Silver post-mortem

Poking at the "left-for-dead"-market

Multiple subscribers asked me to write my take on yesterday’s slamdown. I wasn’t really planning to write anything about it, but hey look, this is silver we’re talking about - price manipulation on days ending in Y is the business model.

But even by silver market standards, yesterday was impressively stupid. Torching billions in margin calls between Christmas and New Year’s - the most illiquid week of the year - 72 hours before China locks down 70% of refined silver supply? You couldn’t wait until January?

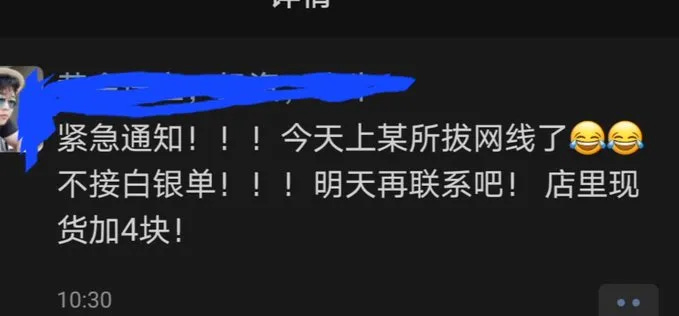

Then the Shanghai Gold Exchange stopped taking orders. Yesterday morning, Chinese silver dealers woke up to this message: “Emergency notice! Today SGE network down, not accepting silver orders! Contact again tomorrow! Store spot price plus 4 yuan!”

Oh, the network just happened to go down. On the same day silver crashes 15%. What are the odds? Must be cosmic coincidence. Definitely not related to the largest physical silver marketplace on Earth realizing they literally cannot source enough metal to fulfill orders.

KingKong9988 on Twitter had the most succinct take: “This is a sign of technical default by LBMA sell-side members”. ICBC is both a LBMA member and a clearing member of the London Precious Metals Clearing Limited. The LBMA sell-side members are probably unable to fulfill their bilateral contract physical silver delivery obligations.

But sure. Network issues. That’ll cool things down. CME knows all about cooling issues.

While everyone’s watching the CME jacking up margins to kill the paper rally, the physical market is disintegrating in real time. And apparently the plan is to just... not talk about it? Close the exchange? Blame IT?

The official story and reality stopped resembling each other about 48 hours ago…

Silver hit $84 Monday morning. By afternoon it was $70. The biggest single-day crash since 2020.

Perfectly normal market behavior. Nothing suspicious about losing 15% in hours during a holiday week when volume is thinner than a Fortune 500 CEO’s connection to reality.

The CME raised initial margins to $25,000 per contract on December 29 - a 13.6% increase that followed another 10% hike two weeks earlier. Shanghai followed with their own margin increases, bumping requirements from 16% to 17% across multiple contracts.

The official line? Risk management. Market volatility. Protecting investors.

Right. Protecting investors by forcing them to liquidate positions at the worst possible moment. Classic protection racket stuff. “Nice silver position you got there. Shame if something happened to it. Now give us another $5,000 per contract or we’ll margin call you into oblivion.”

They’re running the 1980 playbook. When the Hunt Brothers tried cornering silver, the COMEX introduced “Silver Rule 7” and crushed the rally. When silver hit $50 in 2011, the CME raised margins five times in nine days. Prices collapsed 30%.

Same movie. Different decade. At least try to change the script!

But there’s a problem with that comparison - and it’s a problem they really, really, really don’t want you thinking about.

The Hunt Brothers were two guys with too much money and too little sense. 2011 was a speculative frenzy fueled by retail FOMO and QE paranoia.

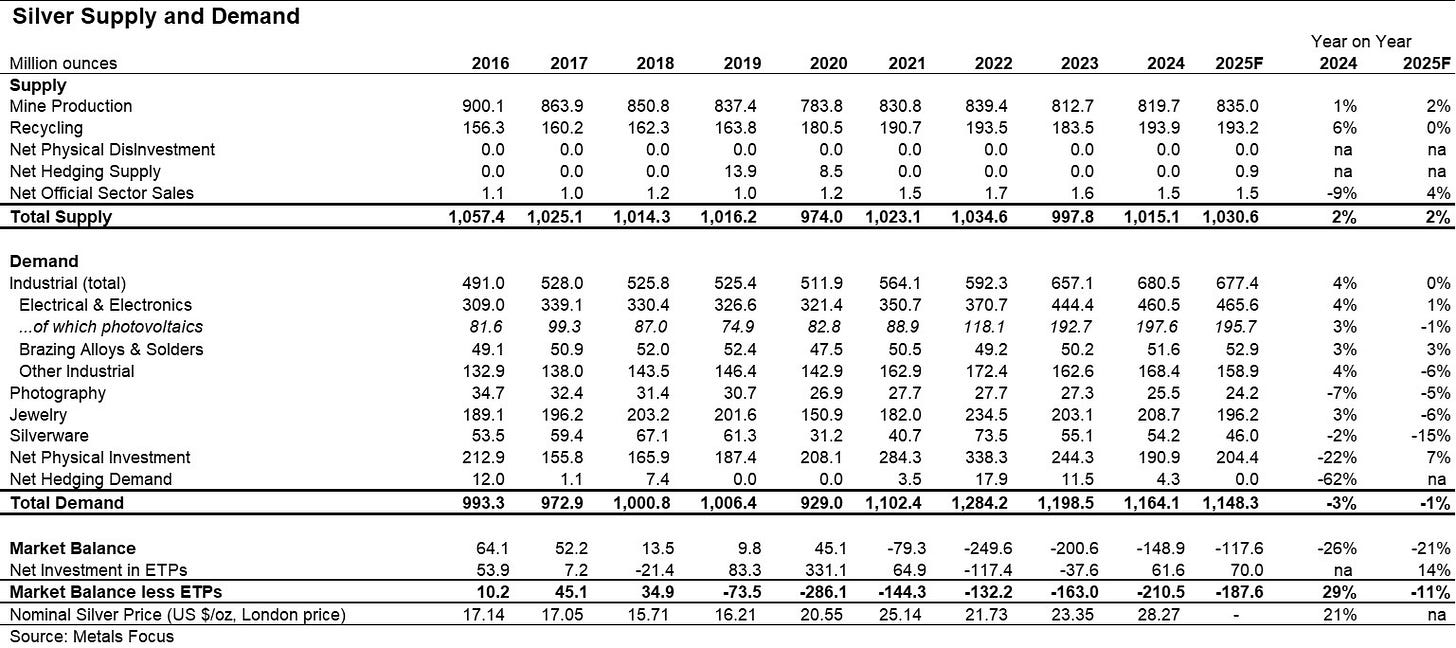

2025 is different. This time it’s industrial buyers scrambling for metal they can’t replace. Solar manufacturers burning through 232 million ounces annually. EV producers consuming 10 times more silver per vehicle than traditional cars. AI data centers requiring silver-lined components that can’t be substituted.

So the brilliant plan is to... raise margins? On industrial buyers who need the metal regardless of price? That’ll stop ‘em?

You can’t print silver. You can’t code it. You can’t quantitatively ease it into existence. You can crash paper prices all you want - the metal still doesn’t exist.

And China just announced they’re cutting off the tap.

Timing. Impeccable.

Starting January 1, 2026 - that’s in two days - China implements export licensing for silver. Only companies producing at least 80 tons annually get approval. Read: state-owned enterprises answerable to Beijing. Everyone else is locked out.

China controls 60-70% of global refined silver supply.

Yup. Not 10%. Not 30%. Sixty to seventy percent.

But I’m certain the CME thought about that before deciding to crash paper prices right before the world’s largest silver supplier turns off the spigot. Strategic thinking at its finest.

Think about what that means. Mexico might mine the most silver, but Chinese refineries process it. When you want silver bars, China makes them. When you need 1000oz good delivery bars for industrial use, China refines them. When you need literally anything involving refined silver, China is in the middle of that supply chain.

In October, China exported a record 660 tons of silver. Why? LBMA couldn’t deliver what it owed. So China loaned them the metal to cover. That was the front-loading - temporarily bailing out LBMA’s delivery failure before the export controls kicked in.

Now the door is slamming shut.

And whispers through the market suggest ICBC - the same bank that shipped approximately 400 tons to LBMA in October and leased them to JPMorgan during the chaos - is preparing to repatriate that supply back to China at the beginning of January.

Let me say that clearer: the metal that temporarily relieved Western shortages might be going home. The borrowed metal that let JPMorgan pretend everything was fine? Yeah, that one.

Of course, keep raising margins. That’ll definitely solve the problem. Can’t possibly backfire.

Silver at $74 in London. Margin calls forcing liquidations. Hedge funds scrambling. Leverage getting wiped out. Bloomberg writing articles about “volatility” and “profit-taking”. Mission accomplished.

Contrast that to physical (buckle up).

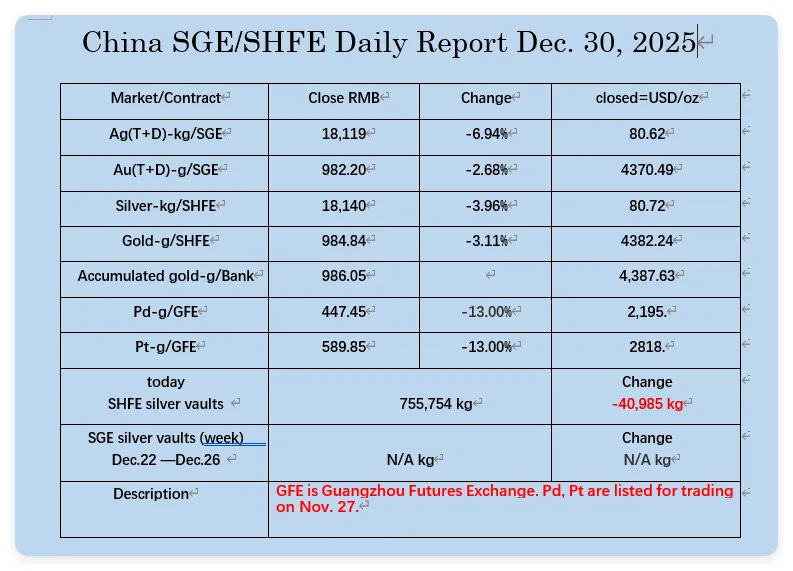

Shanghai closed at $80.62. That’s a $6+ premium to LBMA. Before the weekend it was $8. But I’m sure that’s just... inefficiency? Arbitrage opportunity? Definitely not two completely different markets pricing completely different assets. No sir.

Korea? $100+ per ounce on secondary market for 1kg bars. Because nothing says “efficient price discovery” like 35% premiums.

Mumbai? $85-93 per ounce depending on who you ask. You know, normal stuff.

Hong Kong? Everything’s sold out. LPM, Kitco, San Gold - empty shelves. What’s available carries 12% premiums. Resupply time? One week to one month. Super liquid market. Very efficient.

China? No delivery before Chinese New Year. 15kg bar orders at 2-3% premium minimum. Shops in Shuibei are literally buying old silver jewelry from customers. When retail shops start melting grandma’s tea set, that’s definitely a sign of abundant supply.

Taiwan? Pre-order only, $83 per ounce for 50oz bars. Just like Amazon Prime but with a two-month wait.

Vietnam? Stores out of stock. Only available OTC at inflated prices. Free market working exactly as intended.

Singapore? A few bars at 7-9 dollar premiums depending on size. Pre-orders can’t be delivered before February 6. But paper silver is available instantly at $74. Funny how that works.

Institutional commodity trader based in Singapore? OTC orders at ~$90, bulk at ~$95. Orders only accepted on a “best execution basis”. Which is trader-speak for “we’ll take your order but good luck actually getting delivery”.

UK? 1kg bars at $102 including VAT. Everything else showing “email when in stock”. So you can’t buy it, but you can register your interest in maybe buying it someday. Delightful.

Nashville? Dealer completely sold out - bars, coins, junk silver, everything. But hey, at least you can still buy paper silver at $74.

Seattle? Shops wiped out over the weekend. Nothing like a flash crash to trigger a buying frenzy.

Australia? Two-hour queues at bullion dealers. Perth Mint has backorders. Maximum purchase now around 2oz before you’re waiting. Just your standard supply-demand situation. Totally normal.

You notice a pattern? Physical silver isn’t trading at $74. It’s trading at $80-100 depending on form and location. The premium varies but the shortage doesn’t.

But according to the paper market, there’s no shortage. Just raised margins for risk management. Nothing to worry about. Please disperse. Certainly don’t go trying to take delivery or anything crazy like that.

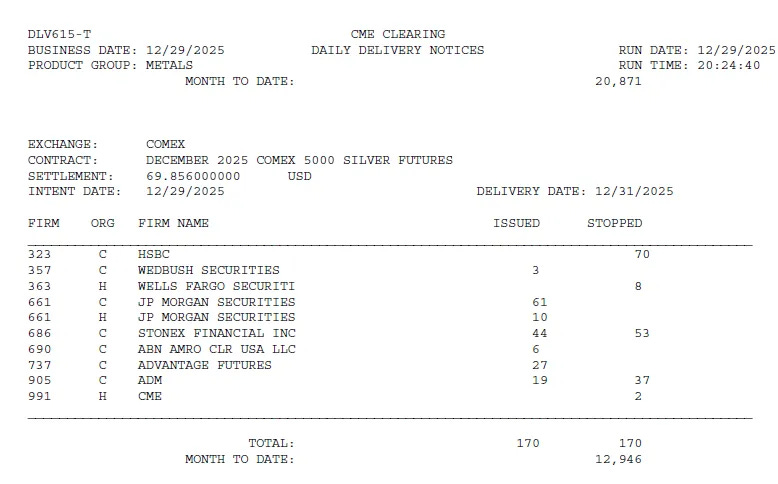

Meanwhile, back in the paper casino, 12,946 December silver futures contracts issued delivery notices at COMEX. That’s approximately 65 million ounces - about 10% of annual supply - settling in a single month.

All accepted. All delivered.

Until the last day of trading. When coincidentally the Shanghai exchange’s network went down. And coincidentally Korea is quoting $100. And coincidentally everything is sold out everywhere. But I’m sure these events are completely unrelated.

The Shanghai vaults showed a withdrawal of 40,985 kg yesterday. COMEX inventories dropped from 290 million ounces at the start of 2024 to below 210 million by October. LBMA holdings available for delivery effectively zero.

Someone is taking delivery. Someone is draining the vaults. Someone isn’t playing the paper game anymore.

And the response is to... raise margins? Force liquidations? Crash paper prices?

OK. Let’s do some basic math. The kind that apparently nobody at the CME bothered with.

Bank of America is reportedly short 1 billion ounces. Citigroup is short 3.4 billion ounces. World annual production? 800 million ounces.

So BofA is short more than a year of global production. Citi is short over four years of global production. Combined, they’re short enough silver to supply the entire world for five and a half years.

And the plan to resolve this is margin hikes during holiday week?

You can raise margins all you want. You can crash paper prices with liquidations. You can write think pieces about volatility and speculators and froth.

But when corporate buyers need silver for production lines that can’t shut down, they pay whatever price gets them the metal. They won’t check the COMEX price and go “oh, it’s down 15%, guess we’ll wait”.

They pay $90. They pay $100. They pay whatever it takes. Because stopping production costs more than any silver premium ever will.

And there isn’t enough metal. That’s the part the paper pushers keep forgetting. There just isn’t enough metal.

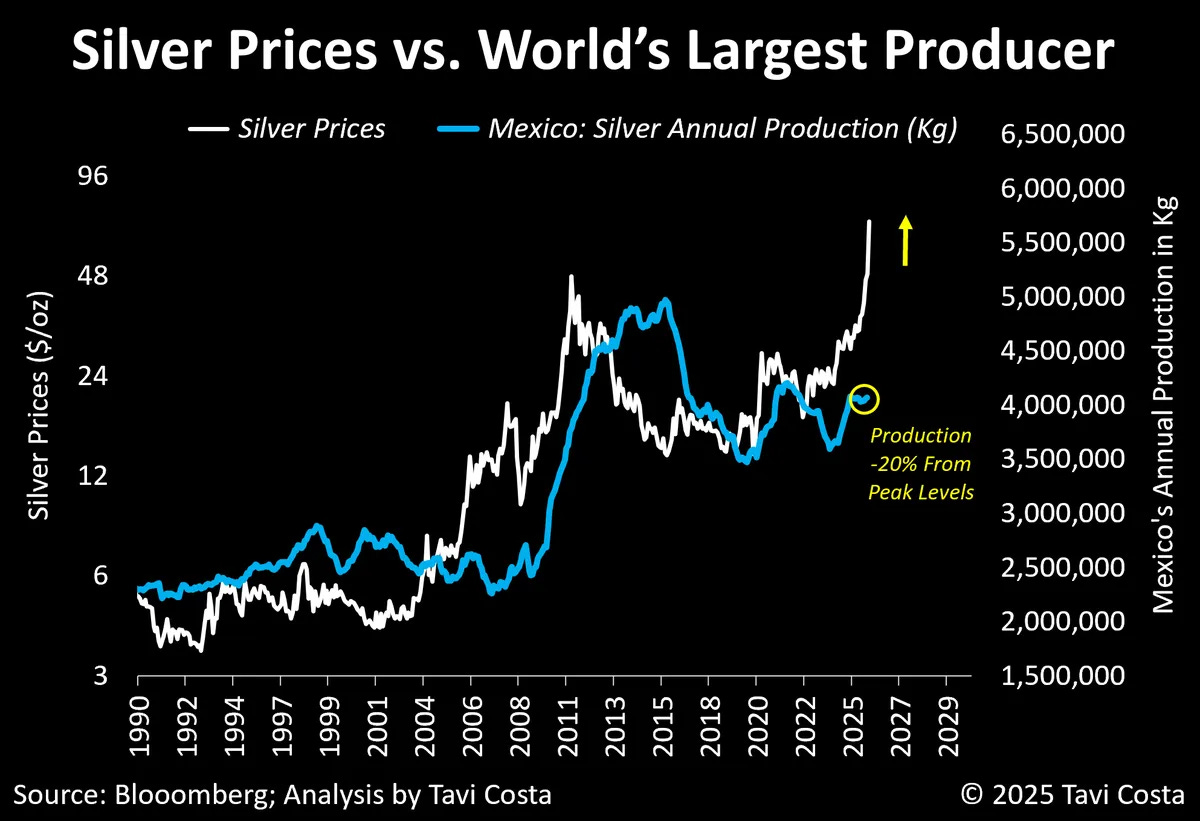

I’ve run the numbers every way I can think of. Supply deficit of 230+ million ounces annually for seven consecutive years. Mine production flat or declining. Mexican output down 20% from peak. Recycling can’t fill that gap.

SEVEN. Consecutive. Years. Of deficits.

Naturally, let’s crash the price. That’ll encourage more mining investment. Nothing says “we need more silver” like margin-calling everyone and forcing liquidations. Miners definitely respond to price destruction by... opening more mines? No wait, that’s the opposite of what happens.

Industrial demand isn’t price-elastic - you can’t substitute silver just because the price doubled. Try telling Samsung “hey, we know you need 50 million ounces for phones this quarter, but have you considered using copper instead?” See how that conversation goes.

The only variable that can resolve this is demand destruction. But demand destruction means factories closing. Solar installations stopping. EV production halting.

Is that what happens in an economy trying to electrify everything? We’re decarbonizing the planet but oops, sorry, ran out of silver, guess we’ll just burn coal forever?

Silver lease rates hit 40% in October. They’re “only” 5-6% now. Normal is 0.3-0.5%. The cost of borrowing physical silver - not buying it mind you!, just borrowing it - is 10-20 times normal.

That’s like if your mortgage rate went from 3% to 60%. Would you describe that as “slightly elevated rates” or “something is catastrophically broken”?

Short sellers are trapped. They sold silver they don’t have. To close their positions, they need to buy it back. But buying it means finding it. And finding it means paying $80-100 per ounce while reporting settlement at $74.

So the ingenious solution is to force more shorts to cover by... raising margins? Making them buy back even more metal that doesn’t exist? Playing four-dimensional chess over here.

The CME can manipulate paper. Exchanges can raise margins. Regulators can force liquidations. Bloomberg can write articles about “cooling speculation”. CNBC can bring on analysts talking about “technical corrections”.

But they can’t make silver appear. They can’t quantitative-ease it. They can’t repo it into existence. They can’t lower interest rates until silver multiplies.

It’s a physical element. It exists in finite quantities. And most of it is already consumed - sitting in landfills as circuit boards, embedded in solar panels, coating mirrors, residing in medical equipment.

You want more? Mine it. Oh wait, miners need 7-10 years and billions in capex to open new deposits. And they need prices to stay high enough to justify the investment. So crashing prices... helps how exactly?

Shanghai is in backwardation. Near-term contracts trading above future months. That means immediate physical demand is overwhelming everything else. In a liquid, efficient market, this isn’t supposed to happen. But apparently Shanghai didn’t get the memo about efficient market hypothesis.

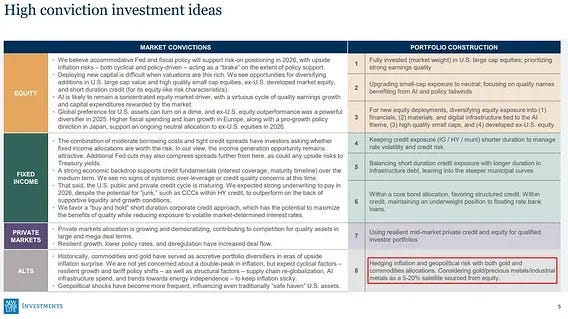

The largest life insurance provider in the US - New York Life - just suggested metal allocations of 5-20% in portfolios. Morgan Stanley’s “High Conviction Investment Ideas” for 2025 included commodities and precious metals prominently.

So institutions are telling clients to buy metals. While the CME is margin-calling everyone who bought metals. While China is locking down supply. While physical dealers are sold out globally.

Perfectly coherent market signals. Nothing contradictory happening here. Just normal finance stuff.

Western media will frame yesterday’s crash as “profit-taking” and “volatility”. The CME will claim prudent risk management. Analysts will say silver got ahead of itself. They’ll use all the right words - cooling speculation, technical correction, orderly market function.

Just don’t ask why they chose the most illiquid week of the year to torch billions in margin calls. Or why they crashed prices right before the world’s largest supplier cuts off 70% of refined silver supply. Or why industrial buyers now have to explain to their CFO why they’re paying $90 for $74 silver. Masterful timing. Can’t possibly see any way this backfires spectacularly when those Chinese export licenses kick in in 72 hours.

The paper-physical divergence isn’t a temporary dislocation anymore.

It’s two different markets pricing two different things.

One is a promise that says you own silver. One is actual silver.

I’m sure everything will be fine.

Most underratted Substacker in finance.

Lovely physical 80-100 while paper crashes.... oh look squirrel!