Silver's unprecedented deficit

And it's only increasing

The silver market is witnessing something unprecedented: central banks are returning to a metal they abandoned half a century ago, just as supply fundamentals reach a breaking point. Add to this already explosive mix the positioning in the futures market and we could be looking at the conditions for the largest breakout in over a decade that could reshape global pricing dynamics.

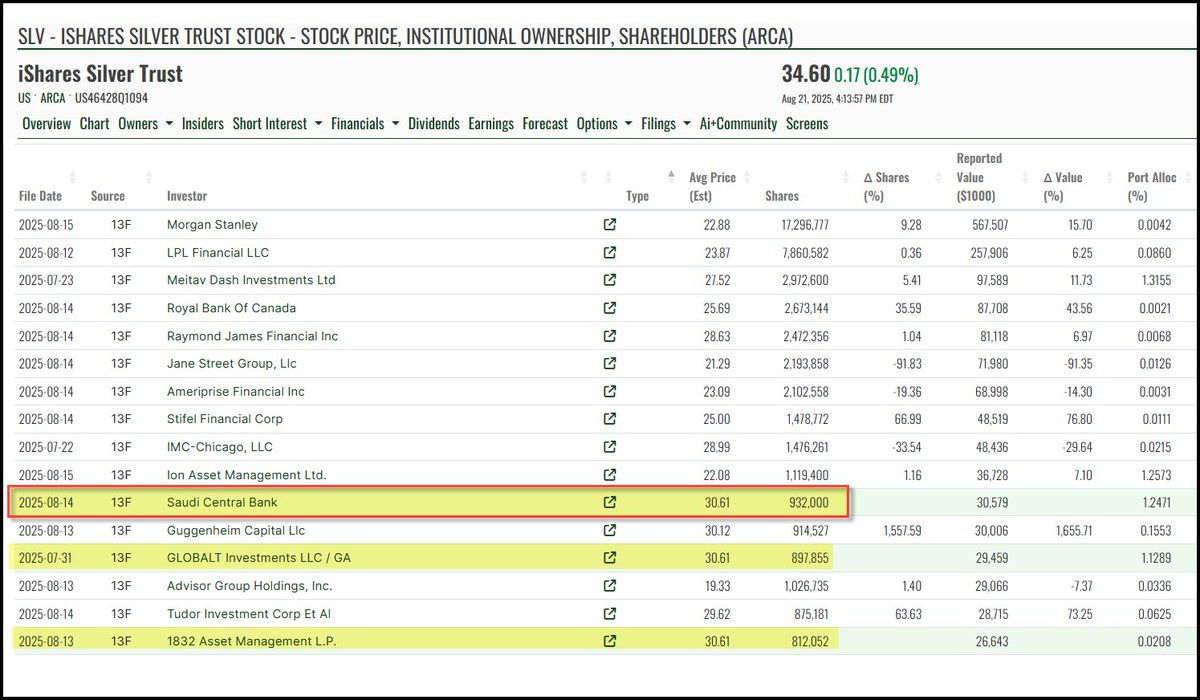

Russia broke the central banking taboo first. In September 2024, the Russian government revealed plans to spend 51 billion rubles ($535 million) over three years to acquire silver for state reserves—the first explicit central bank silver purchase program in decades. Eight months later, Saudi Arabia's central bank followed with significant SLV ETF acquisitions, marking the emergence of institutional silver demand from the world's most conservative investors.

The contrast with gold buying reveals the magnitude of this shift. Central banks purchased a staggering 1,086 tonnes of gold in 2024, continuing a 15-year buying spree with annual purchases exceeding 1,000 tonnes for three consecutive years. Against this $80+ billion annual gold accumulation, Russia's $535 million silver allocation seems modest—until you grasp the supply dynamics that make even small institutional purchases potentially explosive.

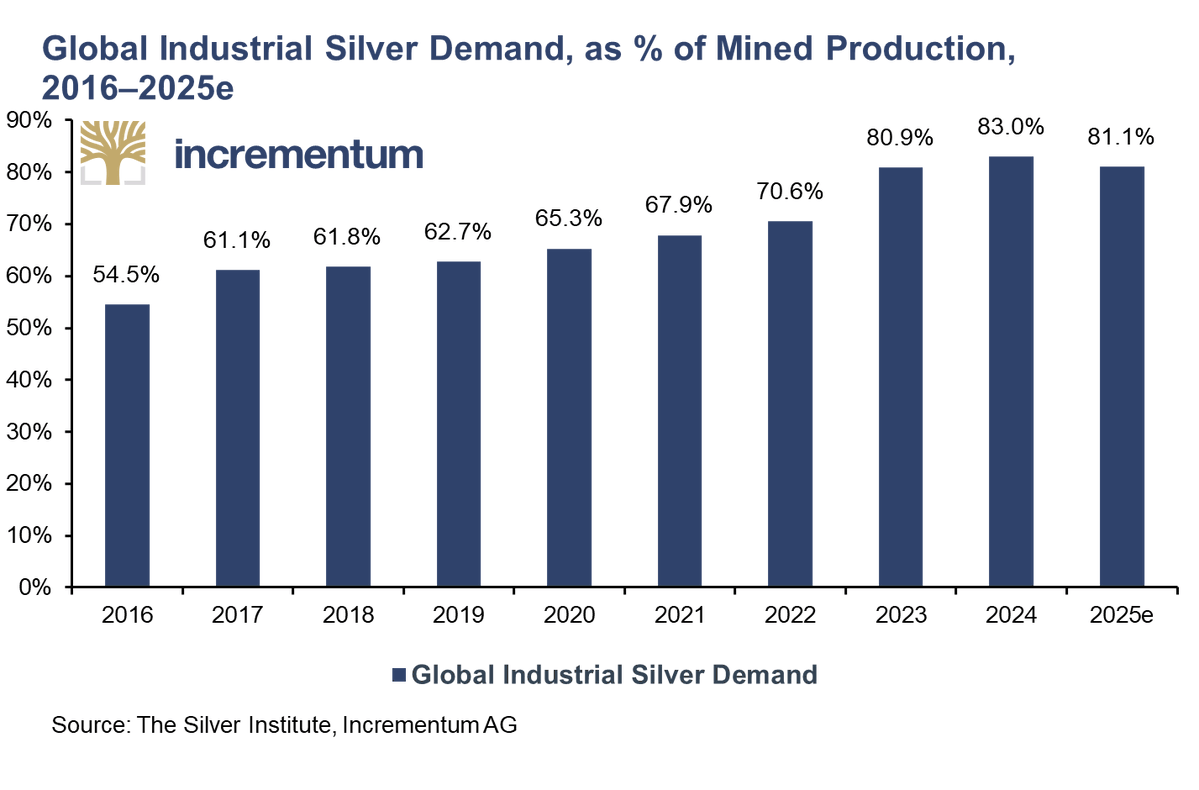

The numbers tell a story of structural transformation. Industrial demand has surged from 54.5% of mined supply in 2016 to a projected 81% in 2025, fundamentally rewiring silver's economic purpose. Solar panels alone consumed 197.6 million ounces in 2024, while the automotive sector uses 80-90 million ounces annually with electric vehicles requiring twice the silver content of traditional cars. The AI revolution adds another demand layer as semiconductors, data centers, and computing infrastructure all require silver-intensive technologies.

Supply cannot respond. Only 28% of silver comes from primary mines, with 72% emerging as a byproduct from copper, lead, zinc, and gold operations. Global mines are projected to yield 835 million ounces in 2025—a 7% decline from 2016 levels despite soaring demand. Combined deficits from 2021-2024 have reached 678 million ounces, equivalent to erasing ten months of annual production from global stockpiles.

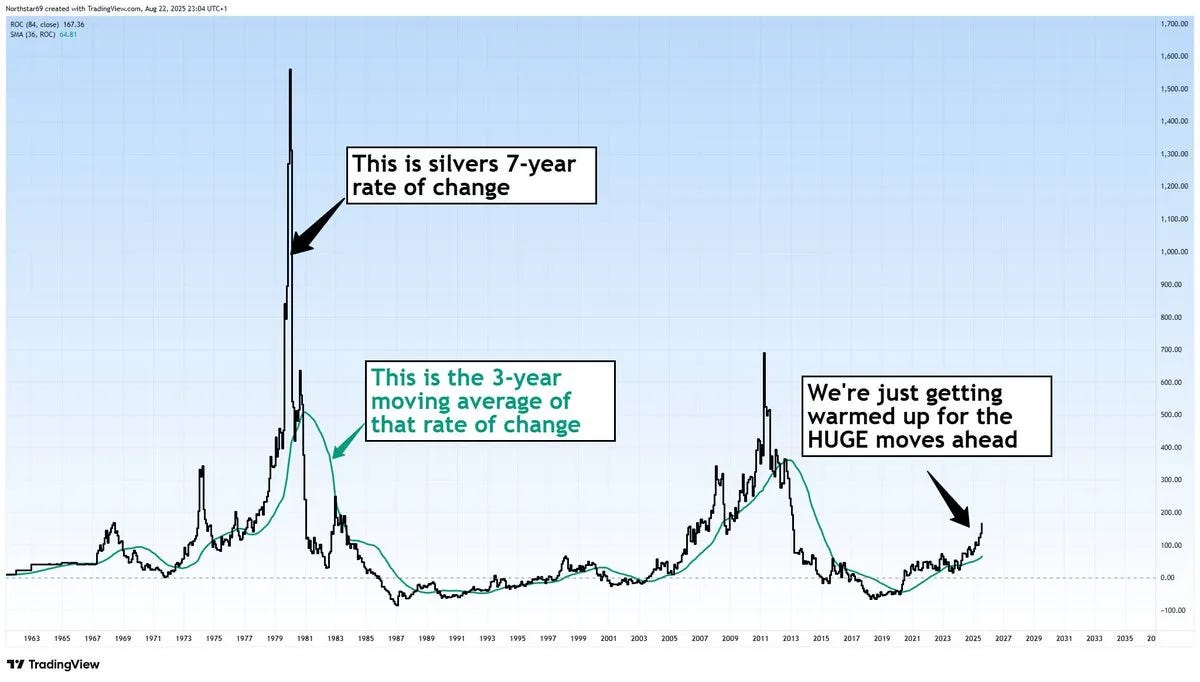

But it's the futures market positioning that suggests central banks may be positioning ahead of an imminent price explosion. As of August 19, 2025, CFTC data reveals swap dealers maintaining a staggering 70,941 short contracts—representing over 194 million ounces of silver. This commercial short position has reached what McClellan Financial describes as "8-year highs not seen since 2020," when silver subsequently rallied from $12 to over $30.

The positioning mirrors the most bullish setups in silver's modern history. Managed money holds a relatively modest net long position of just 28,046 contracts, far below the historical extremes that typically precede major corrections. When commercial shorts reached similar levels in 2020, the resulting squeeze drove silver prices up 150% within months. Current positioning exceeds those historical thresholds, occurring within a market facing its fifth consecutive year of supply deficits.

Professional analysis reveals the explosive potential of this setup. David Jensen at MiningIR estimates bullion banks face a 5-8 billion ounce short position in London physical silver markets, forcing them to accept COMEX losses to prevent potentially existential losses in physical markets. Every $1 increase in silver prices generates approximately $200 million in losses for commercial shorts—creating powerful incentives to cap prices that become increasingly expensive to maintain.

The next five years present particularly volatile scenarios for both supply and positioning dynamics. An economic downturn could trigger supply constraints as base metal mining slows while simultaneously creating safe-haven demand for precious metals—compressing supply just as investors seek alternatives to volatile equity markets. This dual pressure on a market already in its fifth consecutive year of deficits, combined with massive commercial short exposure, could create pricing shocks that dwarf historical precedents.

Major financial institutions recognize the setup's potential. JPMorgan Research targets $38+ per ounce by late 2025, while more aggressive analysis from InvestingHaven projects $50 in 2025 and $88 before 2028. First Majestic CEO Keith Neumeyer projects long-term targets exceeding $100 per ounce, arguing that supply deficits require "triple digit silver just to motivate mining companies to start investing again."

Central banks appear to be positioning ahead of this potential repricing. Russia's move could catalyze similar programs among BRICS nations and other central banks seeking dollar alternatives, particularly given silver's relatively small market size compared to gold. When institutions managing trillions in reserves begin allocating even modest percentages to silver, the impact on a market with extreme commercial short positioning could be exponential rather than linear.

The technical patterns reinforce the fundamental thesis. Silver exhibits strong bullish signals across multiple timeframes, having broken above critical $35 resistance levels with cup-and-handle pattern confirmation. Key resistance sits at $38.8-$39.6 immediately, with channel targets at $40.5-$42+. The alignment of bullish technical patterns with extreme bearish commercial positioning creates what analysts call a rare "double confirmation" setup that has historically preceded the largest commodity moves.

Current market structure shows reduced silver futures liquidity during typical seasonal patterns, while institutional positioning has surged 163% over six months. Silver ETP holdings reached 1.13 billion ounces by June 2025, with 95 million ounces of inflows in the first half alone—already exceeding full-year 2024 investment demand. When combined with declining COMEX inventories and persistent industrial demand growth, the available pool of tradeable silver continues shrinking while speculative and investment interest accelerates.

What's unfolding represents more than supply-demand rebalancing or technical breakouts. Central banks abandoned silver in the 1870s when the world moved off the silver standard. Their return now, amid the largest structural deficits in modern history and extreme futures positioning, signals recognition that silver has become too strategically important to ignore—regardless of its monetary past. With current silver prices around $39 per ounce trading near 8-year commercial short extremes, the convergence of institutional buying, structural deficits, and positioning dynamics suggests a fundamental repricing may be not just inevitable, but imminent.

Excellent analysis my friend.

By the way,.whats the dealerd discount in your area? In my country, the biggest dealer is taking 15% of spot for metals rebuy, which I consider abusive.