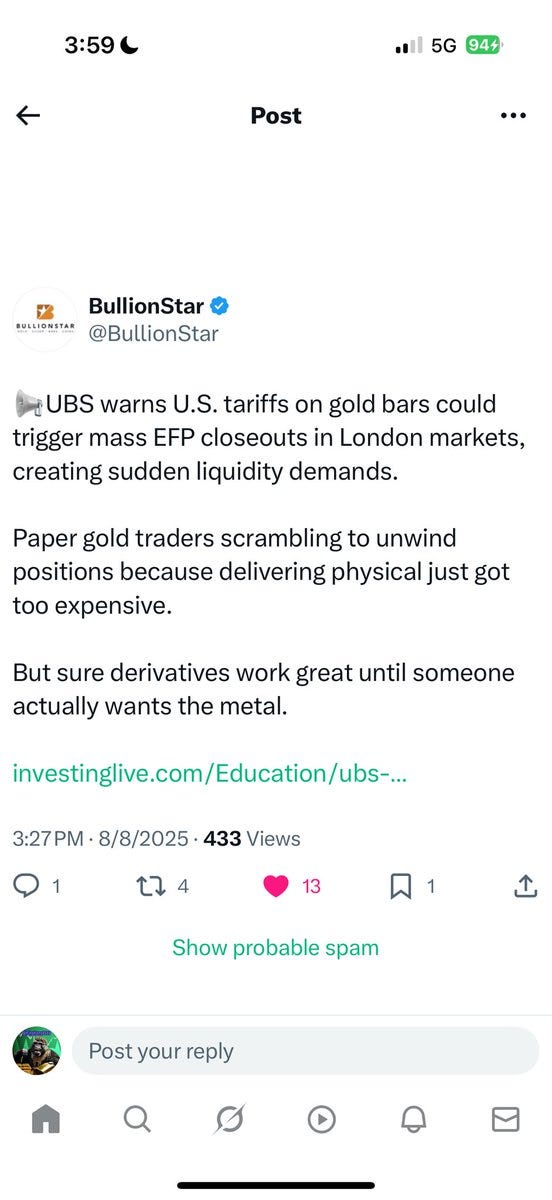

The Swiss gold disruption transcends mere market mechanics. By breaking the triangular flow between London, New York, and Swiss refineries that underpinned the global bullion market for decades, these tariffs shatter the physical infrastructure of monetary alternatives. UBS warns of cascading funding crises as the same gold bars can no longer be endlessly rehypothecated. The Basel III framework, which already pressured banks toward physical holdings, suddenly faces implementation through market force rather than regulation. It's creative destruction of the most destructive sort—annihilating functional systems without viable replacements.

The true genius—or insanity—lies in the accounting trick this enables. US gold reserves remain valued at $42 per ounce on government books, a relic from 1973. Revaluing them at the new tariff-inflated price of $4,865 would generate $1.2 trillion for the Treasury without issuing a single bond. It's monetary alchemy: create artificial scarcity through tariffs, force a price spike, then revalue your holdings at the inflated number. The government essentially prints money by making gold unaffordable for its own citizens while claiming the paper profits for itself.

This financial engineering occurs against the backdrop of Trump's failing "coercive diplomacy"—a term that increasingly seems like an oxymoron. Today marks his self-imposed deadline for Russia to cease fire or face secondary sanctions on oil purchasers. Yet the threatened nations barely stifle their yawns. India maintains its purchases of millions of barrels per day of Russian crude without breaking stride. China continues expanding energy cooperation with Moscow. Even smaller nations that once might have trembled at American displeasure now shrug and continue their business. The world has discovered that US ultimatums are written in disappearing ink.

The Ukraine situation exemplifies this impotence. Steve Witkoff's three-hour Moscow meeting yesterday did produce one concrete result: a scheduled Trump-Putin summit within days. Yet this "breakthrough" merely provides theatrical cover for battlefield realities that diplomatic ceremonies cannot alter. Russia's demands simply reflect evolving facts on the ground, not maximalist fantasies. Putin's conditions have expanded from enshrining protection of Russian speakers and culture in Ukraine's constitution—as existed in 2014—to claiming four Ukrainian oblasts precisely because Russian forces continue advancing while Western support wavers. Pokrovsk, Konstantinovka, and Kupyansk face imminent encirclement. These aren't negotiating positions; they're descriptions of what will exist regardless of what documents get signed. The summit will happen, photos will be taken, but the military situation continues its inexorable logic.

The pattern reveals itself clearly: Trump blusters his way into corners with unenforceable ultimatums, then must manufacture face-saving exits. He threatens tariffs he should know will backfire, sets deadlines he cannot enforce, and promises victories he cannot deliver. This isn't strategic misdirection but the predictable behavior of someone who mistakes shouting for strength, confusing threats with actual leverage. The world has learned to wait out these tantrums, understanding that today's red line becomes tomorrow's forgotten bluster.

India's response exemplifies how nations now navigate American threats—not through confrontation but through quiet alternatives. Modi schedules his first China visit in seven years, a remarkable thaw considering the hatred that festered after the 2020 Galwan clash that left soldiers dead on both sides. That these former enemies now coordinate against American pressure speaks volumes. India explores Russian Su-57 fighters while declining F-35 purchases, signing industrial cooperation agreements with Moscow on the very day Trump doubles tariffs.

Brazil's response to US pressure demonstrates how major economies can rapidly pivot away from American markets when faced with punitive tariffs. Following 50% tariffs imposed August 6, 2025 on Brazilian products worth billions annually, Agriculture Minister Carlos Fávaro immediately announced an aggressive diversification strategy targeting the Middle East, South Asia, and the Global South.

He puts it simply: they'll sell where they're treated better. China welcomes ~200 Brazilian coffee exporters just as US tariffs make Brazilian beans prohibitively expensive for American consumers. The result? US consumers will face higher prices due to reduced Brazilian supply, while Chinese consumers benefit from increased supply diverted from American markets.

These individual adjustments aggregate into systemic transformation. China's digital yuan processed $250 billion in transactions by June 2025—still a fraction of the dollar's $7.5 trillion daily forex volume, but growing exponentially while dollar usage stagnates. Russia and Iran conduct 96% of bilateral trade in local currencies. BRICS nations coordinate responses through direct leader-to-leader calls, building payment systems, development banks, and trade arrangements that bypass Western financial infrastructure entirely. They're not declaring war on the dollar; they're simply walking away from it.

Stephen Miran's Federal Reserve nomination yesterday signals monetary capitulation to fiscal reality. His advocacy for deliberate dollar devaluation while supporting tariffs that raise import prices creates a toxic combination: currency weakness plus inflation, the classic recipe for stagflation. The Fed finds itself trapped between tariff-driven price increases adding 0.2-0.3 percentage points to inflation and an economy weakening faster than anyone admits. Two governors already dissented for immediate rate cuts at the last meeting—the first multiple-governor dissent since 1993. The monetary authorities recognize what markets already know: they're out of good options.

The historical parallel isn't the Soviet collapse or even British imperial decline but the monetary chaos of the late Roman Empire, when debased currency drove commerce underground and authorities responded with increasingly draconian controls that accelerated the very flight they sought to prevent. Today's version unfolds at digital speed, with nations, corporations, and individuals simultaneously seeking alternatives to a system that penalizes participation while demanding loyalty.

Much like a river doesn't resist rocks, the global economy increasingly redistributes itself away from American obstacles. Every tariff creates new trade routes. Every sanction spawns alternative payment methods. Every ultimatum that goes unenforced teaches the world that American threats are theater, not policy. The tragedy isn't that America lacks power but that it squanders what remains through self-defeating applications that accelerate its own irrelevance.

Today's deadline will pass like all the others—with great fanfare about strength and resolve, followed by quiet retreat disguised as strategic patience. Trump needs dramatic gestures to avoid the "TACO" label (Trump Always Chickens Out), but markets and nations increasingly see through the performance. They're not organizing resistance; they're simply conducting business elsewhere, with partners who offer stability rather than ultimatums, cooperation rather than coercion, and currencies that maintain value rather than racing toward debasement.

The August 8 convergence—sanction deadlines, gold market destruction, Fed capitulation, Treasury auction stress, accelerating dedollarization—represents not coordination but correlation, multiple symptoms of the same underlying disease. The empire doesn't fall through conquest but through exhaustion, not through rebellion but through abandonment. The fiat house burns while its owners nail boards over the gold windows, apparently believing they can lock everyone inside. But capital, like water, always finds a way out, and increasingly, it's finding that way leads east, south, anywhere but toward a dollar that serves as both unit of account and weapon of control.

The great irony is that America still possesses tremendous advantages—innovative capacity, rule of law, deep capital markets—but systematically undermines them through policies that prioritize short-term political theater over long-term strategic coherence. Every nation that finds alternative suppliers, every transaction that bypasses SWIFT, every central bank that accumulates gold rather than Treasuries represents a vote of no confidence that aggregates into an avalanche.

The avalanche has already started.

Are you prepared?

Another potential leak for the Dollar, now that Van der Lying caved completely, there is no reason for European countries to keep binging on Treasuries. No need to pressure Trump after caving and the investment is problematic at best. All the increase in US debt in at least 2 years came out of Europe and British dependencies. Who is going to buy more, the Martians?