I'm a frustrated silver bug

Silver +5%, my miners: -0.06%

I posted something that’s been bothering me for weeks now:

The responses I got were better than I expected. Not because anyone has perfect answers, but because each comment revealed a different layer of how broken silver markets have become.

Let’s break down what’s actually happening here.

The Setup: What I’m Seeing

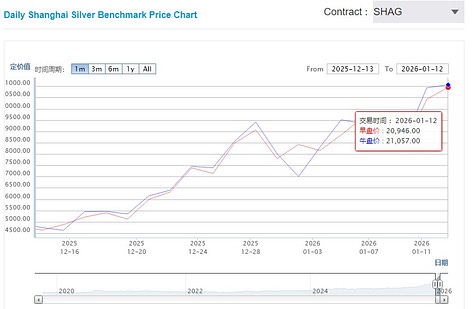

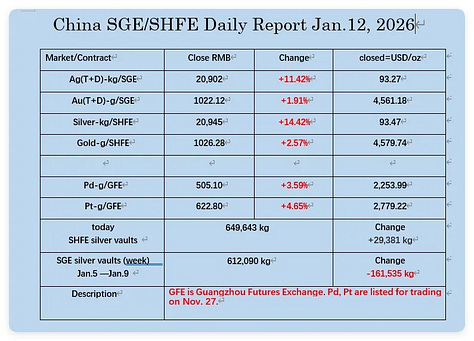

Physical silver is genuinely scarce. The SGE benchmark price is around $101.56 per ounce while COMEX trades at $91.85 - a premium of roughly $10. SGE vaults drew down 161,535 kg in a single week (January 5-9).

Walk into a dealer - if you can find one with inventory - and you’re paying premiums that make you question reality.

The fundamentals are screaming shortage. Seven consecutive years of deficits with cumulative shortfalls totaling nearly 800 million ounces since 2019. 2025 alone showed a 95-160 million ounce shortfall depending on how you measure it. Solar panel consumption hit records and is projected to nearly double between 2020 and 2030. EV demand jumped 20% in 2025. This isn’t speculative - it’s actual industrial offtake that can’t be substituted.

The metal exploded 140% in 2025, hitting $84 before the CME’s intervention triggered a flash crash to the low $70s. To no avail. It’s closing in on $100 right now.

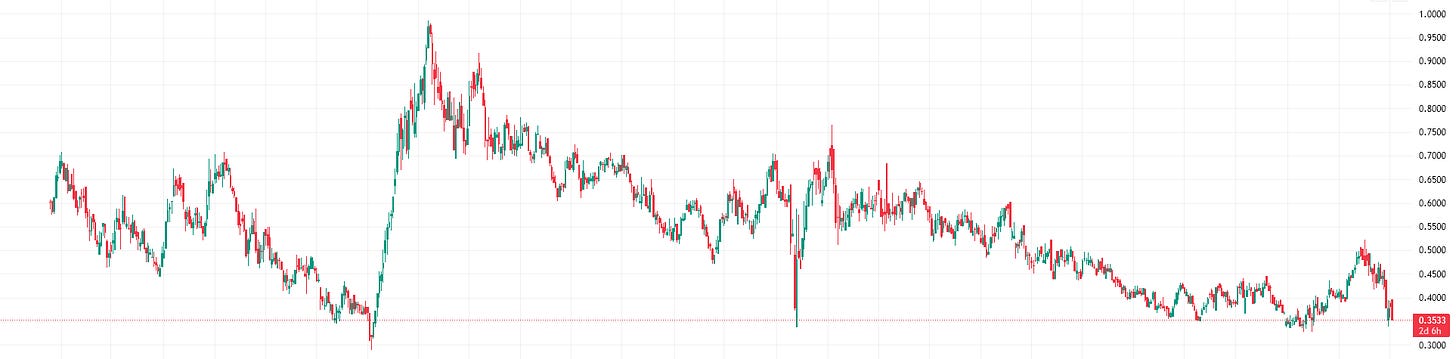

And the miners? Silver miners gained 165-182% depending on which ETF you track. That sounds impressive until you compare it to the metal itself at +140%. That’s barely any leverage.

When gold rose 30-40% in 2025, gold miners soared 100-120%. That’s 3x operational leverage. That’s what’s supposed to happen when commodity prices spike and costs stay relatively fixed.

Silver miners should be crushing the metal’s performance. They’re not. Why?

Comment 1: The Delta-Hedging Hypothesis

ahjuma : A hypothesis: banksters are covering losses in short-covering metal by shorting mining stocks. Perhaps sending the psychological message to larger investors, that being the metals spike is a one-off… cuz any proof of a longterm rally would show in mining stocks in their circular logic.

This theory deserves a proper explanation because it’s not entirely wrong, though the mechanics are more nuanced than simple manipulation.

Delta-hedging in the context of silver works like this: imagine a fund that’s long silver futures. They’re exposed to price movements - if silver drops, they lose money. But they want to maintain exposure to other factors like volatility or time decay while reducing directional risk.

Here’s how they hedge:

A silver futures contract has a delta of essentially 1.0 - it moves dollar-for-dollar with silver prices. To neutralize that exposure, they need to add negative delta. They could short silver futures directly, but then what’s the point? Instead, they short silver mining stocks.

A typical silver mining stock might have a delta to silver of 0.4-0.6 - for every dollar silver moves, the stock moves 40-60 cents. So if you’re long 100 ounces worth of silver futures (delta +100), you could short 200 shares of a miner with 0.5 delta to achieve roughly delta-neutral positioning.

Now you’re exposed to volatility, time value, and other factors without being exposed to whether silver goes up or down. When silver spikes violently like it did in late 2025, funds scramble to rebalance these hedges, creating selling pressure on miners even as the metal soars.

But here’s what makes silver different from gold: the market is thinner, more volatile, and dominated by fewer pure-play companies. When hedge funds need to establish or adjust delta-neutral positions, there aren’t that many liquid silver mining stocks to work with. This concentrates the selling pressure.

According to the CoT report there are ~750 Moz of short positions in silver through paper contracts. Not all will be naked. I’m guessing many won’t be. But many use these shorts specifically as hedges against long positions in mining stocks or related investments.

So yes, there’s genuine hedging activity suppressing miner prices relative to the metal. But it’s not necessarily nefarious - it’s just how derivatives markets function when participants want exposure to volatility rather than direction.

The problem is that this creates the exact psychological signal ahjuma mentioned: if miners aren’t rallying with the metal, it looks like the market doesn’t believe in the move. Which becomes self-fulfilling as momentum investors avoid the space.

Comment 2: The Volatility Problem

French_follower : I’d argue that the parabolic increase this week of silver price increases the chances of government intervention and / or short term correction. Silver miners can’t benefit from a silver price going up and down 5 or 10% daily. For current silver price to be priced in silver miners, volatility needs to reach acceptable level. As always, uncertainty and risk means a premium to be paid, i.e. higher discount rates to the overall thing. How can you reliably build a 5 years business plan for a silver miner right now? You can’t. Hence valuations can’t follow the price increases.

This is the one of the most underappreciated points in the entire discussion.

Silver just moved from $28 to $91 in a little over a year. It crashed 11% in a single day during that time. Daily swings of 5% became routine in December. This isn’t a commodity market anymore - it’s a meme stock.

Try being a CFO of a silver mining company right now. You need to build a capital allocation plan. Do you expand production? At what silver price assumption? $75? $50? $100? Your project takes 3-5 years to develop. What discount rate do you use when the underlying commodity can move 20% in a week?

You can’t. So you don’t. You sit on cash, return nothing to shareholders, and wait for sanity to return.

This is why gold miners are different right now. Gold volatility is relatively contained. It’s been grinding higher steadily. You can build a business model around $3,000-3,500 gold with reasonable confidence. Silver at $75 with ±$10 daily swings? Good luck getting board approval for a $500 million expansion project.

The higher the volatility, the higher the discount rate investors apply. A silver miner generating $50/oz margins looks great until you realize those margins could be $80 or $20 next month. That uncertainty compresses valuations even as spot prices soar.

French_follower is right to want stabilization above $70. Not because higher isn’t better, but because predictability is worth more to mining companies than another parabolic leg that reverses two weeks later. Volatility is the silent killer of mining equity valuations. Hell. Even $50 is fine. As long as it’s stable! Most silver miners will be making a killing either way.

And the government intervention risk? When commodity prices go parabolic, politicians start getting ideas. Which brings us to...

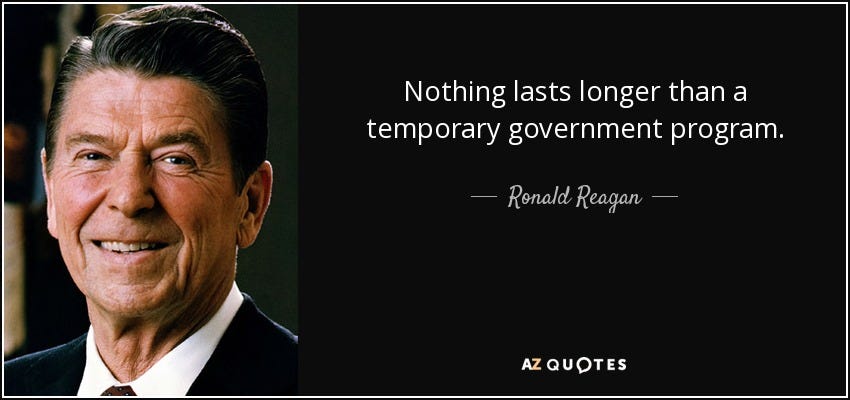

Comment 3: A Farcical Interlude on the Theatrical Brilliance of UK Fiscal Policy

Loic : I agree it feels like there is a buffer with reality. Nationalisation is a real prospect. After all these operators usually have to contend with (at minimum) windfall taxes at the best of times. So it’s not like the traded prices directly translate into matching higher earnings for distribution and reinvestment.

[Scene: A government office in Westminster. Enter CHANCELLOR, wearing robes and carrying an enormous calculator]

CHANCELLOR: Right then. Oil prices have gone up. Energy companies are making profits. Perfectly ordinary profits, but profits nonetheless. This cannot stand! I declare a WINDFALL TAX of 25%!

CIVIL SERVANT: Very good, sir. Temporary, of course?

CHANCELLOR: Oh yes, absolutely temporary. December 2025, then it expires. Mark it down.

[Six months pass]

CHANCELLOR: The windfall tax has been such a tremendous success that we’re raising it to 35% and extending it to 2028.

CIVIL SERVANT: But sir, the windfall has... wound down. Oil prices have normalized.

CHANCELLOR: Yes, but we’ve grown quite fond of the revenue. March 2028 it is!

[Another year]

CHANCELLOR: Splendid news! We’re extending the TEMPORARY windfall tax to 2029 and raising it to 38%. Combined headline rate is now 78%.

CIVIL SERVANT: Sir, the oil companies are leaving. Investment has collapsed by 80%. Harbour Energy just announced another 100 job cuts. That’s 600 jobs gone since 2023.

CHANCELLOR: Ah, but think of the £1.2 billion in annual revenue!

CIVIL SERVANT: [checking papers] The industry estimates maybe £2 billion total over five years because there won’t be anything left to tax...

CHANCELLOR: Nonsense! We’re also eliminating the 29% investment allowance and cutting the decarbonization allowance from 80% to 66%.

CIVIL SERVANT: But sir, companies are fleeing to literally anywhere else. Production is collapsing. We’re importing more energy than ever. And 35,000 jobs are at risk by 2029 according to industry estimates.

CHANCELLOR: [triumphantly] Which is why we’re extending the temporary tax to 2030 and will replace it with a DIFFERENT tax mechanism that won’t kick in until April 2030!

CIVIL SERVANT: After the industry is already dead?

CHANCELLOR: Precisely! The important thing is we got our headlines. Future administrations can explain to voters why domestic production cratered, imports surged, energy security evaporated, and thousands lost their jobs. We’ll be safely retired by then!

[Exeunt, pursued by economic consequences]

Look, I could continue with the absurdist theatre, but the UK’s Energy Profits Levy genuinely reads like a Monty Python sketch that forgot to be funny.

What started as a “temporary” 25% levy in May 2022 - when oil prices spiked after Russia invaded Ukraine - has metastasized into a 78% combined tax rate that’s been extended so many times the word “temporary” has lost all meaning.

The results are exactly what you’d expect from a policy that treats “temporary crisis measure” as “permanent revenue stream”:

Investment collapsed from £14.1 billion to £2.3 billion (2025-2029)

Companies are fleeing to jurisdictions that don’t change the rules mid-game

Production is cratering

Jobs are vanishing by the thousands

But hey, they got their budget headlines and short-term revenue bump. The fact that they’ve destroyed the North Sea oil and gas industry in the process? That’s tomorrow’s problem for tomorrow’s politicians.

And before you think “well, that’s just oil and gas, not silver” - wake up. If silver hits $100 and mining companies start reporting record profits, do you think politicians won’t dust off the exact same playbook? “Windfall taxes on excess profits” sounds great until you realize “excess” means “anything we feel like taxing more” and “temporary” means “permanent”.

The UK proved that developed Western democracies will happily kill domestic industries for short-term political gain. That’s not paranoia. That’s recent history.

The Nationalization Risk

Both ahjuma and Loic mentioned nationalization. They should be taken seriously.

The US is already implementing participation structures in various resource projects. Not outright seizures, but “partnerships” where the government takes equity stakes or production shares. It’s nationalization with better PR, and it’s happening domestically, not just in “unstable” jurisdictions.

When commodity prices spike and governments need revenue or “strategic resources”, mining companies become irresistible targets. The pattern repeats throughout history:

Russia’s acquisition of Yukos assets

Venezuela nationalizing oil operations

Bolivia taking over mining companies

Zimbabwe’s indigenization policies

Chile increasing copper royalties when prices surged

The pattern is always the same: prices spike, governments decide that’s “their” wealth being extracted, operators get squeezed or expelled.

Mining companies are uniquely vulnerable. You can’t move the ore body. Software companies can relocate. Manufacturers can shift production. Miners are stuck. Their assets are literally in the ground in specific jurisdictions.

Which makes them perfect targets for resource nationalism.

The UK windfall tax is just the polite version. Why seize assets when you can tax away 78% of profits? Same outcome, less paperwork, better optics.

When silver hit <insert magical number> and everyone will be talking about it, politicians will notice (belatedly). When mining companies start reporting record profits, the political pressure for “fair share” taxes will become overwhelming.

It’s not paranoia. It’s pattern recognition.

The Three Structural Problems

Beyond hedging activity and volatility, silver miners face fundamental problems that make them structurally different from gold miners:

Problem 1: Silver is mostly a byproduct

75% of silver comes from copper, gold, zinc, and lead mines. It’s not the reason these mines exist. When silver prices spike, it doesn’t incentivize much new silver production because mining decisions are driven by the base metal economics.

As one analyst explained: “if the silver that you produce is a small portion of your stream of revenues, you’re not that motivated to try to produce more silver”.

It gets worse. Higher silver prices might actually reduce silver supply. Sounds counter-intuitive right? Most silver is found together with other base metals like copper. Now when silver rises, most of the time copper also rises. So those copper miners start processing lower-grade ore that’s now economic. Lower-grade ore often contains less silver. So the silver byproduct actually decreases even as silver prices soar.

The reaction time for new primary silver mines is glacial: 10-15 years from discovery to production. There’s no quick supply response to current prices.

Problem 2: The sector consolidated into irrelevance

There are only about 20 pure-play silver miners left globally. Down from 100+ a decade ago.

This creates a thin, illiquid market. Too small for major institutional allocators. Too volatile for conservative money. Too concentrated for diversified exposure.

When hedge funds want to establish delta-neutral positions, they don’t have many options. The selling pressure gets concentrated in a handful of names. Price discovery breaks down.

Problem 3: Junior miners treating rallies as financing opportunities

Yes, some silver miners are up massively - my personal experience confirms this. But look at what many juniors do when prices rally: they immediately raise equity to fund expansion projects rather than proving they can return capital to shareholders.

It’s not systematic dilution across the entire sector. The majors aren’t diluting - Newmont, Barrick, and Agnico Eagle (gold-focused) actually bought back shares in 2025. But smaller silver-focused companies often use strong markets as fundraising opportunities.

So your miners can be way up AND you’re still seeing the stock lag during private placements. Both things are true.

Where I’m At With Miners: Frustrated But Not Done

Look, I need to be honest about something that’s driving me insane.

I’ve watched silver go from $10 to $90. A 150% move in the last year alone. Historic. Unprecedented in recent times. The kind of move that should make silver mining stocks absolutely explode.

And some of my junior positions? Up 50%. Maybe 80% if I’m lucky.

You know what that feels like? It feels like watching everyone else at the poker table hit their flush while you’re sitting there with pocket aces that somehow didn’t improve. The fundamentals are there. The thesis should be right. Silver did exactly what I expected.

And my “leveraged exposure”? Barely keeping pace with the metal itself.

Don’t get me wrong - 80% returns are great. I’m not complaining about making money. But when the underlying commodity more than doubles and you’re getting barely 1:1 leverage? That’s not what I signed up for. That’s not what the math is supposed to deliver. That’s not what “operational leverage” means.

The junior miners in particular have been absolutely maddening. Every time silver makes a leg up, I’m watching these stocks... do nothing. Consolidate. Trade sideways for weeks. Or worse - announce a private placement at a 15% discount that craters the stock for weeks or months while silver keeps climbing.

Then three months later, another raise. “Strengthening the balance sheet.” “Advancing key projects.” Meanwhile silver is hitting new all-time highs and my per-share value is going nowhere because the share count keeps climbing.

My emotions? Watching silver hit $90 while my junior silver miner is trading at the same level it was at $50 silver is absolutely infuriating.

Here’s what I’m contemplating:

I’ll still be holding my miners, however infuriating they are. Q1 should see stellar reports over Q4’25. Might give it a boost.

Going forward however, I think I’m going to think long and hard about pure silver players. Not going to name names - DYOR. These should deliver as they’re a leverage play to silver prices because that’s what drives them, not by copper or zinc.

Especially because SILJ is trading as if it’s January 2025…

That’s what I’m watching for. The final lift-off… The 4 months that makes all the wait worth it.

Until then? I’m skeptical but not abandoning the space. Just being much more selective about which miners get my capital.

Physical silver remains the cleanest exposure

Premiums suck and storage is a pain, but you own the actual scarce asset. Right now, the East is showing you what silver is really worth when you need it in your hands.

If the paper market breaks, physical holders win. If governments start windfall taxes on miners, your bullion isn’t affected. If nationalization becomes a thing, your physical holdings are fine.

For paper exposure without the physical hassle, I’m looking at the Sprott Physical Silver Trust (PSLV) rather than SLV. Sprott stores physical silver in allocated form - you can actually take delivery if you have enough units. SLV is unallocated pooled storage with less transparency.

What I’m avoiding

Leverage. Never. Not even to try and catch up. That’s a gambler’s mentality. Just don’t. The volatility will liquidate you before the thesis plays out. I don’t care how convicted you are - silver moving 10% in a day means levered positions evaporate.

Serial diluters. Any junior miner that’s raised equity three times in two years is off my list. I don’t care how good the story is - if management’s first instinct at $75 silver is to issue more shares rather than generate free cash flow, they’ve told me everything I need to know about capital allocation priorities.

Where This Leaves Me

If this entire episode has taught me anything, it’s that silver is not just a commodity — it’s a stress test.

A stress test of supply chains.

A stress test of paper markets.

A stress test of mining business models.

And increasingly, a stress test of political restraint.

Silver miners don’t need higher prices. They need stable prices. They need time. They need management teams that treat rallies as an opportunity to generate returns, not just raise capital.

Until that happens, miners will continue to frustrate me, even when the metal does exactly what it’s “supposed” to do.

That’s why I’m not abandoning this space — just narrowing my focus. Fewer names. Cleaner balance sheets. Real silver exposure rather than incidental byproduct economics. And a much lower tolerance for dilution disguised as growth.

Until then, patience isn’t just a virtue.

It’s the entire trade.

Sounds like mining is similar to farming, something I'm familiar with. No matter how favorable things are in farming, there's always something that works against you. Great prices? Bad weather and low yield. Bumper crops? Depressed prices. Good weather? High capital costs and fluctuating returns. Ya can't win for losin', even when at first look it seems like everything should be going your way.

I’ve been thinking the same thing… especially over the last month or so. Silver up like 3x higher than my supposed leveraged play SILJ