The line in the sand: $54

Defend it or die trying!

Silver touched $54 twice in 2025. Got slammed both times. Now it’s back, testing that exact same resistance for the third time this week. This isn’t coincidence. This is WAR.

The paper market kept functioning because enough inventory existed to meet marginal demand. But watch what happens at price resistance. Silver touched $54.47 on October 17. Got slammed. Climbed back, approached $54 again. Got slammed harder.

This isn’t profit-taking. It’s defense.

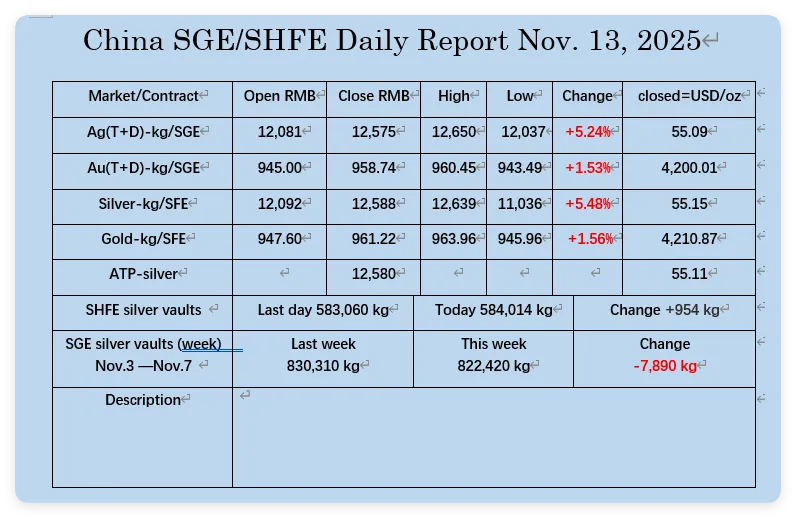

4 weeks later: we’re back at $54. China already passed it:

The bullion banks holding massive short positions aren’t just defending a price level. They’re defending their survival.

As such, I’m expecting a huge take-down today or tomorrow as they can’t let the price close above that level on the weekly timeframe. That would invoke technical trades to pile into this trade.

But any drop in price is continuously bought. Maybe not in paper markets, but in physicals for sure. And that’s what matters now: physical.

Ed Steer estimates that commercial shorts are at ~341 million ounces on COMEX, with another 5-8 billion ounces of exposure in London’s opaque physical market. That’s 6-10 years of global mine production sold short. In the past, JPMorgan already paid $920 million in fines for precious metals manipulation. Deutsche Bank provided smoking gun evidence of rigging from 2007-2013. Multiple traders convicted of spoofing.

They’ve been caught. They’ve been fined. They’re still doing it. Why? Because stopping means bankruptcy. Not bankruptcy like “we had a bad quarter.” Bankruptier. More bankrupt than bankrupt.

The kind where five U.S. banks lose $151 million for every $1 silver rises, with unrealized losses already exceeding $30 billion. That’s Bear Stearns territory, and Bear Stearns collapsed over $2 billion.

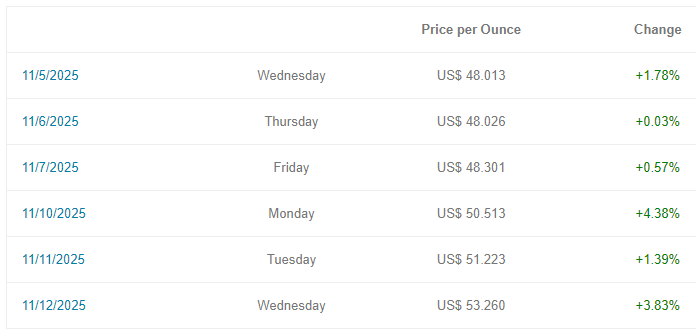

Silver climbed 11% in seven days, from $48 on November 5 to $54 on November 13. Several incredible dramatic single-day moves saw silver gain $1+ per day. This is the kind of precious metals surge that accompanies genuine stress in the financial system. Year-to-date, silver has gained 75-80%, making it the best-performing major commodity of 2025.

But $54 still holds. For now. The moment silver decisively breaks and holds above $54.50, the entire game changes. Because that 45-year resistance level isn’t just psychological anymore. It’s existential.

The physical market is screaming shortage.

See my previous articles for more context. Not going to repeat this here again.

The shorts can’t cover. The float—actual deliverable silver not locked in ETFs—is maybe 293 million ounces against daily London trading volumes of 214 million ounces. That’s one day of trading. One. Standing claims hit 3.86 billion ounces against 844 million ounces of physical inventory. The entire system runs on the assumption that nobody actually wants delivery. The moment that assumption breaks, the whole structure collapses.

You remember the air-shipping silver from COMEX → LBMA? When was the last time anyone air-freighted silver? You don’t. It’s too heavy, too cheap per ounce. But they’re doing it now because London’s cupboards are bare and the alternative is failed delivery.

Silver exiting the theater to the left, entering right is: <drumroll> BTC

Bitcoin is sitting at $102k, hovering just above the psychologically critical $100k level. Technical analysts are pointing to a symmetrical triangle pattern with support at $101k and resistance at $104k. A break below $100k “might revive talk of an extended crypto winter phase,” according to market trackers. And crypto winter doesn’t stay contained anymore.

MicroStrategy’s premium to net asset value—the metric that made the entire leveraged Bitcoin play work—has collapsed. The mNAV is basically at 1x, and if Bitcoin breaks $100k to the downside, MSTR breaks below 1x.

Or is it the opposite? Tail wagging the dog or vice versa, you know?

Why does this matter? If Bitcoin tests $95-97k support, MSTR’s premium doesn’t just compress further. It inverts completely.

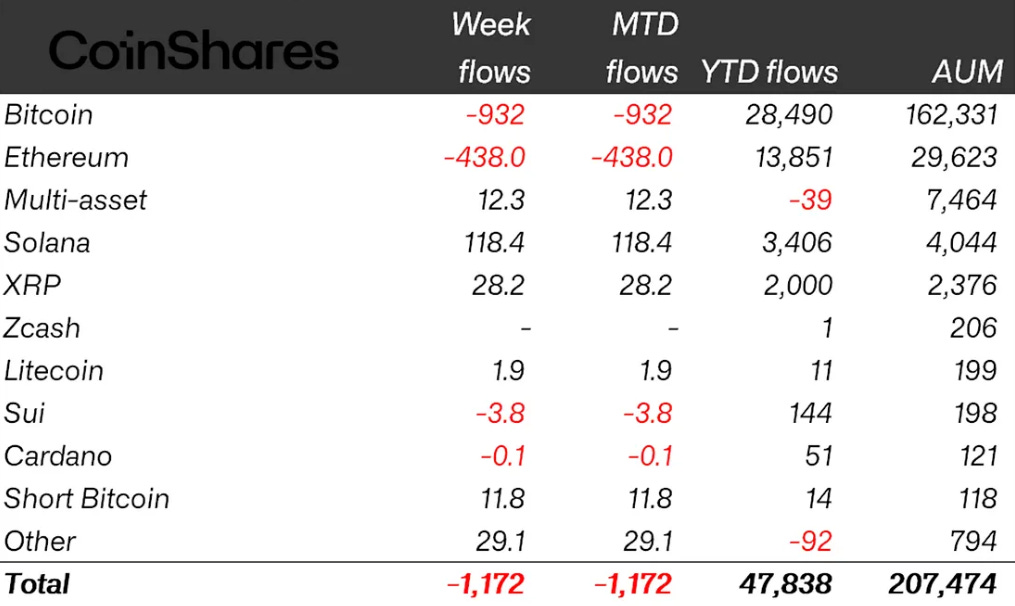

The crypto market has seen $661 million in net ETF outflows in November, a sharp contrast to the $3.5+ billion monthly inflows seen in September and October. Long-term Bitcoin holders distributed 104,000 BTC in November—the heaviest wave since July. $100k was supposed to be the floor.

A crypto winter triggered by Bitcoin breaking $100k and MSTR’s premium collapsing doesn’t just hurt crypto bros. It drags the entire financial system with it because of where the money came from. Remember, the whole AI boom, the whole “this time is different” narrative, was funded on the premise that these technologies would generate returns justifying their valuations. MicroStrategy became a proxy for that belief—leveraging up to buy an asset with no cash flows, selling that exposure at massive premiums to investors who believed the story.

When MSTR’s premium inverts, people start asking questions. Not just about Bitcoin, but about all the other unenforceable promises made during this cycle. Like the AI companies burning billions claiming they’ll eventually monetize models that currently cost more to run than they generate in revenue. Or the venture-backed startups promising revolutionary breakthroughs that never quite materialize. The whole structure depends on confidence that future returns will justify present valuations.

Silver at $54 and Bitcoin at $100k are both testing the same fundamental question: what happens when paper claims exceed physical reality? In silver, it’s literal—paper contracts for metal that doesn’t exist in deliverable form. In Bitcoin, it’s metaphorical—financial engineering creating synthetic exposure that trades at premiums to the underlying asset.

Both can hold as long as nobody demands delivery. The moment someone does, the façade cracks.

Shanghai’s silver market is already showing signs of decoupling from Western paper prices, with Asian physical markets trading at $4-8 premiums during stress periods. Chinese silver prices rose more sharply than London or New York prices throughout 2024, with Shanghai increasingly leading rather than following Western price discovery. When you can’t get physical delivery in London but can in Shanghai, which price is real?

Ed Steer warned that banks will be forced to shut down COMEX and LBMA. Hyperbole? I don’t think so, but it is a nuclear option—close the markets, settle in cash, destroy confidence in paper pricing, and watch price discovery shift to Shanghai where physical settlement is standard.

The alternative is bankruptcy. Not for one bank, but systemically, across the institutions that have built massive short positions assuming they’d never have to deliver.

The Fed’s balance sheet contraction, SOFR collapse to 3.92% (lowest in two years), and persistent inflation data all point to a liquidity environment that can’t support both the paper silver market’s leverage and crypto’s valuation multiples for much longer. Something has to give.

Maybe silver breaks to the upside first, triggering bank failures that cascade into crypto. Maybe Bitcoin breaks to the downside first, triggering risk-off moves that let everyone scramble for cash?

Either way, the pretense that infinite paper claims can substitute for finite physical assets is ending.

You’re watching the moment where decades of financial engineering meets reality.

Where promises written on contracts face the simple question: can you actually deliver?

After market opening:

Spot where COMEX opened 🤣.

At this point it’s just getting ridiculous.

Keep writing. This is great !

What shows up for me right now is that in the event of a Bear Stearns-style failure, there is so much potential contagion and rehypothecation, in the midst of so many asset bubbles it's more like asset froth, that the result is financially uncontainable this time. Like trying to stop a nuclear explosion in a safe.