Something moved yesterday.

Several somethings, actually.

Yesterday was a busy day for silver. Not in the “silver rallied to new highs” sense - it didn’t, it got pushed lower. But underneath the surface, in the plumbing nobody talks about, several things happened simultaneously that probably aren’t coincidence. I’m going to walk through them one by one and let you draw your own conclusions.

Part 1: about IV and windows

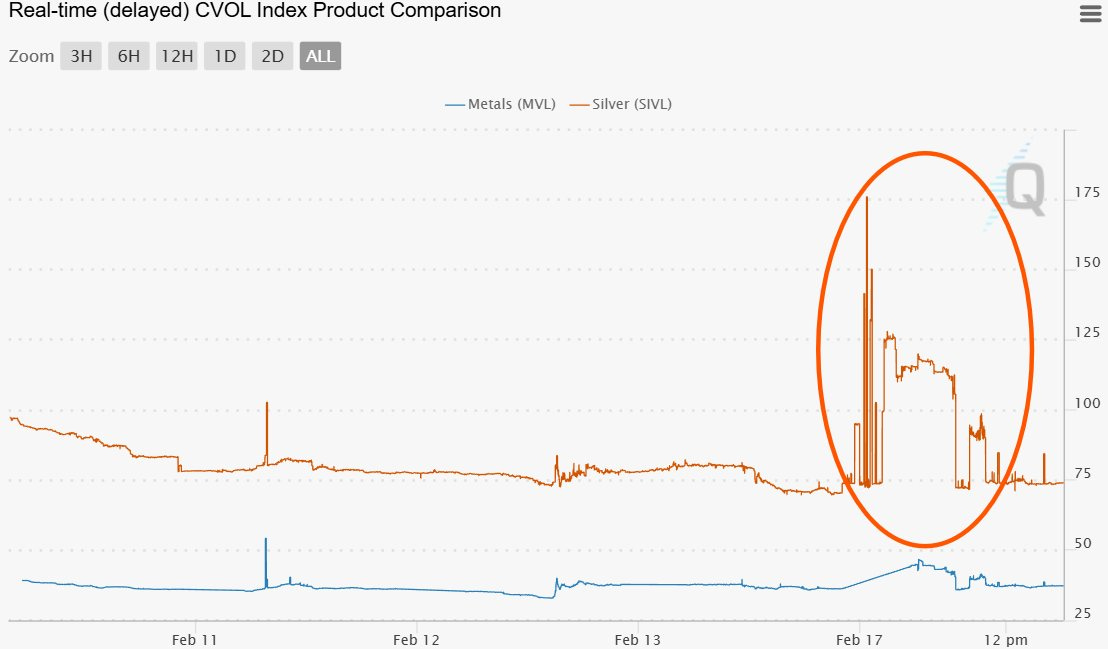

Silver’s implied volatility index - SIVL on the CVOL - spent most of the last six weeks doing nothing interesting. Grinding sideways around 75-80, occasionally spiking, mostly flat. Then yesterday happened.

The spike you see in that chart isn’t a glitch. Silver IV shot above 175, smashing through the January 30th peak that was itself a multi-year extreme. And it stayed elevated for hours. Not a brief flash - a sustained, hours-long eruption of options market activity as someone, or several someones, bought a truckload of out-of-the-money calls while the paper price was simultaneously getting walked lower.

Think about that for a second. The spot price falls. And someone buys massive amounts of upside options. That’s not hedging. That’s positioning for something.

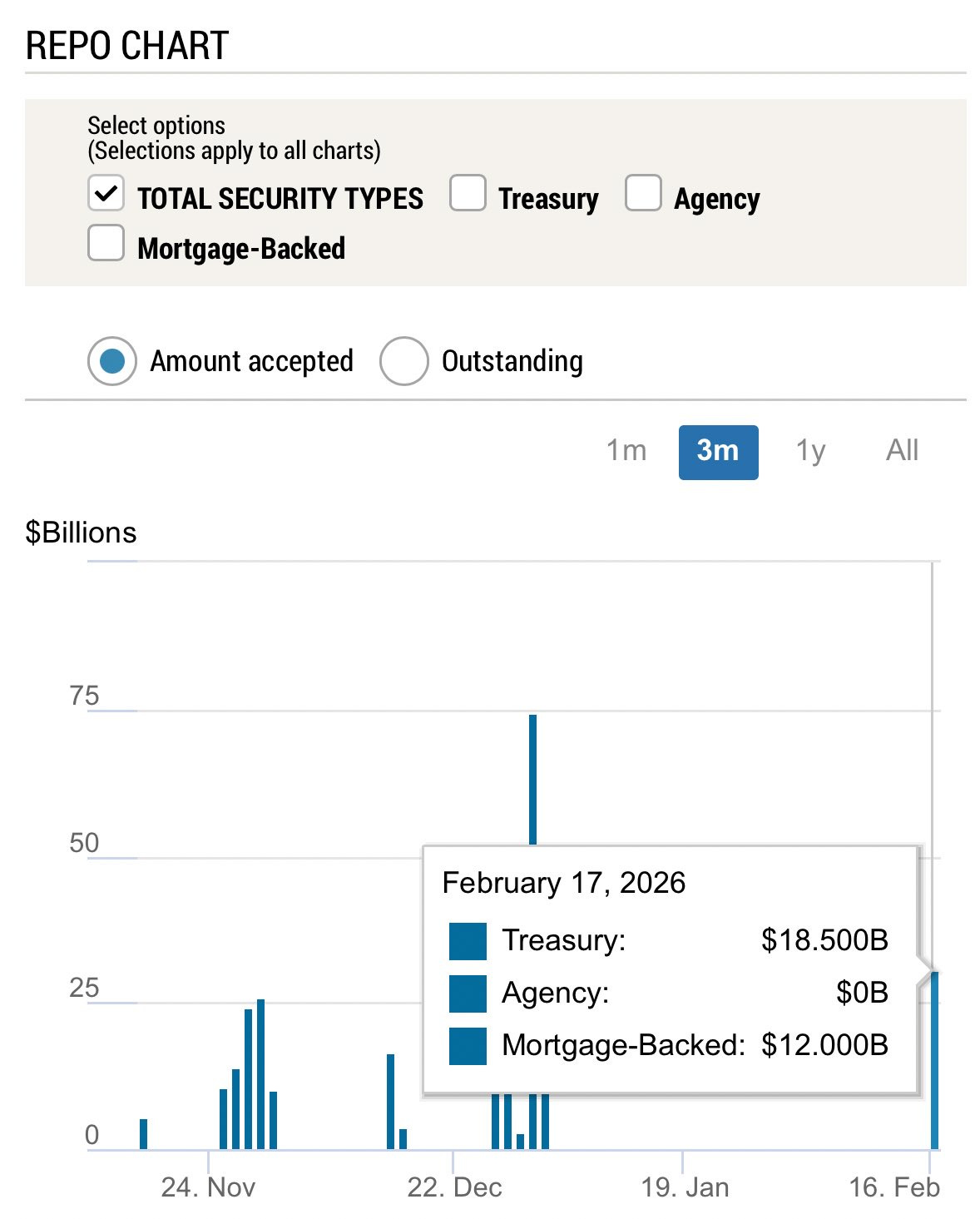

On the exact same day, banks borrowed roughly $30 billion from the Federal Reserve’s standing repo facility. $18.5 billion in Treasuries and $12 billion in mortgage-backed securities. The single largest repo operation in months - dwarfing every other bar on that three-month chart by a factor of two or three.

Are the two connected? I genuinely don’t know. Could be pure coincidence. Two separate things happening to share a Tuesday.

But I find it hard to believe that the same afternoon banks scramble for $30 billion in emergency overnight liquidity is also the afternoon silver options go completely vertical - six weeks of calm, then simultaneous fireworks in two markets that have nothing ostensibly to do with each other. Funding stress tends to precede price moves. That’s not a controversial observation. When banks need liquidity that badly, it’s usually because something in their book is moving against them.

I’ll leave the rest to your interpretation.

Part 2: vaulting

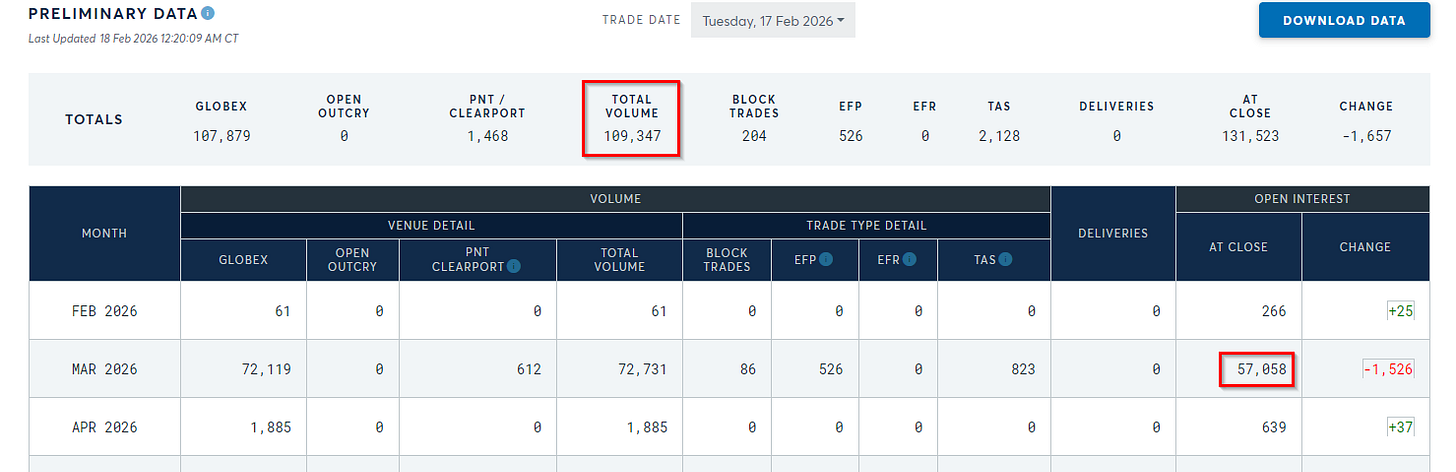

Tuesday’s COMEX data landed this morning and the numbers haven’t gotten less alarming since last time I looked.

First, the weekly vault drain: like already reported, current COMEX vaults contains around 92Moz registered - the silver that can actually be used to settle futures contracts - and around 280Moz eligible.

Now look at the open interest table for March 2026. The March contract is the benchmark, and it’s the one settling in about 10 days. Open interest currently stands at approximately 285 million ounce-equivalent. That’s 285 million ounces of paper silver that will need to roll, cash-settle, or deliver against 92 million ounces of registered metal.

The math still doesn’t work. It never did. The question - as always - is which contracts cave and roll rather than stand for delivery.

What changed in Tuesday’s session: total OI dropped ~1,600 contracts, with March specifically shedding ~1,500. People are rolling. Whether enough people will roll is the thing we’ll find out over the next ten days.

Part 3: Hecla’s Q4 ‘25 & 2025 report

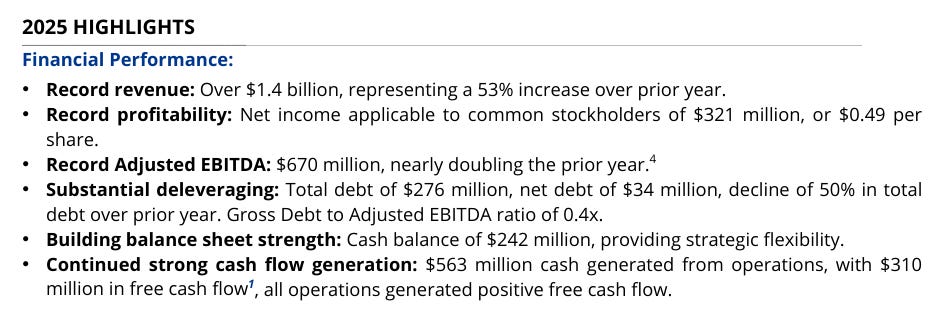

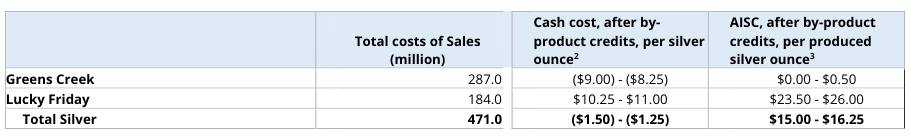

The headline numbers are genuinely extraordinary and deserve a moment before we get into the interesting part. Full-year 2025: revenue exceeding $1.4 billion (up 53%), net income of $321 million (nine times last year’s figure), $563 million in operating cash flow, $310 million in free cash flow. Debt cut in half to $276 million, net leverage collapsed from 1.6x to 0.1x.

Lucky Friday set production records. Keno Hill had its first profitable year under Hecla ownership. Every single mine was cash-flow positive. The stock is up roughly 300% since the start of 2025.

“Good” year.

Now the interesting part.

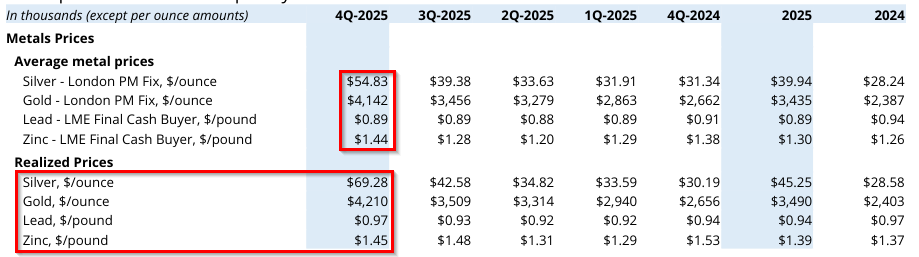

Hecla reported an average realized silver price in Q4 2025 of $69.28 per ounce. The fourth quarter COMEX average was somewhere in the $55-60 range - silver opened October at $47, spent November in the $48-57 band, and only broke decisively higher in late December. A rough average across those three months puts the benchmark around $56.

Hecla realized $69.28. That’s roughly $13 above the quarterly average spot price. A 23% premium.

The company’s own report notes the outperformance came from “timing of sales in a rising price environment”. Which is partially true - if you sold more in December than October, you’d beat the quarter’s average. But that explanation only goes so far. A 23% gap above the quarterly COMEX average isn’t just savvy timing. That’s a structural divergence.

The COMEX price is increasingly a fiction that miners no longer need to accept. When physical supply is tight and industrial buyers are competing hard for actual deliverable metal, the people with the silver can charge what the market will actually bear. Not what a derivatives exchange in Chicago says it’s worth at 3am.

Hecla isn’t a charity. They sold 17 million ounces last year at prices that made their income statement look like a typo. The average price they realized across all of 2025 was somewhere well north of the annual average COMEX print too, because they have leverage here that they didn’t have three years ago.

The irony is delicious. The same paper market that spent years suppressing silver prices to whatever level the big short positions needed has become so disconnected from physical reality that the miners are now quietly pricing around it. Nobody announced this. No press conference. Hecla just... sold their silver for what it was actually worth.

And the Q4 realized price was $69.28 while the paper tape said $56.

The benchmark is losing the room.

I love the smell of burning contracts in the morning.

No honest money = No honest government